You can use any method to calculate your running expenses, as long as:

- it's reasonable in your circumstances

- you exclude the percentage of costs for your private (normal) living costs

- you have records to show how you calculated the expense.

Your business use of the home business area must be substantial and not incidental. For example, you can't claim electricity costs 24 hours per day simply because your fax machine is always on to receive business faxes. Also, minimal tasks such as occasionally checking emails or taking telephone calls while at home will not qualify as substantial use of the home business area.

Here are some methods that are commonly used to calculate home-based business additional running expenses.

- Floor area method

- is often the most appropriate way to work out some of your running expenses if you have a dedicated area set aside for business which qualifies as a place of business.

- Actual cost method

- calculates your running expenses based on their actual cost.

- Fixed rate method

- allows you to claim a deduction of 70 cents per hour based on the actual hours worked during the year and applies from 1 July 2024.

- to use this method, you must keep evidence of the total hours you worked from home and for each of the running expenses you incurred.

If you’re unsure which method you want to use, you can calculate your expenses using each applicable method and select the one that gives you the best result.

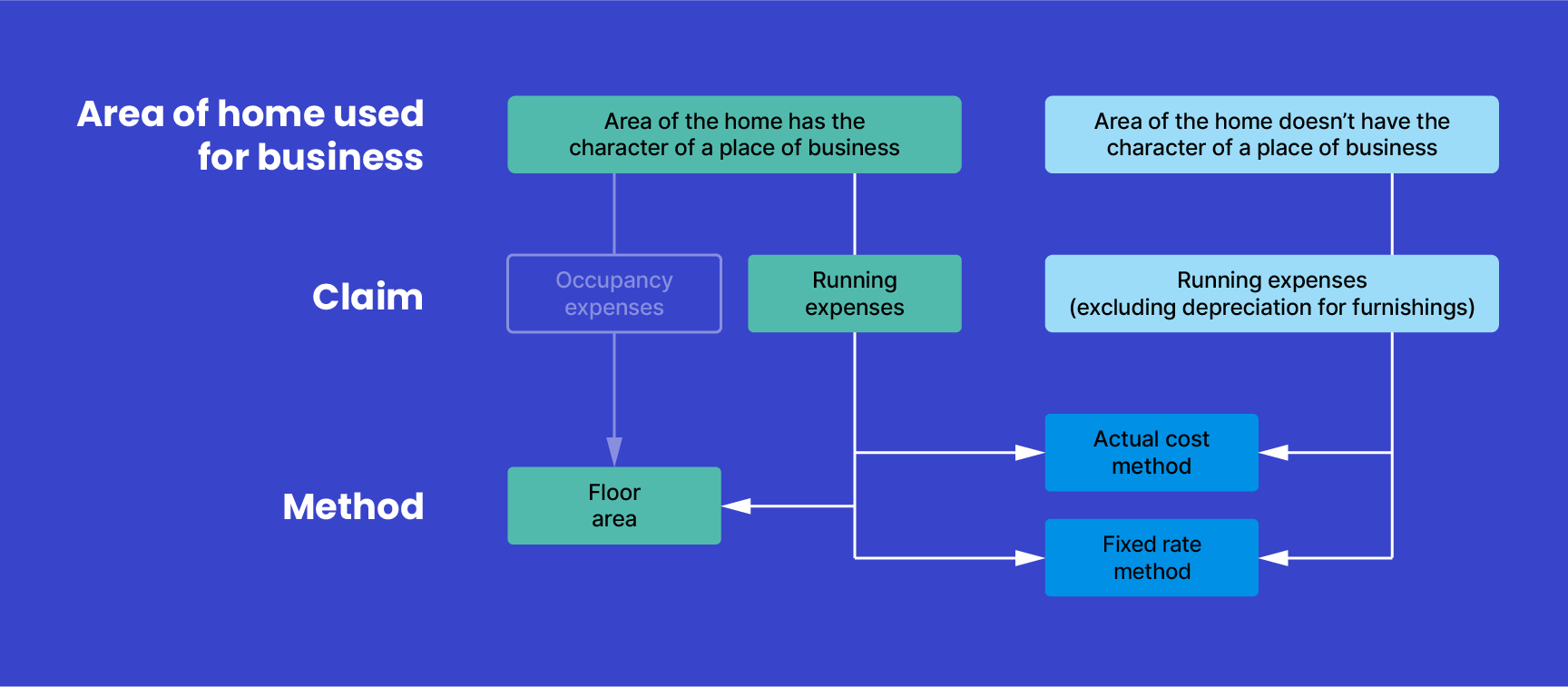

This image guides you through the methods you can use when claiming home-based running expenses, depending on whether the area of your home used for business qualifies as a place of business.

- If the area has the character of a place of business, you can calculate your claims using the floor area, actual cost or revised rate methods.

- If the area doesn’t have the character of a place of business, you can calculate your claims using the actual cost or fixed rate methods.

Claiming deductions for your home-based business

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

What is a home-based business? |

3 mins | |||||

Types of expenses |

7 mins | |||||

Calculating running expenses |

10 mins | |||||

Calculating occupancy expenses |

3 mins | |||||

How your business structure affects your deductions |

3 mins | |||||

Case studies: home-based business |

5 mins | |||||

Home-based business deductions records |

1 mins | |||||

Related courses |

1 mins | |||||

Course feedback |

||||||