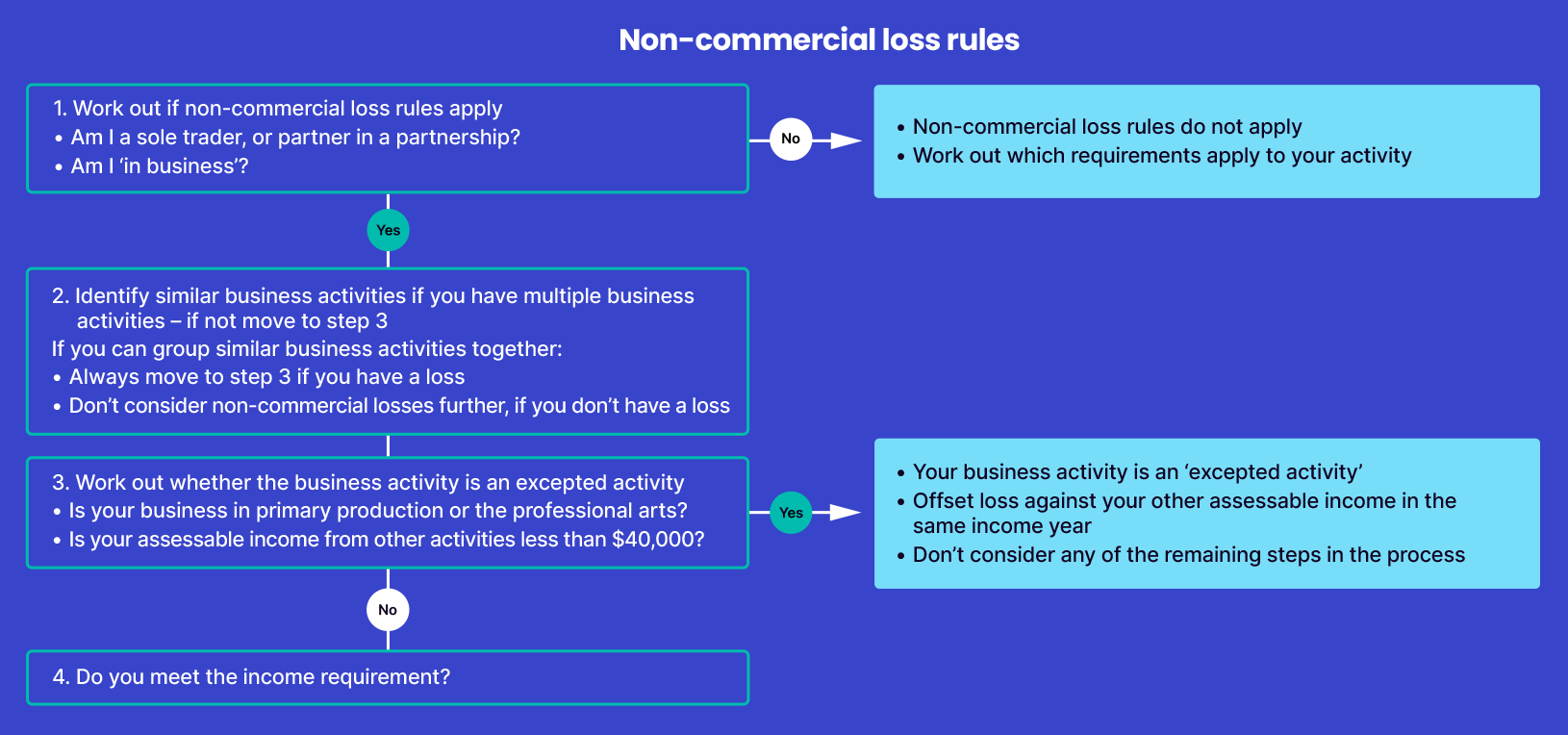

After reviewing the first 2 steps, you then look at whether your business activity is an ‘excepted activity’.

Excepted activity

We refer to certain primary production and professional arts business activities as ‘excepted business activities’. Loss-making businesses in primary production or professional arts are 'excepted business activities' if your income from other sources is less than $40,000 (excluding any net capital gains).

If your business is an ‘excepted business activity’ and you make a loss from those activities, you may be able to deduct your business losses from other income in the same income year.

What is a primary production business?

Primary production business activities include:

- plant and animal cultivation

- fishing and pearling

- tree farming and felling.

What is a professional arts business?

A professional arts business is a business you carry on as:

- an author of a literary, dramatic, musical or artistic work

- a performing artist

- a production associate.

Example

Mary has a primary production business in plant cultivation. She made a loss of $5,000 from this business.

Mary also worked part time in a café, earning $38,000. Because Mary’s other income (from the café) is less than $40,000 and she carries on a primary production business her business is an excepted business activity. Mary can deduct the primary production loss from the café income, i.e.:

$38,000 – $5,000 = $33,000 reduced assessable income.

If your business is an excepted activity

If your business activity is an excepted activity then the non-commercial loss rules don’t apply. You can claim your business loss against your other income in the same income year and may contribute to a tax loss for the income year. You don’t need to apply the other steps in the process.

If your business activity is not an excepted activity, you go to the fourth step in the process.

Find out more about excepted business activities.