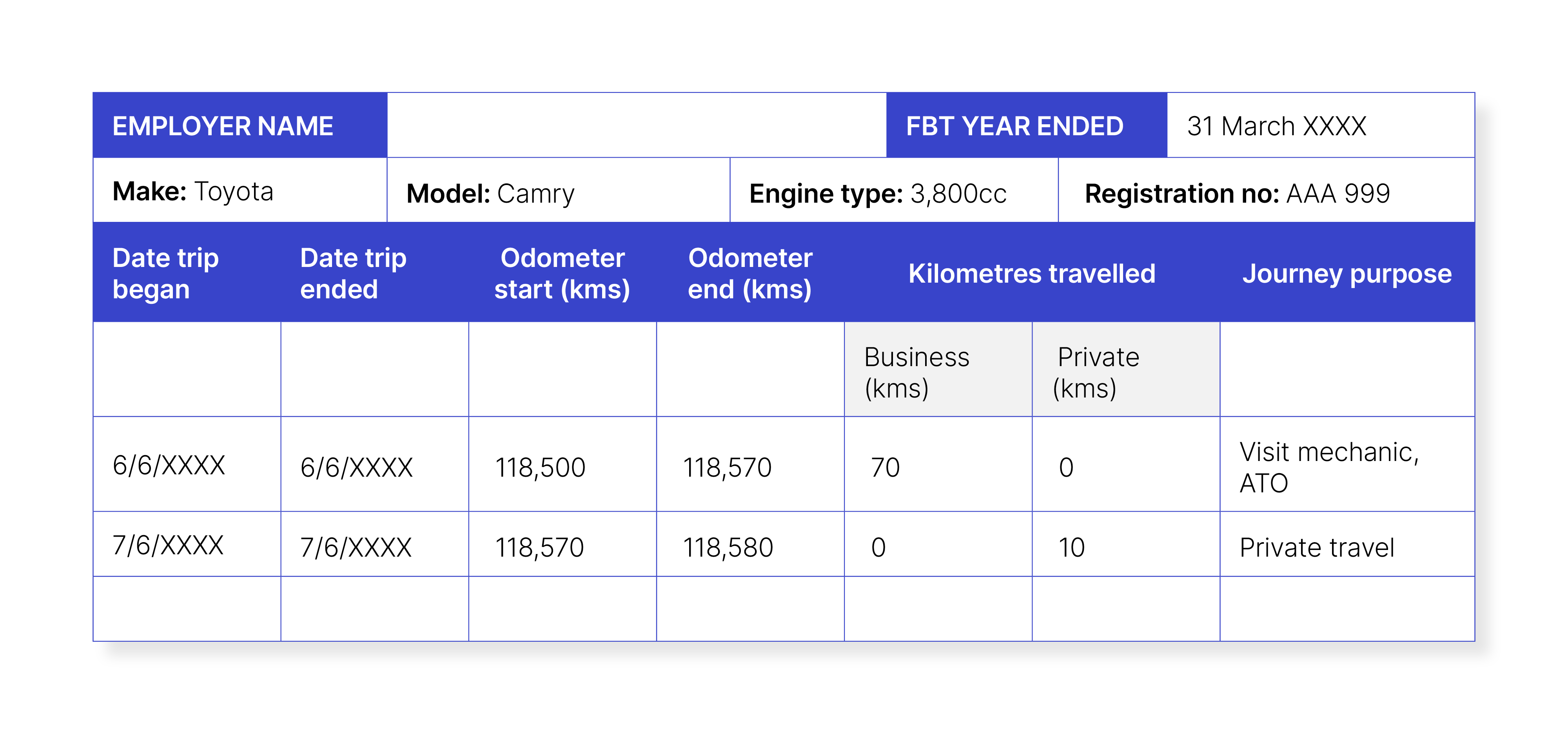

The minimum information you need to record in a logbook is shown here.

There are a few important points.

For purpose of journey, entering something vague like ‘business’ or ‘miscellaneous business’ is not detailed enough. Your entry should sufficiently describe the purpose of the journey so it can be clearly classified as a business journey.

You don’t have to record private travel in a logbook, but some people find it helps with calculations.

One car, one logbook. Keep a separate logbook for each car.

