If a passenger requests a tax invoice (that is, an invoice that includes the amount of GST) for a fare over $82.50 including GST, you must provide one. If your platform issues tax invoices on your behalf (which most do) – find out the process for doing this, before a passenger asks you for an invoice.

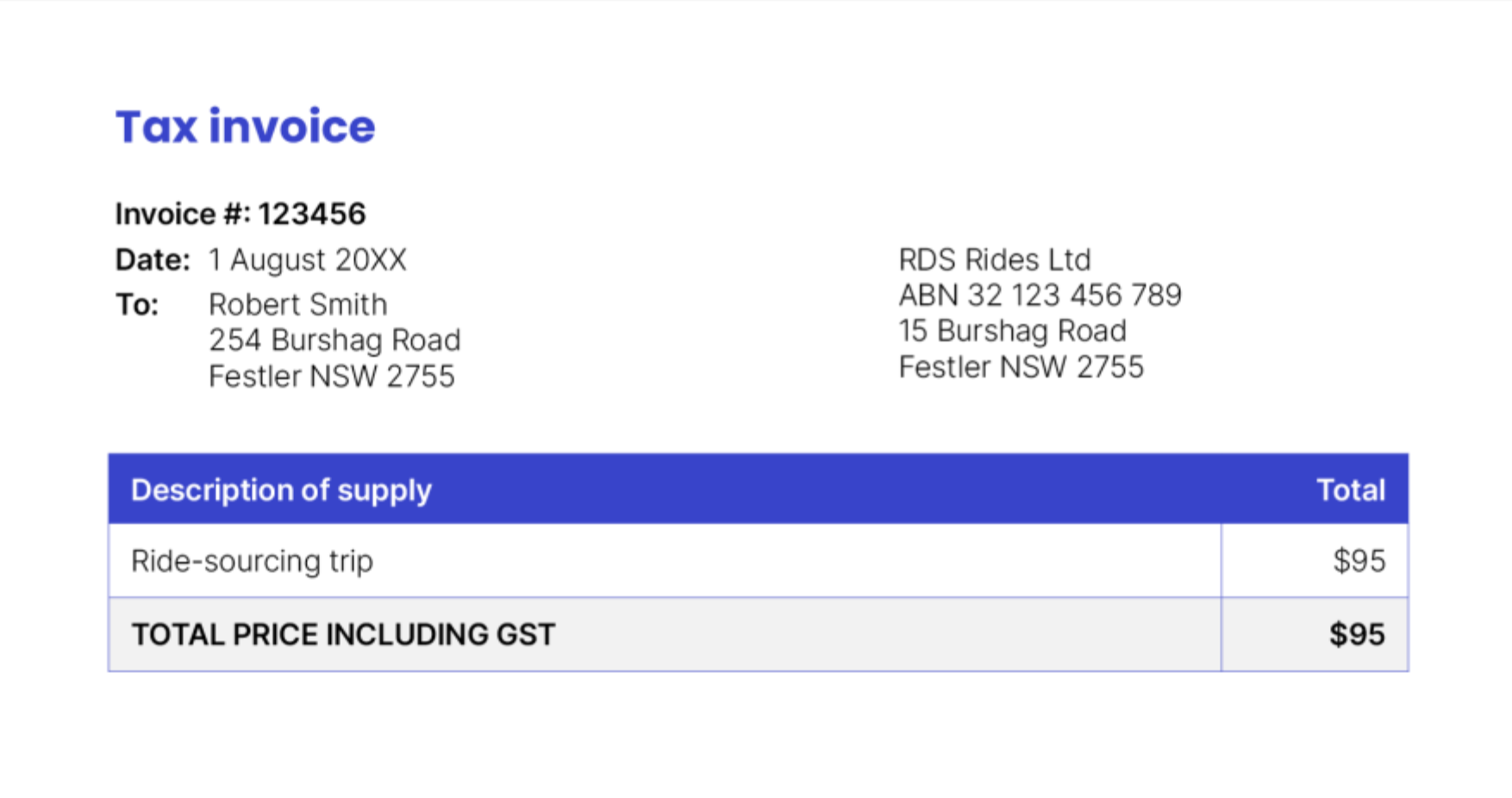

If the platform you are using cannot do this on your behalf, use a tax invoice book with your ABN on it – the tax invoice must contain certain details as shown here on screen. The ATO website has detailed information about what you should include on an invoice should you need to look it up later.

Tax invoice

The invoice must indicate that it is a tax invoice.

Identity and ABN

Your identity and ABN must be present.

Date

The invoice must include the date.

Service description

A brief description of the service provided must be included.

GST

The GST-inclusive price, or GST for each item must be shown.