To pass the results test, you need to meet all of the following conditions for 75% of your PSI for the income year:

- You are paid to produce a specific result.

- You are required to provide the equipment or tools needed to produce the result.

- You are required to fix mistakes at your own expense.

If you operate through a company, partnership or trust and you have more than one individual generating PSI, you need to work out whether you pass the results test for each individual. It is possible for one individual to conduct a PSB but not another.

If you obtain work through an agency, you most likely won't pass the results test. This is because you are generally hired by an agency to provide your services on an ongoing basis for an hourly or daily rate, not to produce a specific result. If you earn more than 25% of your PSI in this way, you will not pass the results test.

Let’s look at 3 examples where a business obtains work through an agency to better understand this.

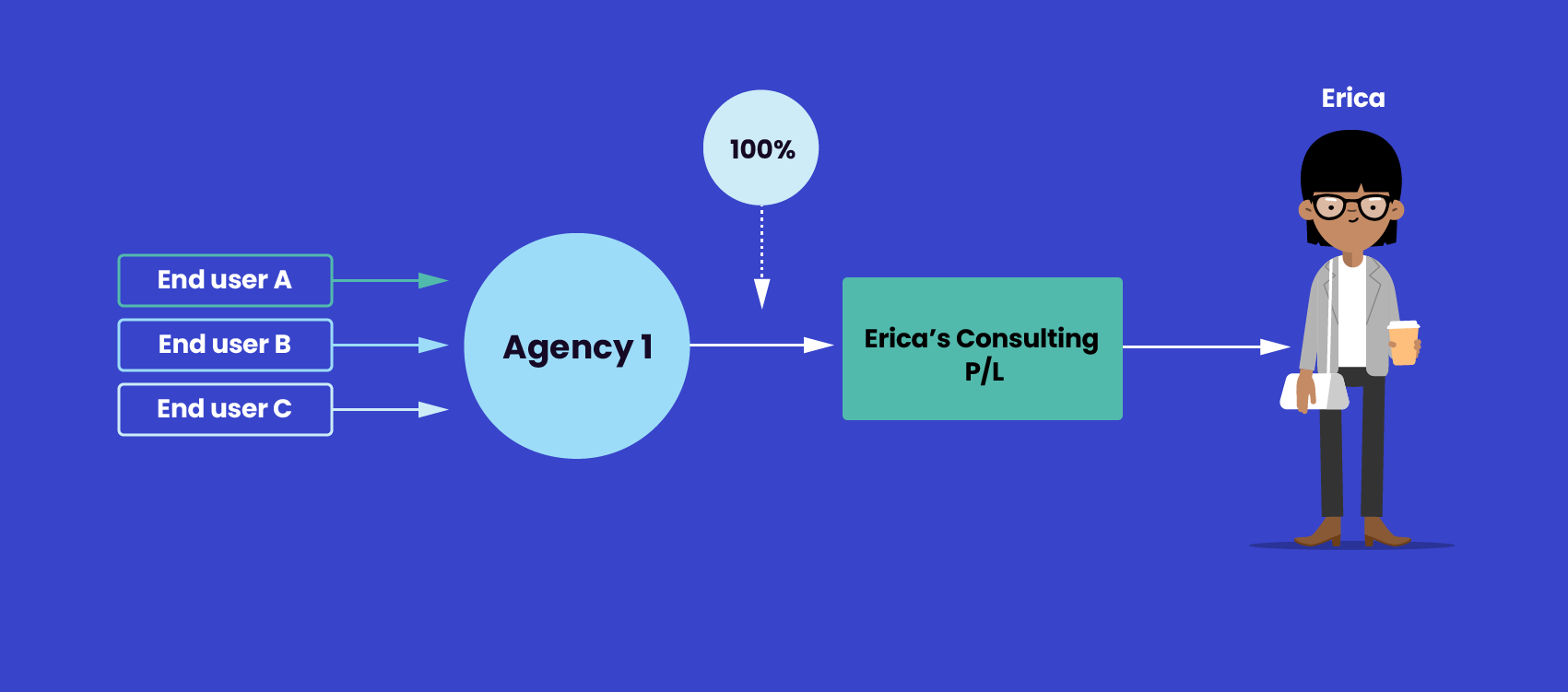

Example 1: Erica – one agency

Erica's company, Erica's Consulting Pty Ltd, contracts with Agency 1 to deliver Erica's services. Erica is required to perform work for, and at the direction of, the agency's clients. Agency 1 has 3 contracts that Erica works on. Erica's company receives 100% of its income from Agency 1.

