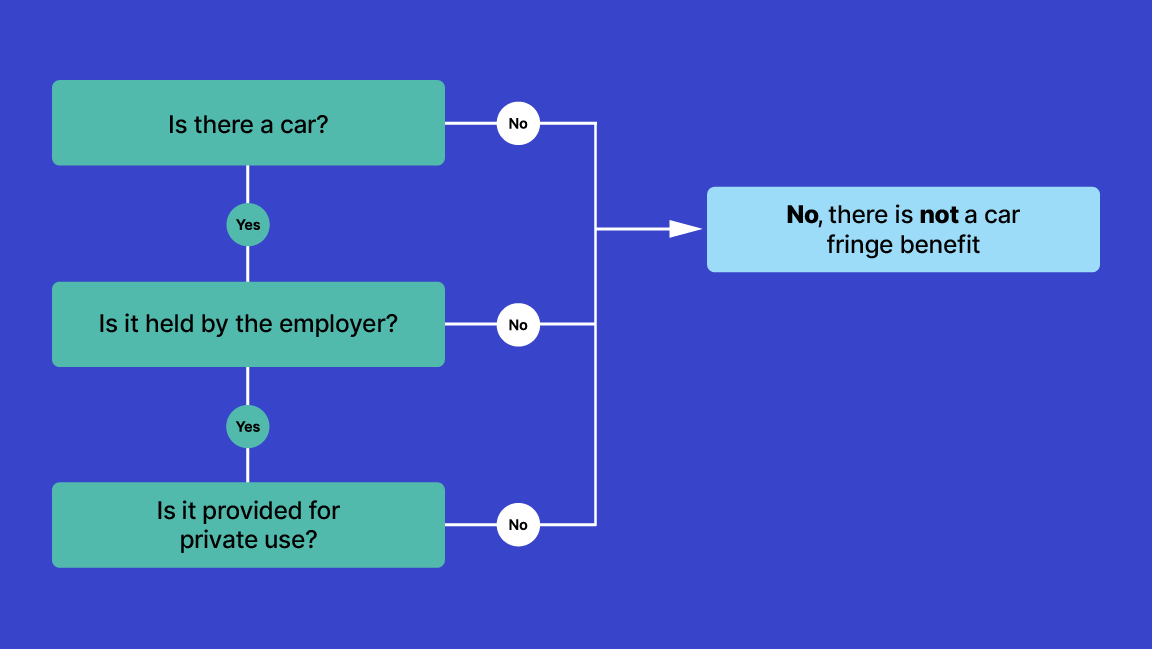

You may think that you don’t provide a car for private use, you provide the car for work use and if it happens to be used now and then for private purposes, that it’s probably not a car fringe benefit.

However, you provide a car for private use on any day that either the car is actually used for private purposes by the employee; or the car is available for the private use of the employee.

A car is treated as being available for private use by an employee on any day that either the:

- car is garaged at the employee's home

- car is not at your business premises and the employee is entitled to use it for private purposes

- employee is not performing employment duties and has custody or control of the car.

Thinking about garaging as well as use, custody and control can help you understand ‘available for private use’.

Garaging

Garaging is where the car is kept.

A car that’s garaged at or near an employee's home is treated as being available for the private use of the employee. This is regardless of whether they have permission to use it for private purposes. Actual use of the car by the employee is not relevant as the place of garaging is the determining factor. This means that a fringe benefit will arise even though the employee might not be in a position to use the car. For example, where the employee is overseas during the days concerned.

Where a car is garaged at your business premises, the car is not deemed to be available for the employee's private use unless the premises are also the employee's place of residence.

As a general rule, travel to and from work is private use of a vehicle.

Where a car is in a workshop for extensive repairs it isn’t available for private use of the employee. For example, following a car accident. However, a car is considered to be available for private use where it’s in the workshop for routine servicing or maintenance.

Use, custody and control

Where a car that you hold is, on any day, not garaged at your business premises, it’s taken to be available for an employee’s private use if either of the following 2 conditions are satisfied.

- The employee is entitled to apply the car to a private use. That is, an employee

- is deemed to be entitled to use a car, or apply a car for a private purpose, if you do not consistently enforce a prohibition on private use

- will remain entitled to apply a car for private purposes unless you remove the custody and control of the car from the employee, for example take the car keys, and can substantiate a prohibition on the private use of the car.

- The employee is not performing employment duties and has custody and control of the car. The physical custody and physical control of the car would be removed from the employee when you take possession of the car and car keys.

Circumstances can vary significantly but thinking about it in these terms can be a good first step.

Car fringe benefits tax

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

Fringe benefits overview |

3 mins | |||||

Reducing your FBT liability |

3 mins | |||||

Providing a car fringe benefit |

7 mins | |||||

Operating cost method |

20 mins | |||||

Statutory formula method |

11 mins | |||||

Car fringe benefits records |

1 mins | |||||

Related courses |

1 mins | |||||

Course feedback |

||||||