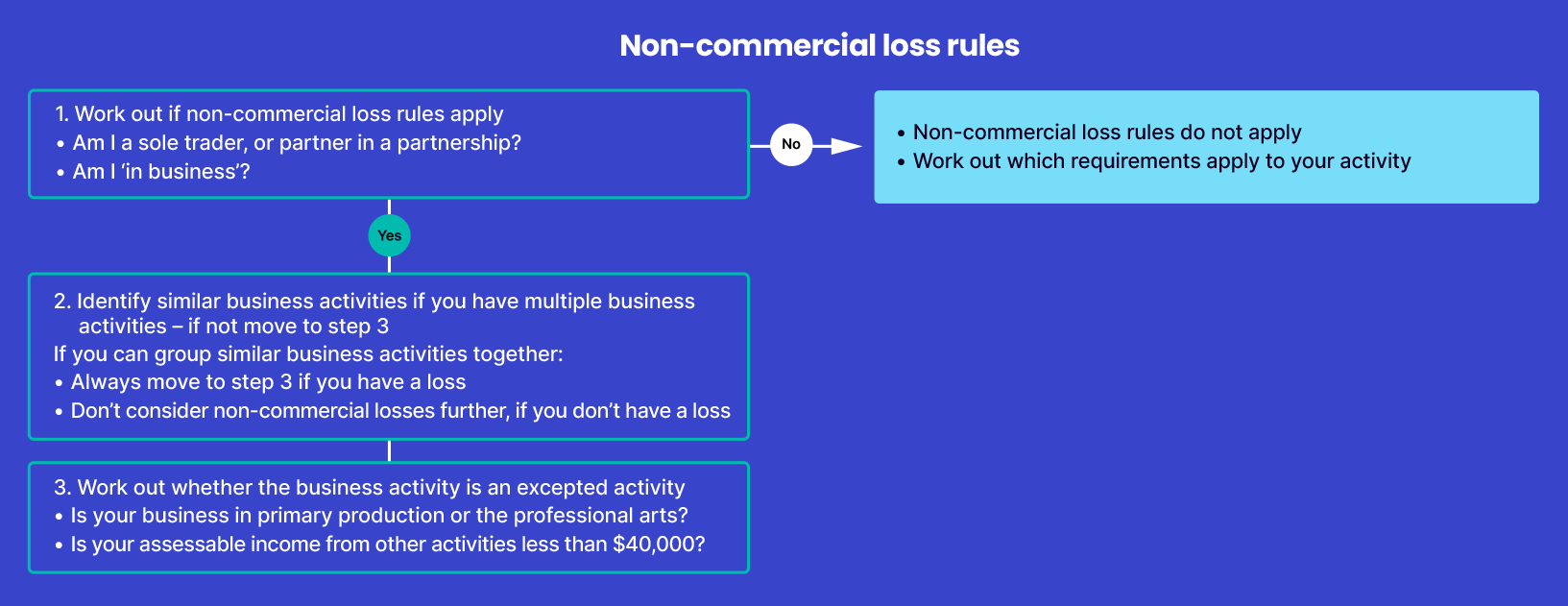

Once you confirm that you need to consider the non-commercial loss rules, the next step is to look at all your activities.

If you have more than one business activity and they’re similar, you can group them together when considering the non-commercial loss rules. Grouping similar business activities may be beneficial to you because this may mean:

- you don’t make a loss, or

- the non-commercial loss rules don’t apply to a loss you make from the combined activity, because you meet the income test and pass one of the four tests.

For example, to pass the first test the assessable income of your business must be at least $20,000. If you have 2 similar business activities, and one generates $12,000 income while the other generates $10,000, they wouldn’t pass the test individually. However, by grouping these similar activities together they will pass the income test.

To decide whether business activities are similar, you consider:

- the assets they use

- the nature of their operations

- their location

- the goods or services provided

- the market conditions for the goods and services

- any links between the activities of the businesses.

The more the business activities have in common, the more likely they can be grouped together.

Examples of activities that may be similar include:

- grazing sheep and grazing cattle

- growing grapes and growing olives

- manufacturing shirts and manufacturing jeans.

Examples of activities that may not be similar include:

- manufacturing children’s goods and farming

- repairing cars and making furniture

- growing potatoes and providing contract services.

If you have multiple business activities that aren’t similar and they each make losses, you must apply the non-commercial loss rules separately for each set of business activities.

For more details and examples on when business activities are considered to be similar, see TR 2001/14 Income tax: Division 35 – non-commercial losses.

If you’re able and choose to group your business activities, move to the third step if you still have a loss.

If, you have not made a loss from the combined business activity you don’t need to consider the non-commercial loss rules any further.