When businesses make a payment (voluntary contribution) to hobbyists, they may ask for an Australian business number (ABN) from the hobbyist. A business does this because when they pay for a service, they want to be able to claim the payment as a tax deduction. They need an ABN to make that claim. If they don’t quote an ABN, they must withhold 47% of the payment for tax purposes. That means the hobbyist would lose out on 47% of the payment.

However, if the service provider is truly a hobbyist they likely don’t have and certainly don’t need an ABN. A true hobbyist is not running a business but is likely to want to accept any payment offers.

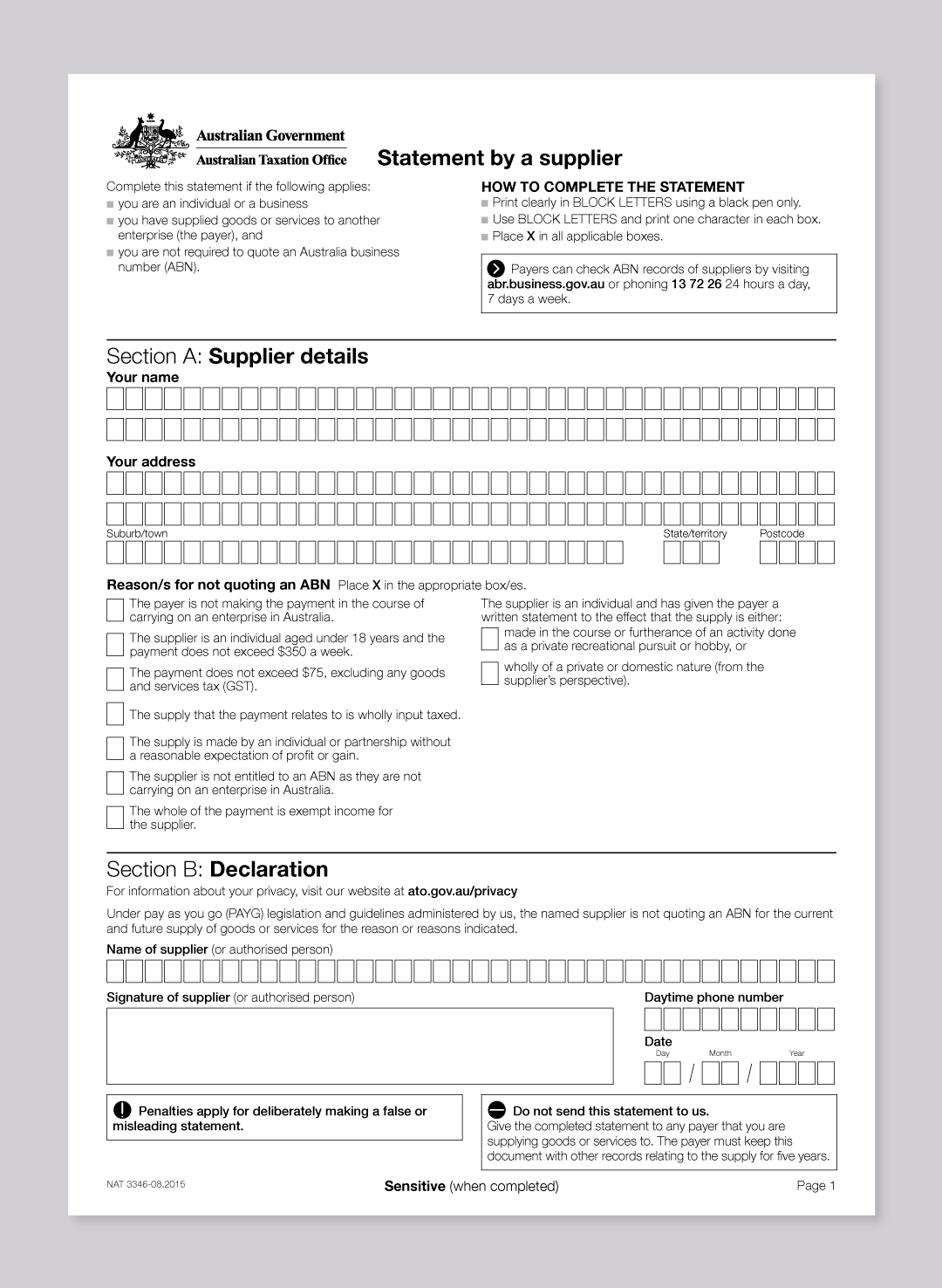

The hobbyist can complete a form called a Statement by a supplier.

By giving this form to the business making a payment, that business doesn’t have to withhold any amount from the payment. The hobbyist receives the full amount of money and the business can claim a tax deduction for the service.

Starting a small business

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

Is my hobby a business? |

9 mins | |||||

Business structures overview |

5 mins | |||||

Business registrations |

5 mins | |||||

Sole trader structure |

7 mins | |||||

Partnership structure |

10 mins | |||||

Company structure |

13 mins | |||||

Trust structure |

7 mins | |||||

Small business support |

10 mins | |||||

Related courses |

1 mins | |||||

Course feedback |

||||||