×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

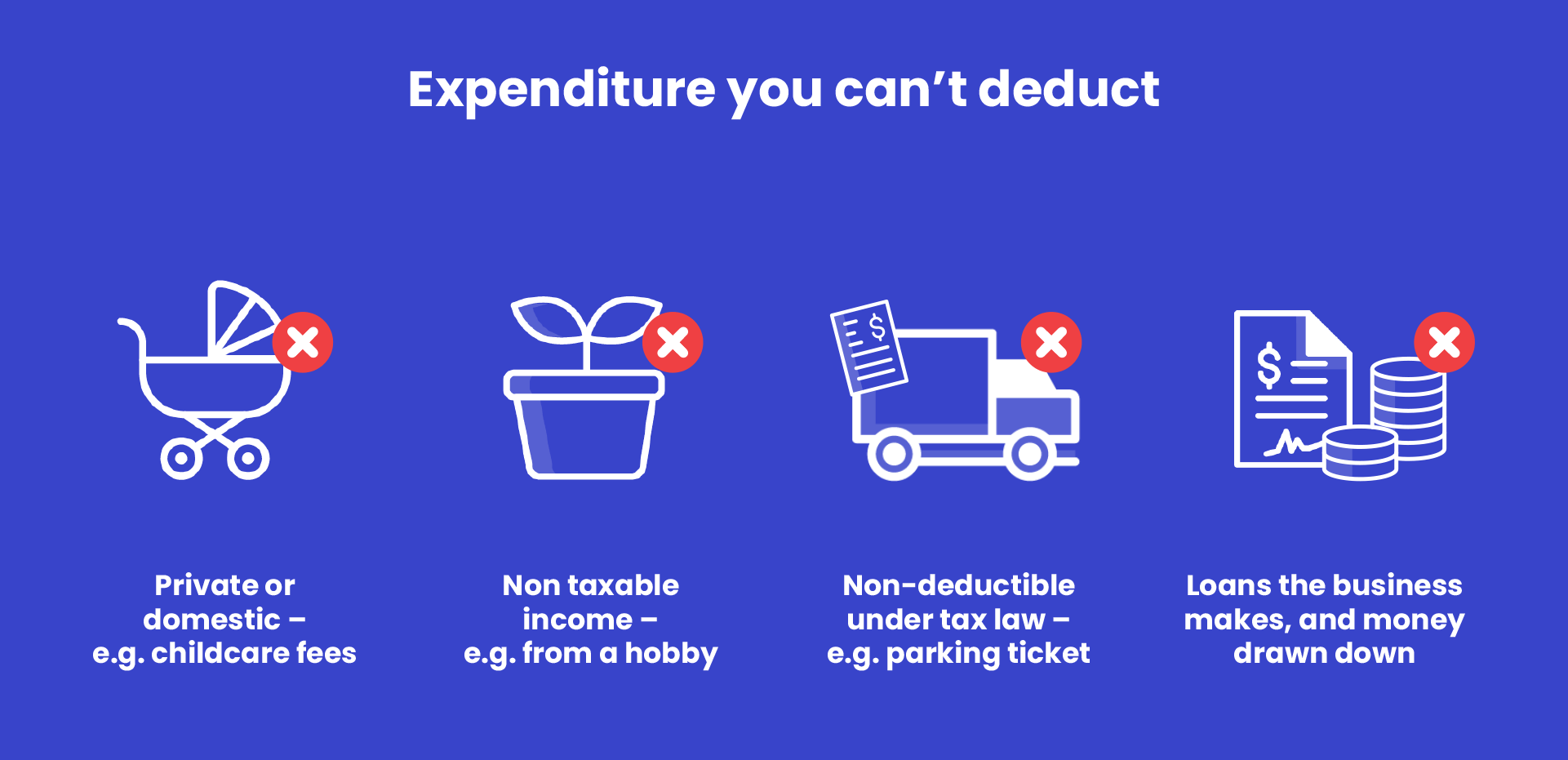

You can’t deduct private or domestic expenses like childcare fees and clothes for your family.

You can’t deduct expenses relating to income that is not taxable, for example, money you earn from a hobby.

Certain expenses that are specifically non-deductible under the tax law can never be deducted. Examples are speeding fines and parking tickets.

Finally, you cannot deduct loans the business makes, and money drawn from the business by the owner.

Last modified: 04 Apr 2025

Claiming small business tax deductions

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

What are deductions and what can I claim? |

5 mins | |||||

Accounting for private use of assets |

9 mins | |||||

Expenses you can never deduct |

1 mins | |||||

Expenses you can deduct over time |

10 mins | |||||

Stock and asset records |

5 mins | |||||

Expenses you can deduct immediately |

5 mins | |||||

Other deductions records |

1 mins | |||||

Motor vehicle deductions |

4 mins | |||||

Motor vehicle deductions records |

2 mins | |||||

Related courses |

1 mins | |||||

Course feedback |

||||||