×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

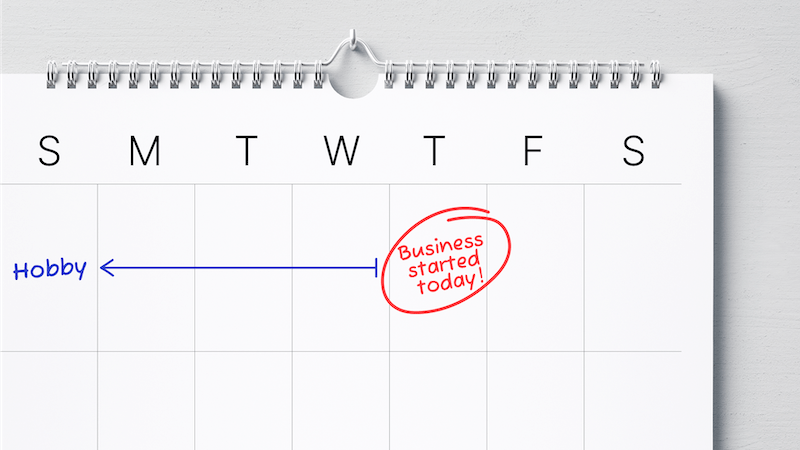

If your hobby changes into a business, it’s important to know when that happened. Your tax and super obligations begin from that date.

That means, you are liable to pay tax on your income. You can also claim appropriate business expenses as tax deductions from the business start date.

Last modified: 25 Aug 2022

Starting a small business

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

Is my hobby a business? |

9 mins | |||||

Business structures overview |

5 mins | |||||

Business registrations |

5 mins | |||||

Sole trader structure |

7 mins | |||||

Partnership structure |

10 mins | |||||

Company structure |

13 mins | |||||

Trust structure |

7 mins | |||||

Small business support |

10 mins | |||||

Related courses |

1 mins | |||||

Course Feedback |

||||||