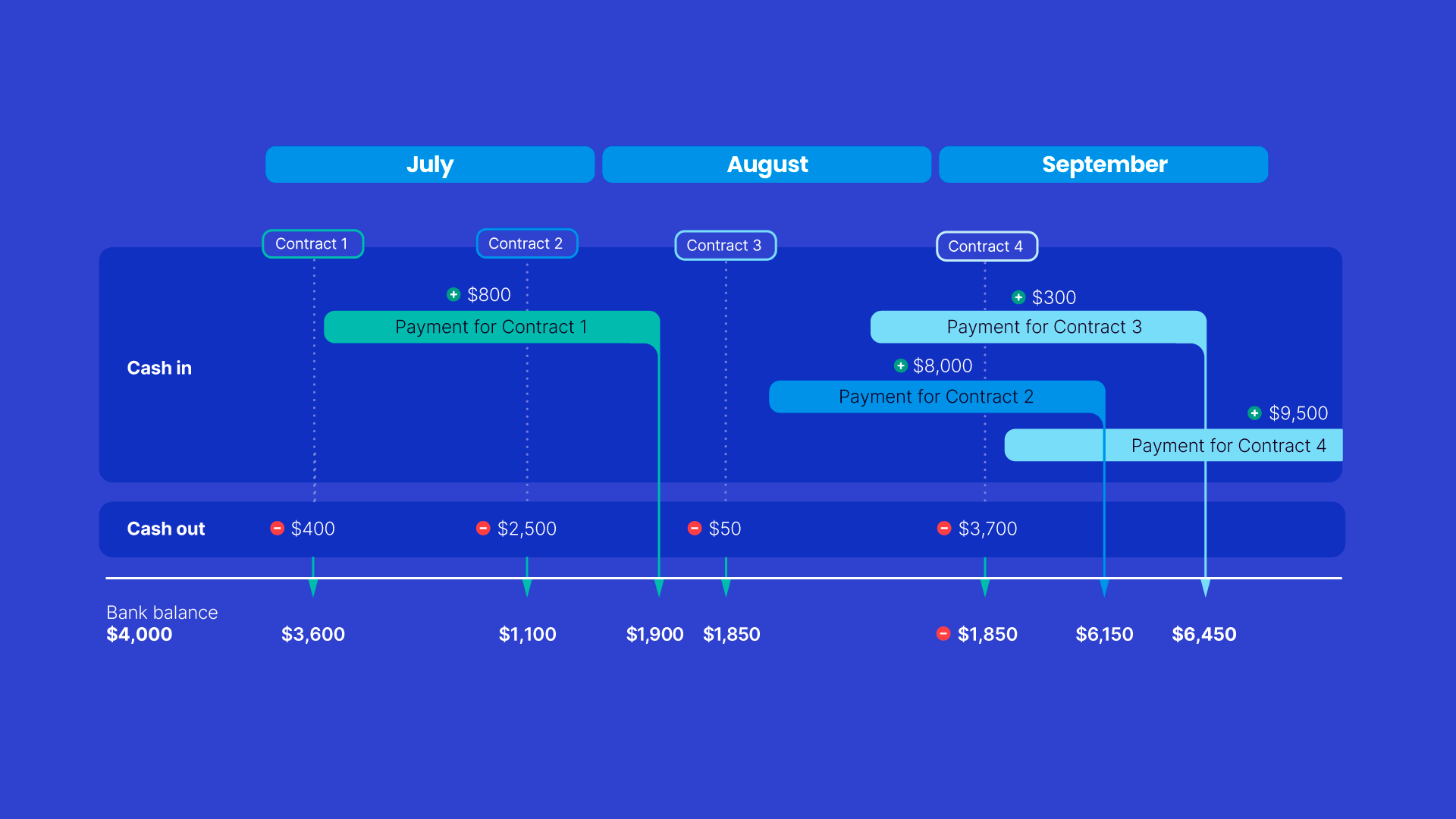

Sarah has decided to map her business cash flow. She starts by mapping out her work contracts. In reality, Sarah will have other commitments to include in this mapping process that affect her cash flow, such as her quarterly goods and services tax, repayments on her business loan, insurance, fuel costs. The list goes on.

Sarah’s business has a few contracts on the go. Each contract requires her to purchase materials before doing the job, which she must pay for on the day of purchase.

She gives her customers up to 30 days to pay after the invoice is issued and most use all 30 days before paying their account. Sarah can see periods where she has both positive and negative cash flow.

Remember when mapping your cash flow you record when you actually receive the cash.

