Let’s meet Alex. She is a 25 year old ride-sourcing driver.

Alex is new to business and is using a folder in her glove box to track her expenses while driving. She enters her expenses into a spreadsheet that a friend sent her. She also uses the tax summaries provided by her ride-sourcing platforms to assist with tracking her expenses. She can’t remember if she has kept all her receipts since she started ride-sourcing. She uses her bank statement to check for any discrepancies.

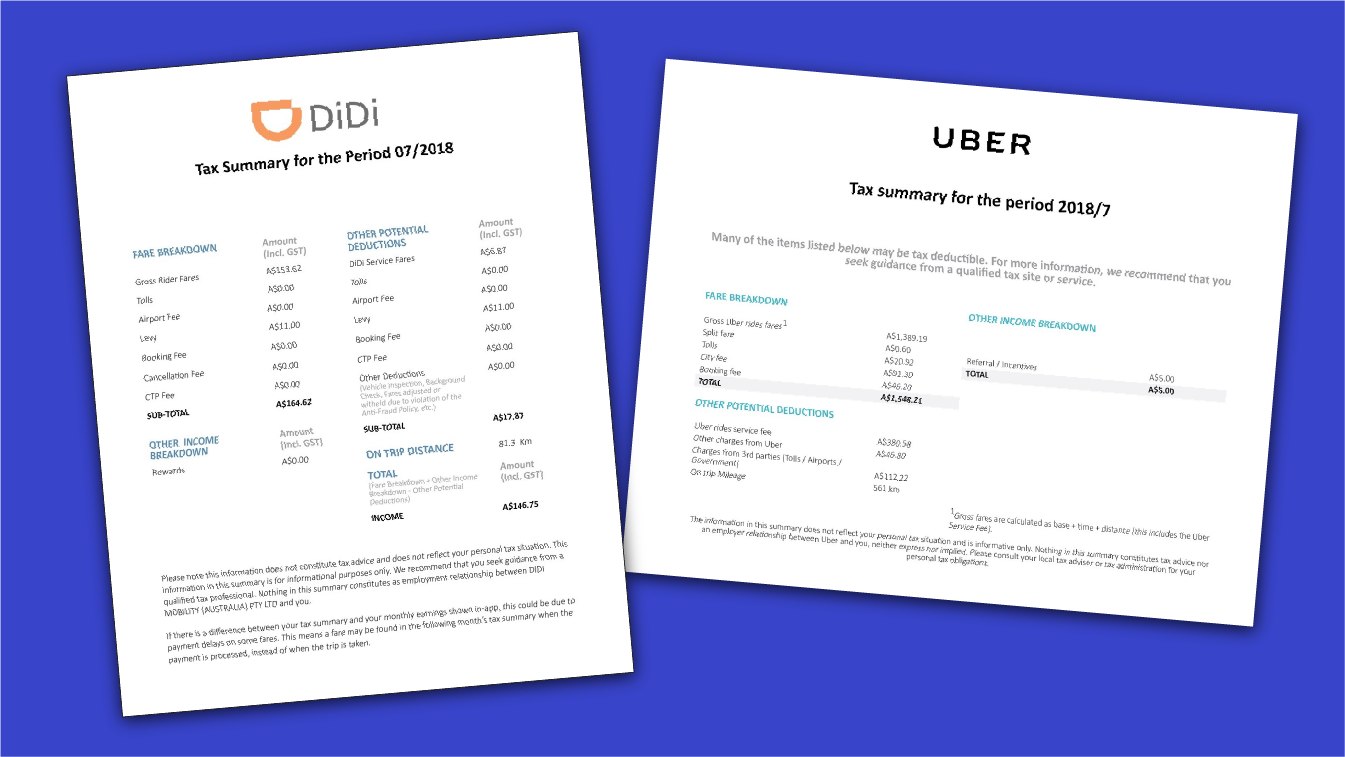

Alex receives a different tax summary from each of the platforms she uses to ride-source. Her income and expenses are mixed together with several fees and charges she doesn’t understand. She finds it difficult to know what to report on her business activity statement (BAS) and tax return.

Does this sound familiar? In this course, you will follow Alex and learn how to:

- interpret, calculate and report payments (income) from your ride-sourcing platform

- identify and calculate ride-sourcing expenses

- calculate GST on your income and expenses

- keep records of ride-sourcing income, GST, deductions and calculations

- complete a BAS.

This course does not recommend or endorse any of the ride-sourcing platforms listed – please research from the many available options online to meet your own unique small business needs.

Ride-sourcing: Income, expenses and GST

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

Ride-sourcing and tax |

4 mins | |||||

Managing income |

4 mins | |||||

Claiming expense deductions |

13 mins | |||||

Calculating and recording expense deductions |

6 mins | |||||

Calculating and recording GST |

6 mins | |||||

Completing your business activity statement (BAS) |

2 mins | |||||

GST considerations when purchasing a new ride-sourcing vehicle |

2 mins | |||||

Related courses |

1 mins | |||||

Course feedback |

||||||