×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

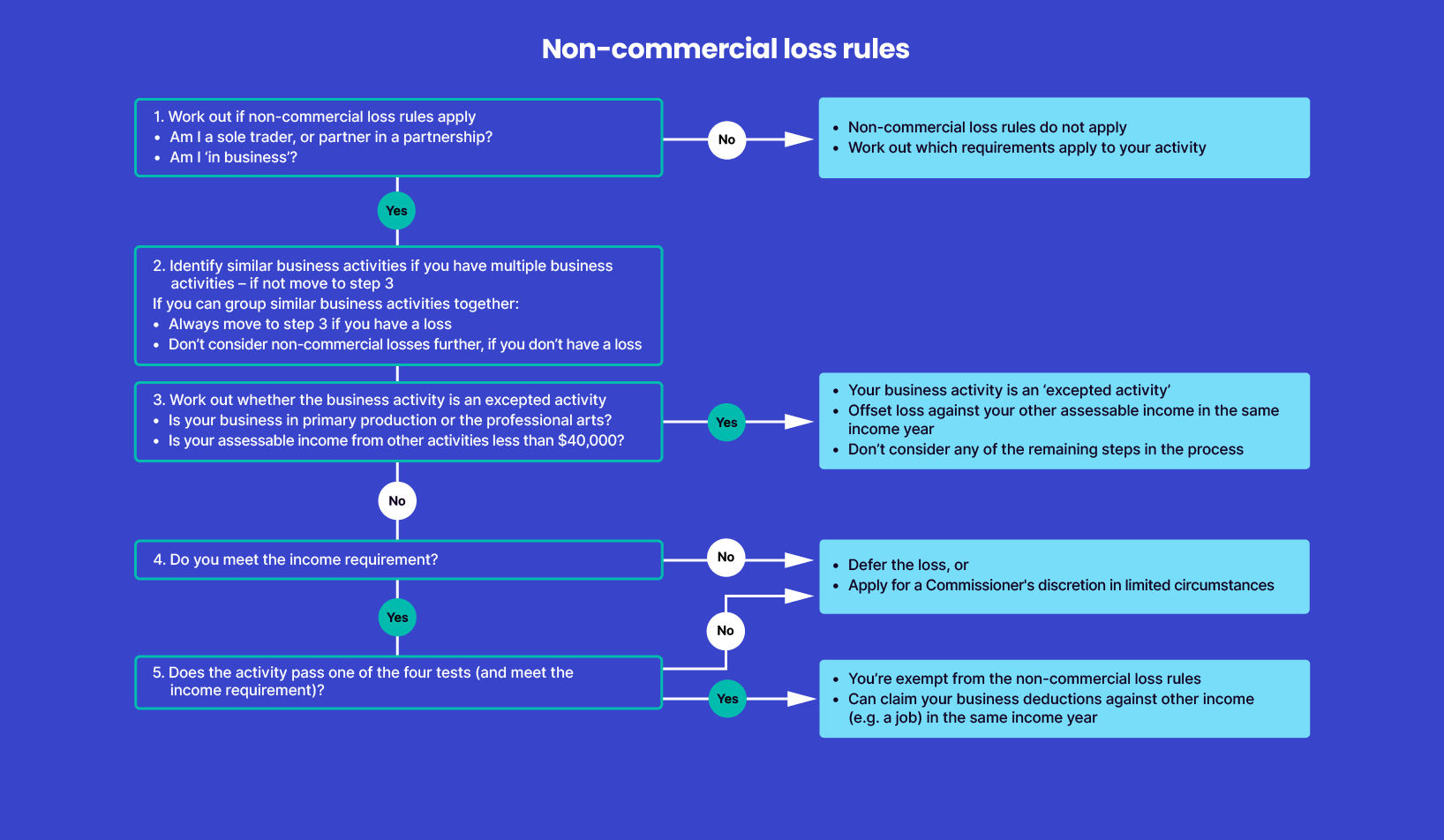

If you meet the income requirement and pass at least one of the four tests you can offset the loss from your business activity against your other income, in the same income year.

If you don’t meet the income requirement or you don’t pass one of the four tests, then non-commercial loss rules apply and you must defer your loss. Your deferred loss can be deducted in the next year you carry on the same business activity and must be claimed against that same business activity.

Last modified: 16 Apr 2024