A fringe benefit is a ‘payment’ made to an employee but in a different form to salary or wages. It’s provided 'in respect of employment'.

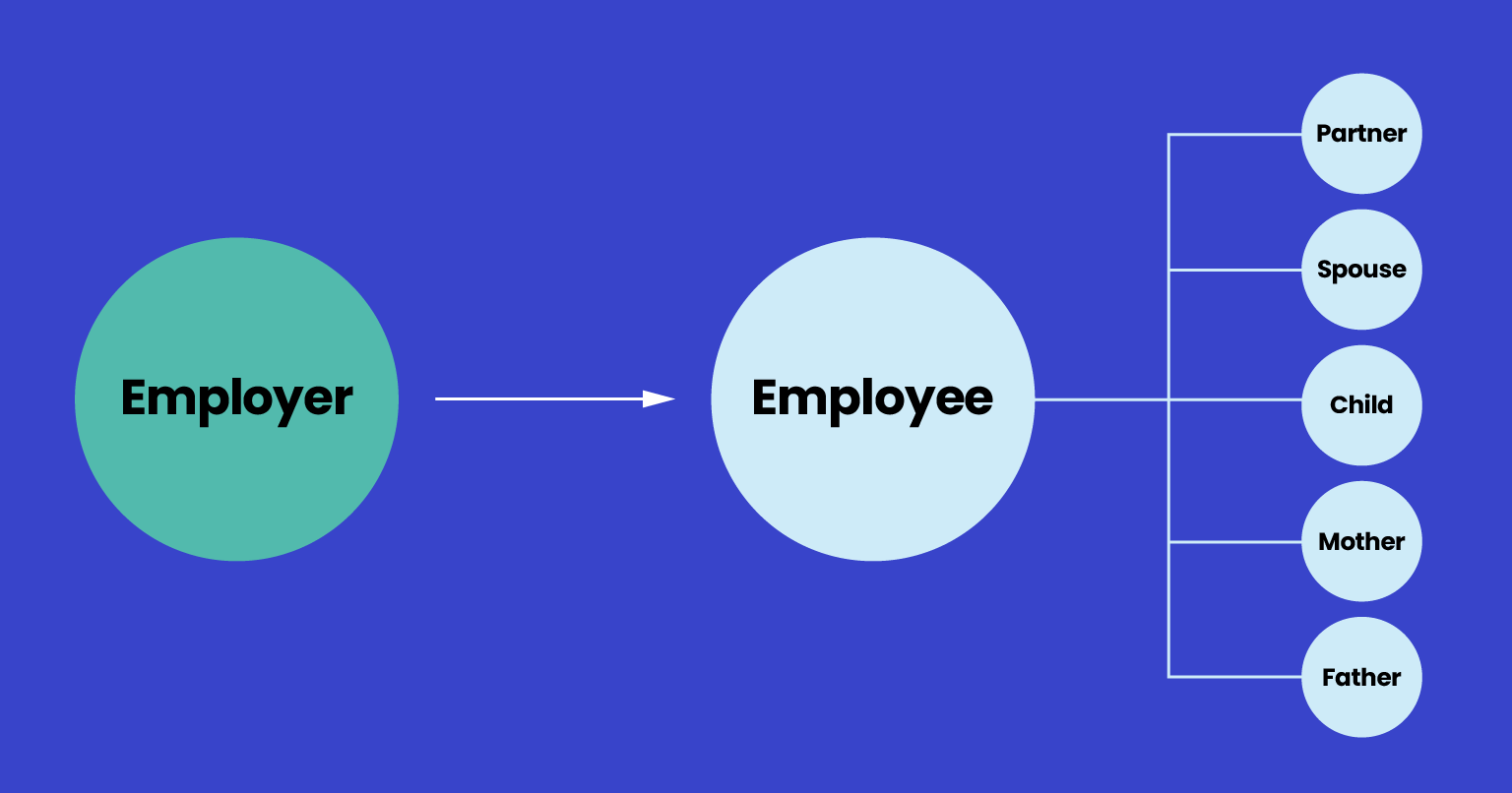

The employer/employee relationship is crucial to whether you’re providing a fringe benefit.

Interestingly, this relationship can extend past the employee to what is called an associate of the employee. An associate of an employee includes their partner, spouse, child or other relative. For example, if an employer pays the gym fees of an employee’s spouse, this is considered a fringe benefit provided to an associate of the employee.

Benefits provided to volunteers and contractors are not considered fringe benefits. Fringe benefits only exist when the benefit is being provided from an employer to an employee. There needs to be an employer/employee relationship.

Tax on a fringe benefit is paid by you, the employer.

Car fringe benefits tax

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

Fringe benefits overview |

3 mins | |||||

Reducing your FBT liability |

3 mins | |||||

Providing a car fringe benefit |

7 mins | |||||

Operating cost method |

20 mins | |||||

Statutory formula method |

11 mins | |||||

Car fringe benefits records |

1 mins | |||||

Related courses |

1 mins | |||||

Course feedback |

||||||