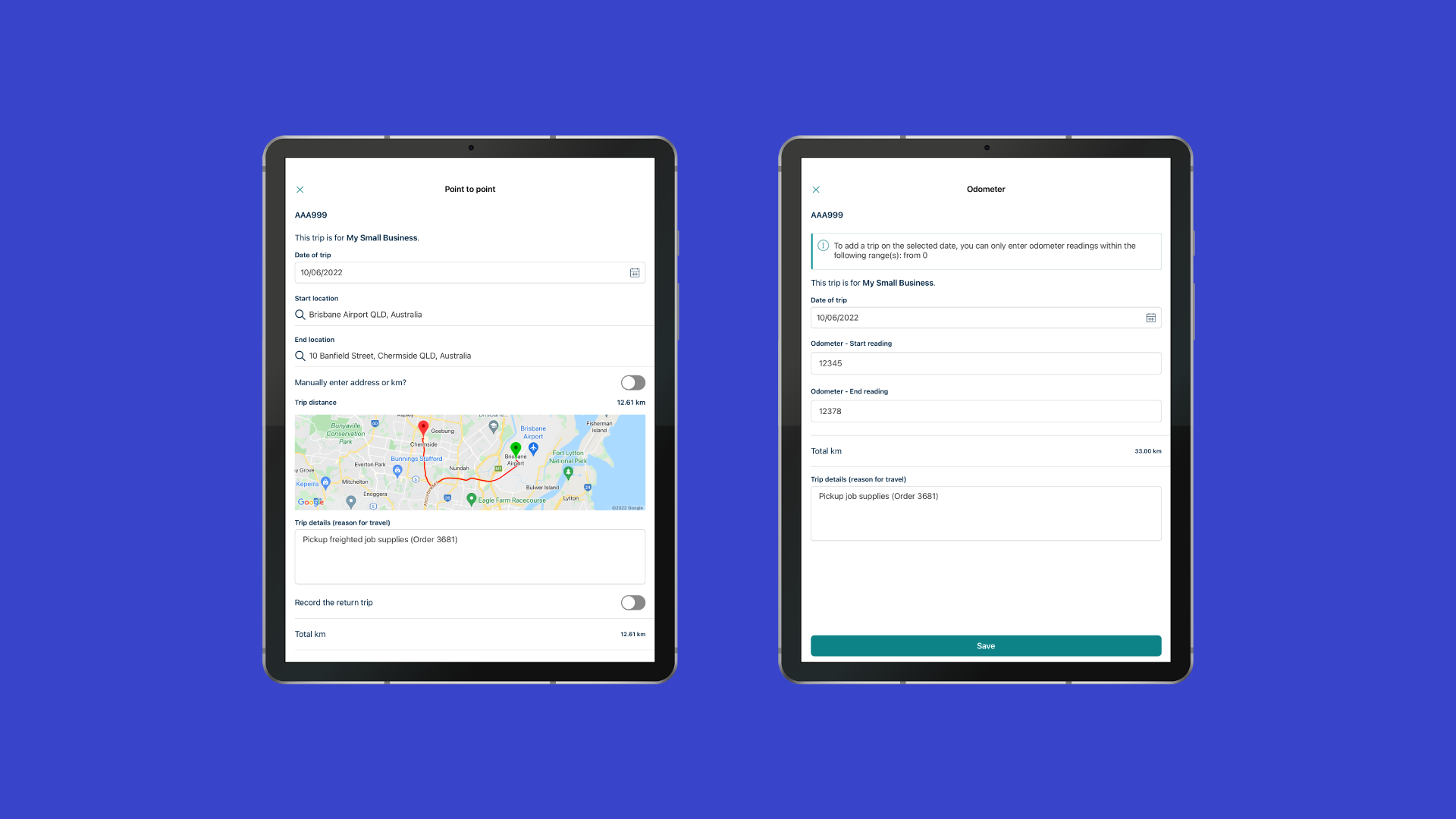

You can design your own logbook or there are many commercial paper or electronic products available. A Google search of ‘logbooks’ returns a long list.

Another option is the ATO app’s logbook feature.

