There is a particular order to cancelling your tax registrations. Depending on your circumstances, this could include registrations for:

- pay as you go withholding

- fringe benefits tax

- luxury car tax

- wine equalisation tax

- fuel tax credits

- goods and services tax (GST)

- Australian business number (ABN).

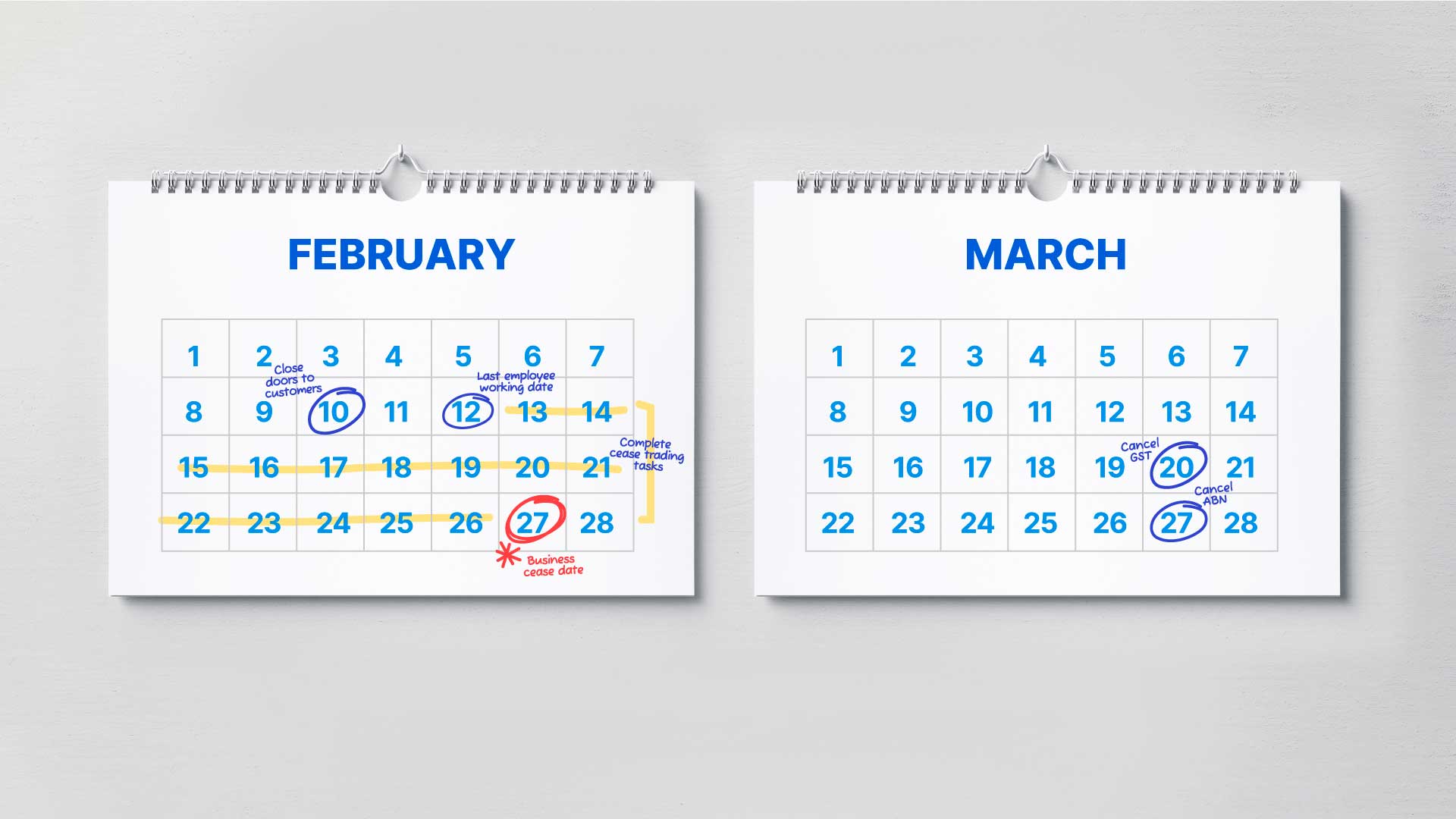

You can choose to cancel your registrations separately or all at once. If you choose separately, cancel all registrations you have, but not GST or your ABN. From your business cease date, you have 21 days to cancel your GST registration and 28 days to cancel your ABN. This allows time for your final lodgments and obligations to be processed.

If your GST registration and ABN are cancelled too close to your business cease date, your final lodgments cannot be processed. This may delay any potential refunds. Cancelling GST will automatically cancel registrations for luxury car tax, wine equalisation tax and fuel tax credits.

You can choose to cancel all registrations at once simply by waiting until one month after your business cease date and then cancelling your ABN. Cancelling your ABN will automatically cancel all other registrations.

Cancelling your ABN also cancels any authorised relationship between your ABN and your myID. This means that you won’t be able to access your business details in Online services for business or other online services.

You can cancel registrations:

- using ATO Online services for business

- through your registered tax or BAS agent who can cancel registrations on your behalf

- by phoning the ATO on 13 28 66.

Closing your small business

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

Make a plan |

2 mins | |||||

Closing your business |

4 mins | |||||

Finalise your tax and super obligations |

17 mins | |||||

|

|

||||||

Selling or closing your business records |

2 mins | |||||

Small business support |

10 mins | |||||

Related courses |

1 mins | |||||

Course feedback |

||||||