×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

As a trustee you can accept contributions and rollovers for your members from various sources.

A contribution can be certain assets transferred to your SMSF or money deposited into your SMSF financial institution account on behalf of a member.

A rollover is when a member transfers some or all their existing super between funds.

There are some steps you need to take for contributions and rollovers to be successful. Make sure:

- you obtain an active electronic service address (ESA) that offers contributions and rollover services

- you advise us of your ESA – you can only record one ESA with the ATO, so check that your ESA provider offers both services should you require this

- your SMSF has an Australian business number (ABN)

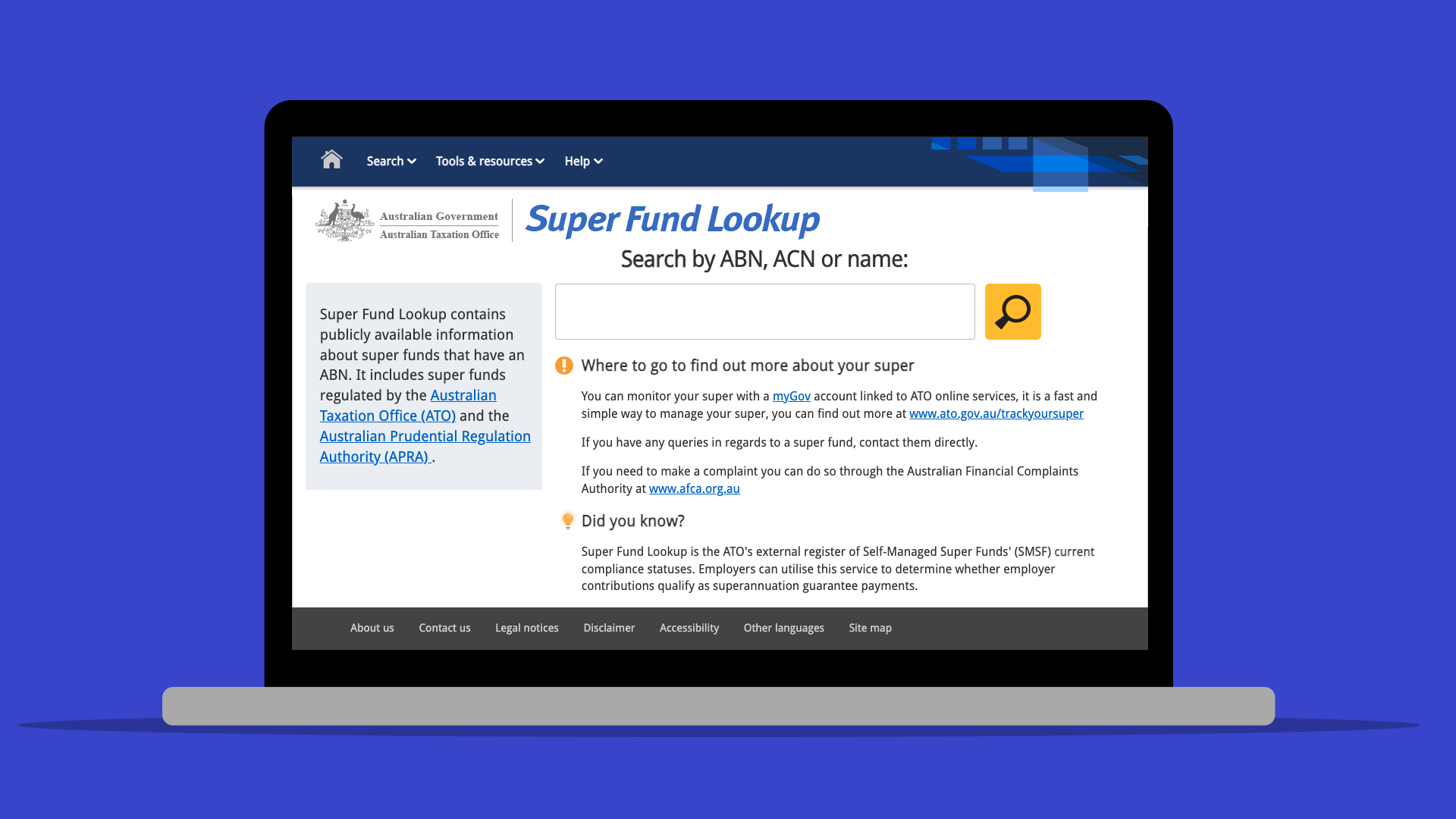

- your SMSF has a ‘Complying’ or ‘Registered’ status on Super Fund Lookup

- you have a unique financial institution account for your SMSF recorded with the ATO

- member and fund details held by the ATO, the sending fund and the receiving fund are up-to-date and identical

- you contact the transferring fund to understand any proof of identity (POI) requirements.

ESA’s can expire, so make sure yours is still active with your provider to successfully process contributions and rollovers.

To record your fund’s active ESA details with the ATO you can:

- use the Profile menu in Online services for business

- use a registered agent, or

- phone the ATO on 13 10 20.

Last modified: 25 Nov 2024

Running a self-managed super fund (SMSF)

| Steps | Progress | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

What is an SMSF? |

3 mins | |||||||||||||||||||||||

Your obligations when running an SMSF |

1 mins | |||||||||||||||||||||||

Contributions and rollovers |

1 mins | |||||||||||||||||||||||

Contributions |

6 mins | |||||||||||||||||||||||

Rollovers |

6 mins | |||||||||||||||||||||||

Managing your fund’s investments |

36 mins | |||||||||||||||||||||||

|

|

||||||||||||||||||||||||

Paying super benefits |

8 mins | |||||||||||||||||||||||

Types of benefits |

18 mins | |||||||||||||||||||||||

|

|

||||||||||||||||||||||||

Reporting and administration |

1 mins | |||||||||||||||||||||||

Understand how your fund is taxed |

5 mins | |||||||||||||||||||||||

Value your fund’s assets and prepare financial statements |

2 mins | |||||||||||||||||||||||

Arrange and receive an SMSF audit |

7 mins | |||||||||||||||||||||||

Lodge your SMSF annual return (SAR) |

4 mins | |||||||||||||||||||||||

PAYG withholding obligations |

4 mins | |||||||||||||||||||||||

Reporting transfer balance cap events |

3 mins | |||||||||||||||||||||||

Record-keeping requirements |

2 mins | |||||||||||||||||||||||

Notify the ATO and ASIC of changes |

2 mins | |||||||||||||||||||||||

Consider professional advice |

2 mins | |||||||||||||||||||||||

Help and more information |

3 mins | |||||||||||||||||||||||

|

||||||||||||||||||||||||

Related courses |

1 mins | |||||||||||||||||||||||

Course feedback |

||||||||||||||||||||||||