×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

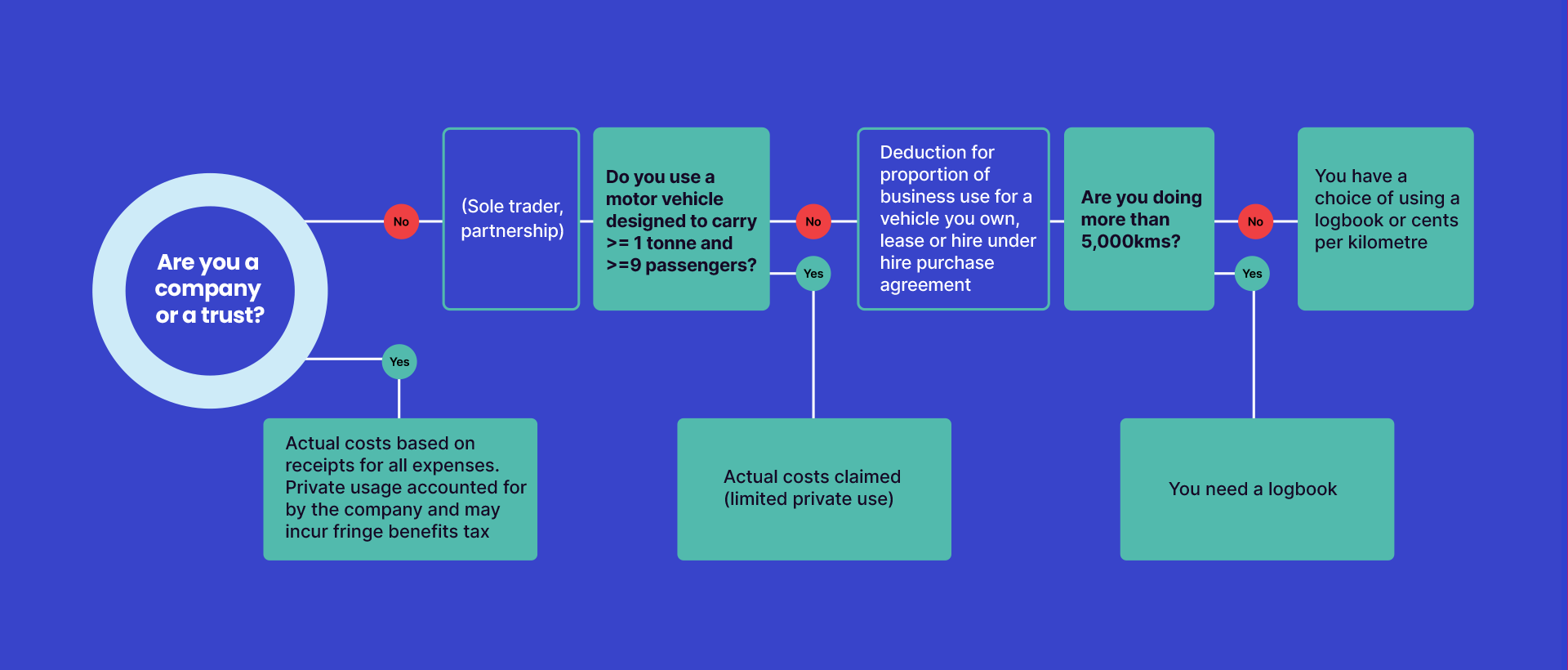

The deductions you can claim when using a motor vehicle for business depend on your business structure, the type of vehicle you use, and whether you also use the vehicle for private purposes. The flowchart graphic summarises who can claim what. We will look at this in more detail over the next screens.

Last modified: 04 Apr 2025

Claiming small business tax deductions

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

What are deductions and what can I claim? |

5 mins | |||||

Accounting for private use of assets |

9 mins | |||||

Expenses you can never deduct |

1 mins | |||||

Expenses you can deduct over time |

10 mins | |||||

Stock and asset records |

5 mins | |||||

Expenses you can deduct immediately |

5 mins | |||||

Other deductions records |

1 mins | |||||

Motor vehicle deductions |

4 mins | |||||

Motor vehicle deductions records |

2 mins | |||||

Related courses |

1 mins | |||||

Course feedback |

||||||