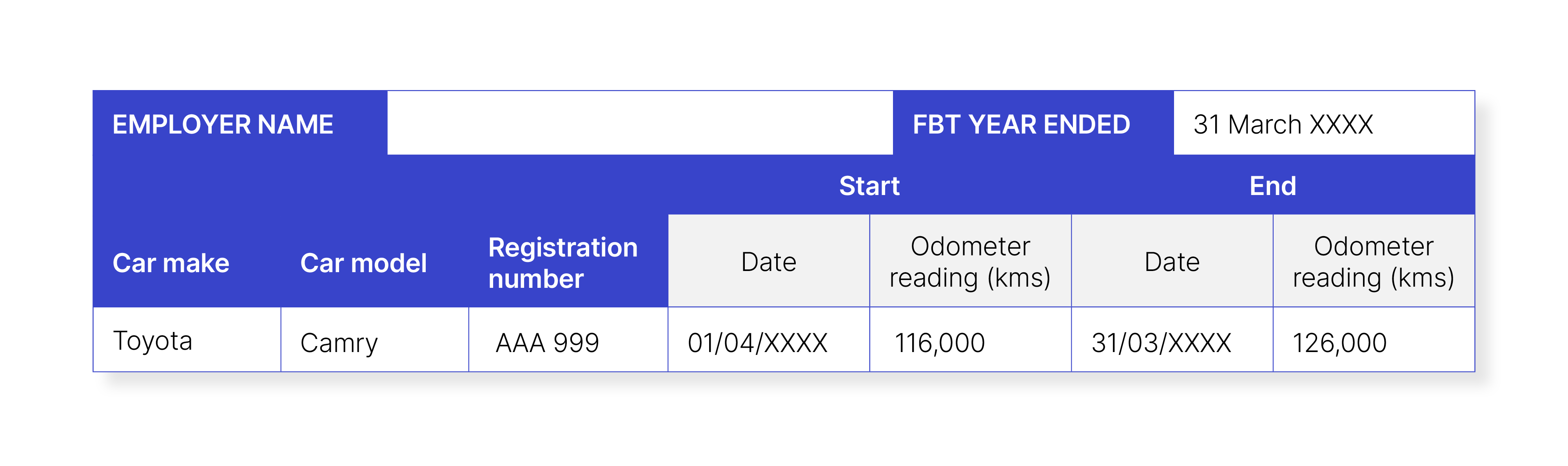

Every year you need to keep an odometer record of the year opening and closing reading. You also need to keep an odometer record for the total distance travelled during the same 12 weeks when a logbook is being kept.

You also need to keep an odometer record. You record the odometer reading at the start of the fringe benefits tax year – the first of April. Then you record the reading at the end of the fringe benefits tax year – the 31st of March.

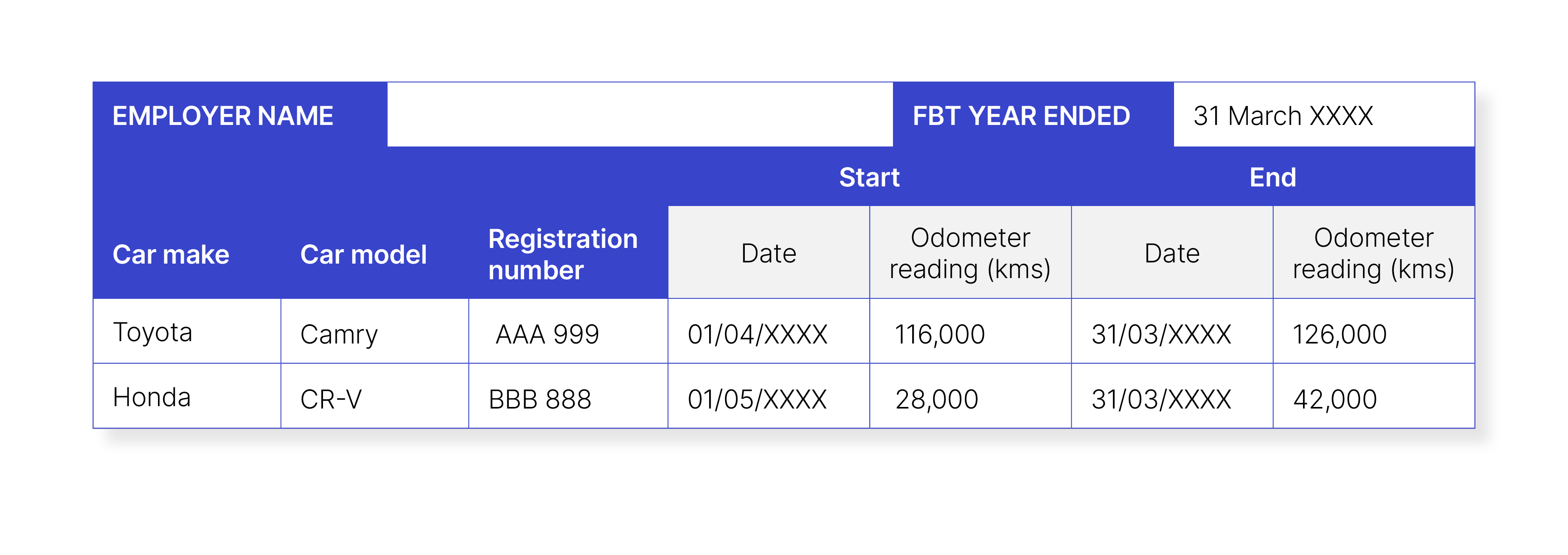

If you’re keeping a logbook to establish the business use of a car you also need to keep odometer readings for that 12-week period.

An odometer record can be used for more than one car. This shows an added line for a different car for a logbook period.

Car fringe benefits tax

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

Fringe benefits overview |

3 mins | |||||

Reducing your FBT liability |

3 mins | |||||

Providing a car fringe benefit |

7 mins | |||||

Operating cost method |

20 mins | |||||

Statutory formula method |

11 mins | |||||

Car fringe benefits records |

1 mins | |||||

Related courses |

1 mins | |||||

Course feedback |

||||||