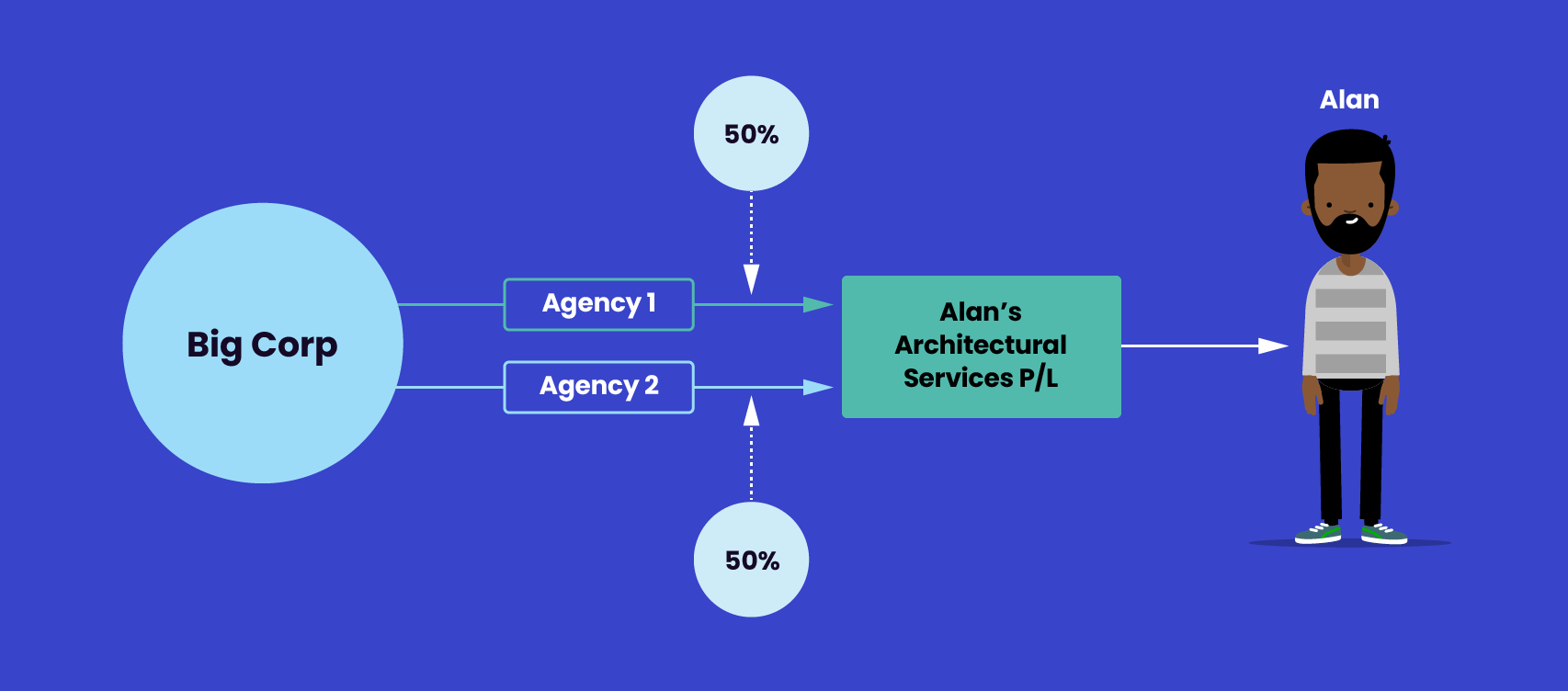

Example 2: Alan – more than one agency

Alan's company, Alan's Architectural Services Pty Ltd, contracts with 2 agencies, Agency 1 and Agency 2, to deliver Alan's services. Under both contracts, Alan is required to perform work for, and at the direction of, the agencies' clients. Agency 1 and Agency 2 provide Alan's services to the same client, Big Corp. Alan's company receives 50% of its income from Agency 1 and 50% from Agency 2.