1 July

Opening bank balance

| Date | Cash | Bank balance |

|---|---|---|

| 1 July | $4,000 |

8 July

Contract 1 materials

| Date | Cash | Bank balance |

|---|---|---|

| 8 July | -$400 | $3,600 |

| 1 July | $4,000 |

10 July

Contract 1 invoiced $800

Before the 30 days for that invoice is due, that is, before Sarah receives payment, she needs to purchase materials for the next contract.

| Date | Cash | Bank balance |

|---|---|---|

| 10 July | $3,600 | |

| 8 July | -$400 | $3,600 |

| 1 July | $4,000 |

27 July

Contract 2 materials

| Date | Cash | Bank balance |

|---|---|---|

| 27 July | -$2,500 | $1,100 |

| 10 July | $3,600 | |

| 8 July | -$400 | $3,600 |

| 1 July | $4,000 |

5 August

Contract 1 payment received

| Date | Cash | Bank balance |

|---|---|---|

| 5 August | $800 | $1,900 |

| 27 July | -$2,500 | $1,100 |

| 10 July | $3,600 | |

| 8 July | -$400 | $3,600 |

| 1 July | $4,000 |

14 August

Contract 3 materials

After purchasing materials for contract 3, Sarah’s bank balance is reduced.

Sarah has been operating with positive cash flow to this point.

| Date | Cash | Bank balance |

|---|---|---|

| 14 August | -$50 | $1,850 |

| 5 August | $800 | $1,900 |

| 27 July | -$2,500 | $1,100 |

| 10 July | $3,600 | |

| 8 July | -$400 | $3,600 |

| 1 July | $4,000 |

17 August

Contract 2 invoiced $8,000

Sarah invoices for contract 2 and is expecting $8,000 payment within the next 30 days.

| Date | Cash | Bank balance |

|---|---|---|

| 17 August | $1,850 | |

| 14 August | -$50 | $1,850 |

| 5 August | $800 | $1,900 |

| 27 July | -$2,500 | $1,100 |

| 10 July | $3,600 | |

| 8 July | -$400 | $3,600 |

| 1 July | $4,000 |

7 September

Contract 4 materials

Before Sarah receives payment for contract 2, she needs to purchase materials for her fourth contract. It’s a big contract and the materials cost $3,700 taking her bank balance into the red.

Sarah is now operating with a cash deficit or negative cash flow.

| Date | Cash | Bank balance |

|---|---|---|

| 7 September | -$3,700 | -$1,850 |

| 17 August | $1,850 | |

| 14 August | -$50 | $1,850 |

| 5 August | $800 | $1,900 |

| 27 July | -$2,500 | $1,100 |

| 10 July | $3,600 | |

| 8 July | -$400 | $3,600 |

| 1 July | $4,000 |

13 September

Contract 2 payment due

Sarah is looking ahead at this point. She knows if the payment for contract 2 comes in on time, she will again have a cash surplus. If she doesn’t receive the payment she will still have a negative cash flow of -$1,850.

| Date | Cash | Bank balance |

|---|---|---|

| 13 September | $8,000 | (Projection) $6,150 |

| 7 September | -$3,700 | -$1,850 |

| 17 August | $1,850 | |

| 14 August | -$50 | $1,850 |

| 5 August | $800 | $1,900 |

| 27 July | -$2,500 | $1,100 |

| 10 July | $3,600 | |

| 8 July | -$400 | $3,600 |

| 1 July | $4,000 |

26 September

Contract 3 payment due

Sarah continues to look ahead. Contract 3 is due to be paid in the last week of September which means she will continue to have positive cash flow.

| Date | Cash | Bank balance |

|---|---|---|

| 26 September | $300 | (Projection) $6,450 |

| 13 September | $8,000 | (Projection) $6,150 |

| 7 September | -$3,700 | -$1,850 |

| 17 August | $1,850 | |

| 14 August | -$50 | $1,850 |

| 5 August | $800 | $1,900 |

| 27 July | -$2,500 | $1,100 |

| 10 July | $3,600 | |

| 8 July | -$400 | $3,600 |

| 1 July | $4,000 |

20 October

Contract 4 payment due

Still projecting forward Sarah can see contract 4 is due to be paid in October which means her cash flow will remain positive.

| Date | Cash | Bank balance |

|---|---|---|

| 20 October | $9,500 | (Projection) $15,950 |

| 26 September | $300 | (Projection) $6,450 |

| 13 September | $8,000 | (Projection) $6,150 |

| 7 September | -$3,700 | -$1,850 |

| 17 August | $1,850 | |

| 14 August | -$50 | $1,850 |

| 5 August | $800 | $1,900 |

| 27 July | -$2,500 | $1,100 |

| 10 July | $3,600 | |

| 8 July | -$400 | $3,600 |

| 1 July | $4,000 |

Sarah can see when she has money due to come in from contracts and the times she is running low on cash.

As Sarah receives more contracts she will map those details. Knowing her cash flow position over the coming months will help Sarah to prepare for those times when she has a negative cash flow.