×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

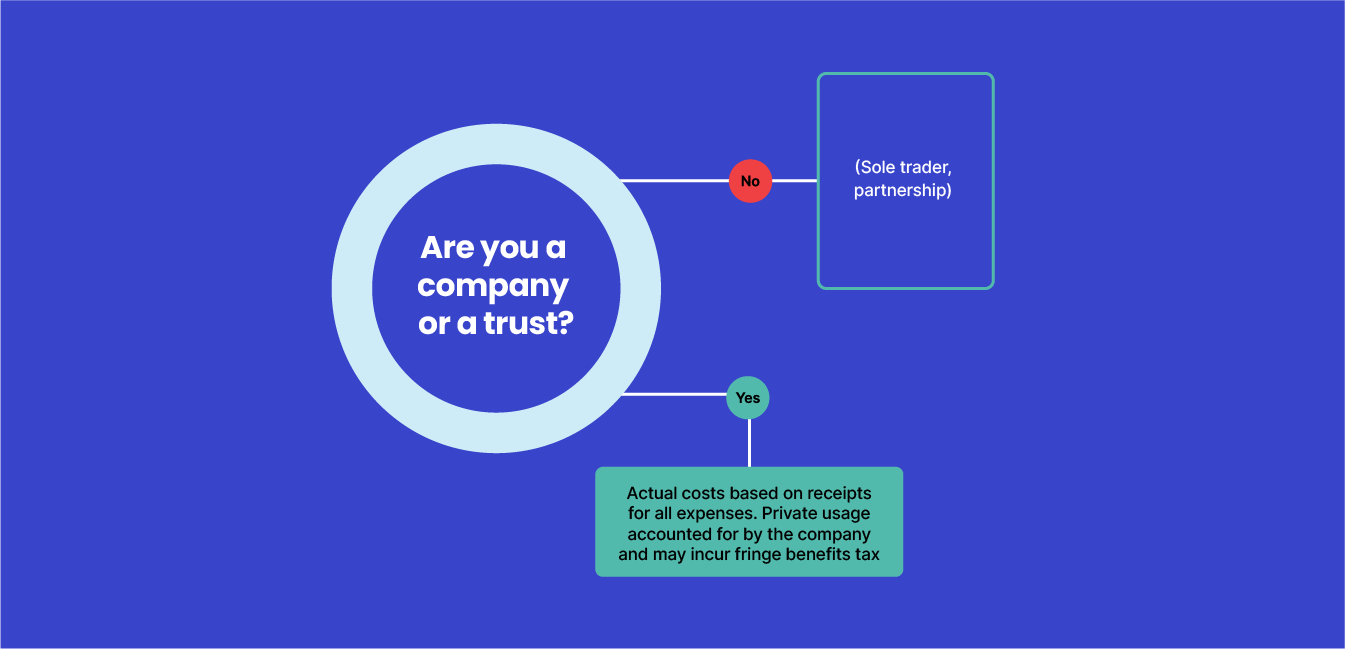

If you are a company or a trust, you can claim actual costs based on the receipts for the expenses you are claiming.

You can also claim private usage accounted for by the company but this can be complicated to calculate. If this applies to you, review ‘car fringe benefits’ at ato.gov.au for more information.

Last modified: 08 Jun 2023

Claiming small business tax deductions

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

What are deductions and what can I claim? |

5 mins | |||||

Accounting for private use of assets |

9 mins | |||||

Expenses you can never deduct |

1 mins | |||||

Expenses you can deduct over time |

10 mins | |||||

Stock and asset records |

5 mins | |||||

Expenses you can deduct immediately |

5 mins | |||||

Other deductions records |

1 mins | |||||

Motor vehicle deductions |

4 mins | |||||

Motor vehicle deductions records |

2 mins | |||||

Related courses |

1 mins | |||||

Course Feedback |

||||||