The fixed rate method apportions the following additional running expenses you incur on a fair and reasonable basis by using a fixed rate of 70 cents per hour for each hour you worked from home during the income year:

- electricity expenses for lighting, heating/cooling and electronic items used while working from home

- gas expenses used for heating

- internet expenses

- mobile and/or home telephone expenses, and

- stationery and computer consumables.

The rate per hour

The rate per hour calculates the total of these deductible expenses for the income year. This means you can’t claim an additional separate deduction for any of these expenses. For example, if you use your mobile phone when you are working from home and when you are working from somewhere other than your home, your total deduction for mobile phone expenses for the income year will be covered by the hourly rate of 70 cents per hour.

This rate is reviewed yearly, so check for the correct rate for each year.

You need to separately calculate the work-related decline in value of any depreciating assets that you used while working from home during the income year. Such as, depreciation on furniture and equipment.

Evidence of hours worked

You must keep a record for the entire income year of the number of hours you worked from home during that income year.

An estimate for the entire income year, or an estimate based on the number of hours you work from home during a particular period and applied to the rest of the income year, will not be accepted.

A record of your hours worked for the income year can be in the form of:

- timesheets

- rosters

- diary or similar document.

Evidence of running expenses

The documents you need to keep to demonstrate that you have incurred additional running expenses must show what the expense is and that you incurred the expense.

For electricity, gas, mobile and/or home telephone and internet expenses you must keep one monthly or quarterly bill. A credit card statement can be kept instead of a bill if it shows what the payment was for and the amount you incurred. If the bill is not in your name, you will also have to keep additional evidence showing you incurred the expenses. For example, a joint credit card statement showing payment or a lease agreement showing you share the property, and therefore share the expenses, with others.

For stationery and computer consumables, which are occasional expenses, you must keep one receipt for an item purchased.

If you do not keep evidence of the total hours you worked from home and for each of the running expenses you incurred, you will not be able to use the fixed rate method.

How to calculate your claim

Calculate the number of hours you worked from home during the income year based on your records. Multiply the total number of hours you worked from home during the income year by the fixed rate.

Formula:

Actual business hours worked x fixed rate

Example:

Actual business hours worked from home: 768 hours

Fixed rate = 70 cents per hour

Deduction = Actual business hours worked x fixed rate

= 768 hours x 70 cents per hour

= $537

In this example, $537 is the total amount you can claim for the business portion of electricity, gas, internet, mobile and/or home telephone and stationery and computer consumables for the income year. Remember this 70 cents doesn’t include the depreciation deductions on your business furniture and equipment – you calculate that deduction separately and then add it to $537.

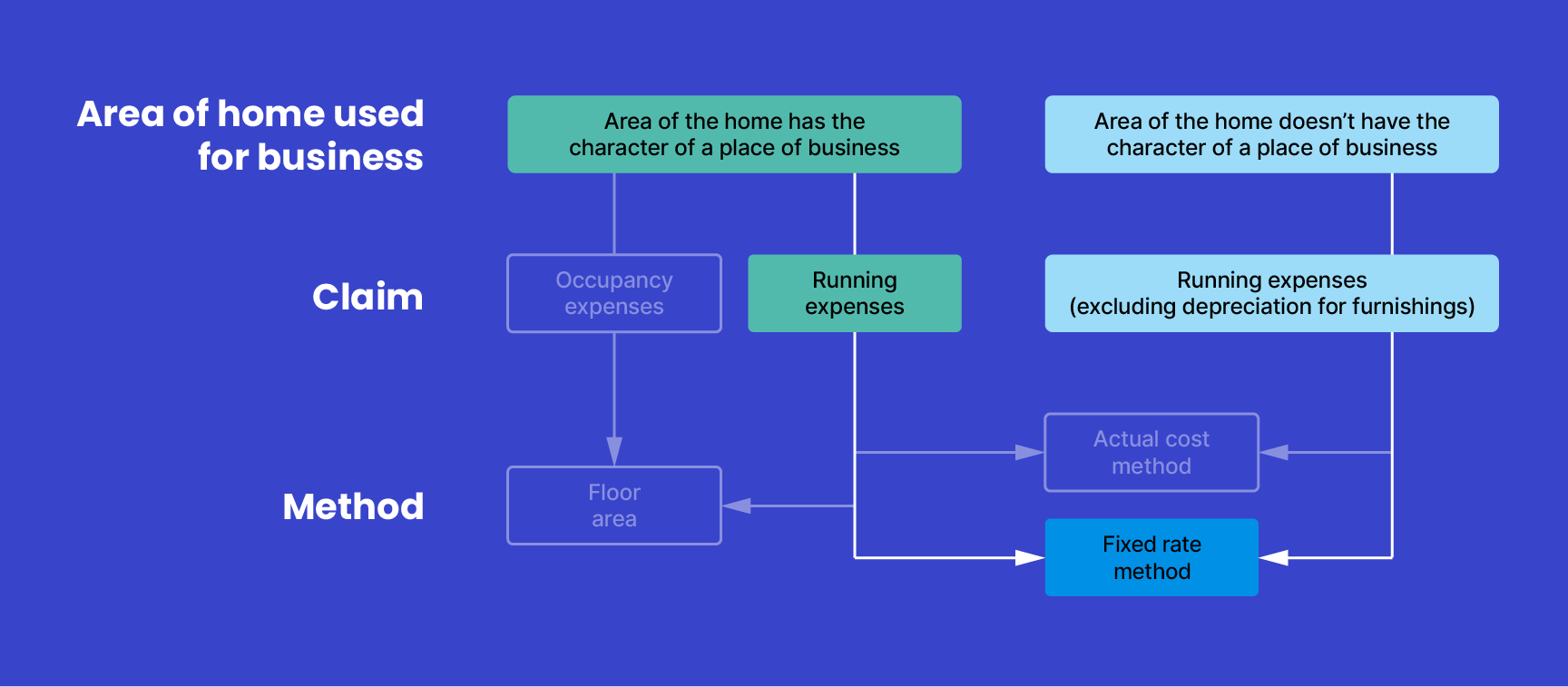

Claiming deductions for your home-based business

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

What is a home-based business? |

3 mins | |||||

Types of expenses |

7 mins | |||||

Calculating running expenses |

10 mins | |||||

Calculating occupancy expenses |

3 mins | |||||

How your business structure affects your deductions |

3 mins | |||||

Case studies: home-based business |

5 mins | |||||

Home-based business deductions records |

1 mins | |||||

Related courses |

1 mins | |||||

Course feedback |

||||||