If you’re starting a business, you need to choose a business structure. It’s an important decision because different structures have different rules and tax rates. This can affect the ongoing costs and administrative time it will take to run your business. The structure you choose will depend on the size and type of your business, your personal circumstances and how much you plan to grow your business.

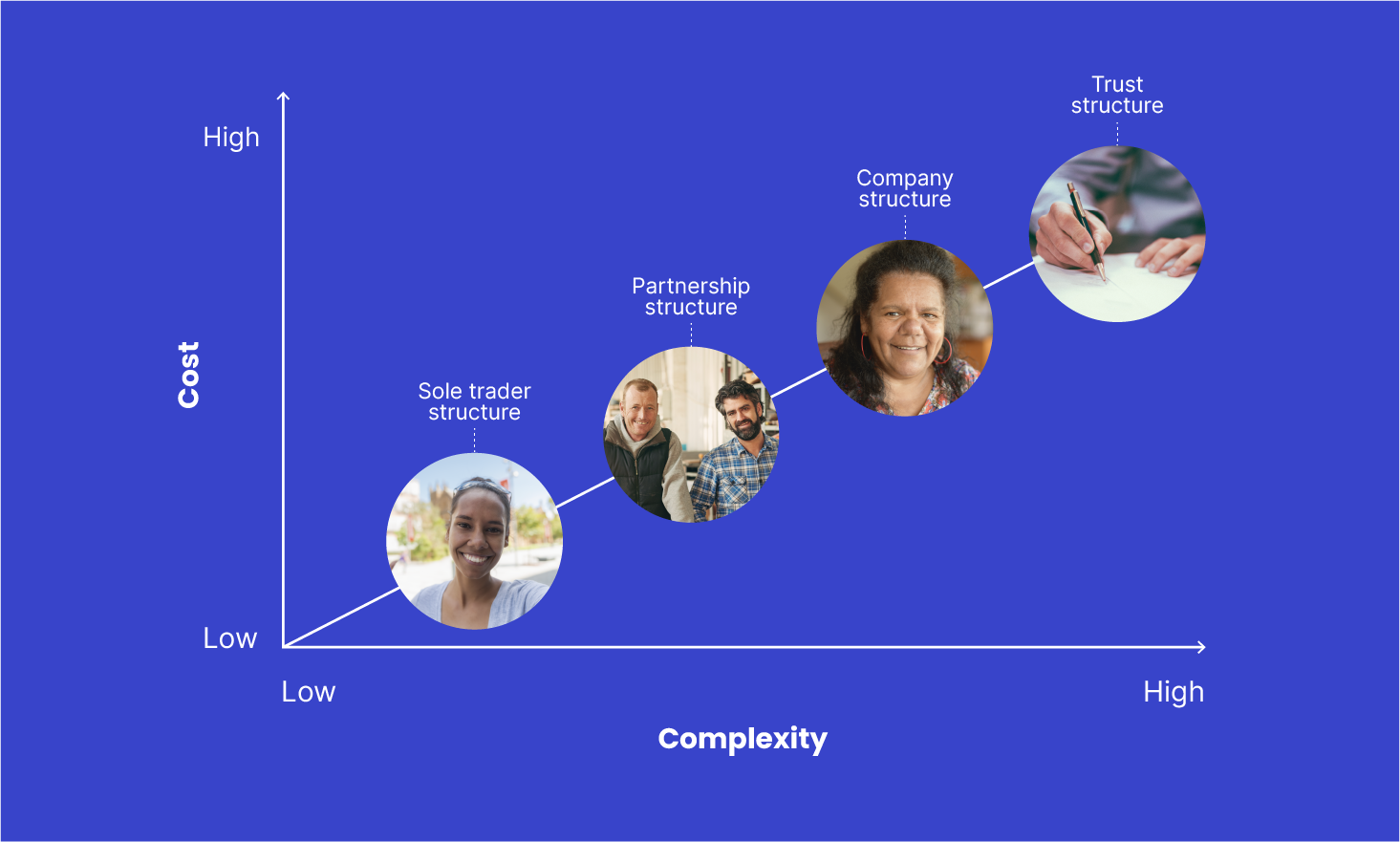

The 4 most common business structures are:

- sole trader

- partnership

- company

- trust.

It’s important to understand the responsibilities of each structure because the structure you choose may affect:

- whether your assets are protected

- how you take money from your business (pay yourself)

- the tax you’re liable to pay

- costs of running your business.

The costs and complexity of each of these structures increase. Sole trader is the simplest to operate and a trust is the most complex.

You’re not locked into any structure and you can change your structure as your business changes or grows. There may be costs associated with changing structures.

Starting a small business

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

Is my hobby a business? |

9 mins | |||||

Business structures overview |

5 mins | |||||

Business registrations |

5 mins | |||||

Sole trader structure |

7 mins | |||||

Partnership structure |

10 mins | |||||

Company structure |

13 mins | |||||

Trust structure |

7 mins | |||||

Small business support |

10 mins | |||||

Related courses |

1 mins | |||||

Course feedback |

||||||