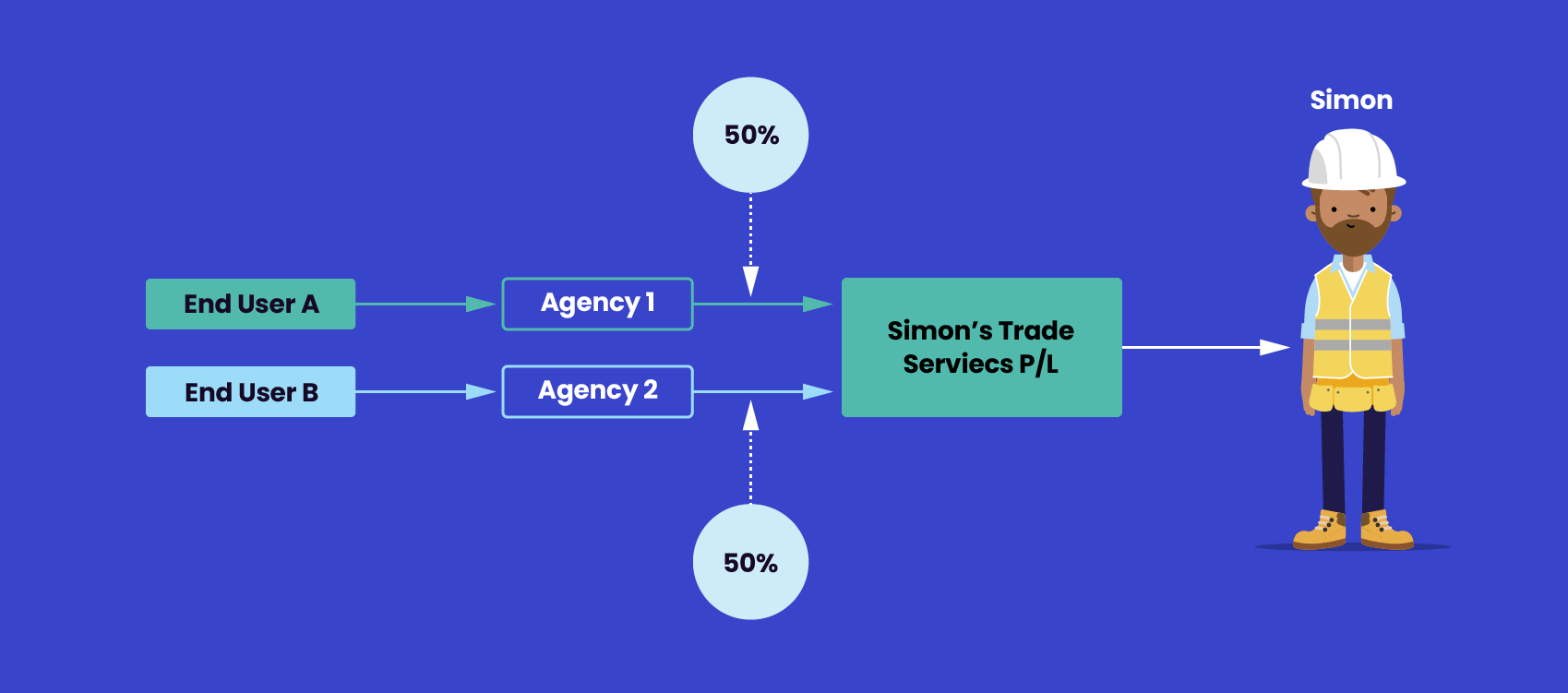

Example 3: Simon – more than one agency

Simon's company, Simon's Trade Services Pty Ltd, contracts with Agency 1 and Agency 2 to deliver Simon's services. Under both contracts, Simon is required to perform work for, and at the direction of, the agencies' clients. Each agency has a different client. Simon's company receives 50% of its income from Agency 1 and 50% from Agency 2.

In these examples, Erica's, Alan's and Simon's companies are not engaged by the end users. Their companies are contracted by the agencies to provide services to the end users. They do not contract with the agencies to complete a specific result or outcome for them. They’re contracted by the agencies to provide labour on an ongoing basis in accordance with direction from the agencies' clients or end users.

This means that the companies aren’t being paid to produce a specific result. As 100% of their PSI is earnt through these agency contracts, these companies don't pass the results test in relation to Erica, Alan or Simon. The PSI rules will apply unless they pass one of the other PSB tests.

Personal services income

| Steps | Progress | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

What is PSI? |

4 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Is the income PSI? |

5 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Income that is not PSI |

9 mins | ||||||||||||||||||||

Whose PSI is it? |

7 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Working out if the PSI rules apply: self-assess as a personal service business (PSB) |

2 mins | ||||||||||||||||||||

The 80% rule |

5 mins | ||||||||||||||||||||

Results test |

8 mins | ||||||||||||||||||||

Unrelated clients test |

5 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Employment test |

5 mins | ||||||||||||||||||||

Business premises test |

7 mins | ||||||||||||||||||||

Obtaining work through an agency |

5 mins | ||||||||||||||||||||

Apply for a personal services business determination (PSBD) |

3 mins | ||||||||||||||||||||

What to do when the PSI rules apply |

2 mins | ||||||||||||||||||||

What to do when the PSI rules apply: claiming deductions |

11 mins | ||||||||||||||||||||

|

|

|||||||||||||||||||||

What to do when the PSI rules apply: how to attribute PSI |

8 mins | ||||||||||||||||||||

What to do when the PSI rules apply: PAYG |

18 mins | ||||||||||||||||||||

|

|

|||||||||||||||||||||

What to do when the PSI rules apply: completing your tax return |

4 mins | ||||||||||||||||||||

What to do if the PSI rules don’t apply |

3 mins | ||||||||||||||||||||

Record keeping for PSI |

1 mins | ||||||||||||||||||||

Help for PSI |

1 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Case study: instructions |

1 mins | ||||||||||||||||||||

Case studies: sole trader |

11 mins | ||||||||||||||||||||

Case studies: partnership |

12 mins | ||||||||||||||||||||

Case studies: company |

12 mins | ||||||||||||||||||||

Case studies: trust |

12 mins | ||||||||||||||||||||

Related courses |

1 mins | ||||||||||||||||||||

Course feedback |

|||||||||||||||||||||