There are some types of cars that, while they may fit the definition, they’re exempt from fringe benefits tax if the employee’s private use is limited.

Any taxi that meets the definition of ‘car’ is exempt from car fringe benefits if the private use is limited. Remember the definition is ‘less than one tonne goods carrying capacity, or fewer than 9 passenger capacity’.

Panel vans and utes are also exempt from fringe benefits tax if their private use is limited, keeping in mind the load limitations.

Modified vehicles, where modifications permanently change a car and cannot be easily reversed, are exempt. A hearse is an example of a modified vehicle.

Eligible electric cars and their associated car expenses (not including home charging stations) are also exempt if all of these conditions are met:

- the benefit is a car benefit

- the vehicle must be a car, which is a zero or low emissions vehicle

- the car was first held and used on or after 1 July 2022

- the car is used, or available for private use, by a current employee or their associates (including family members), and

- no amount of luxury car tax (LCT) has become payable on the supply or importation of the car.

Electrical vehicles are slightly different from other exempt cars because although private use is exempt from fringe benefits tax, the benefit still needs to be reported.

The ATO has more information about the FBT Electric car exemption.

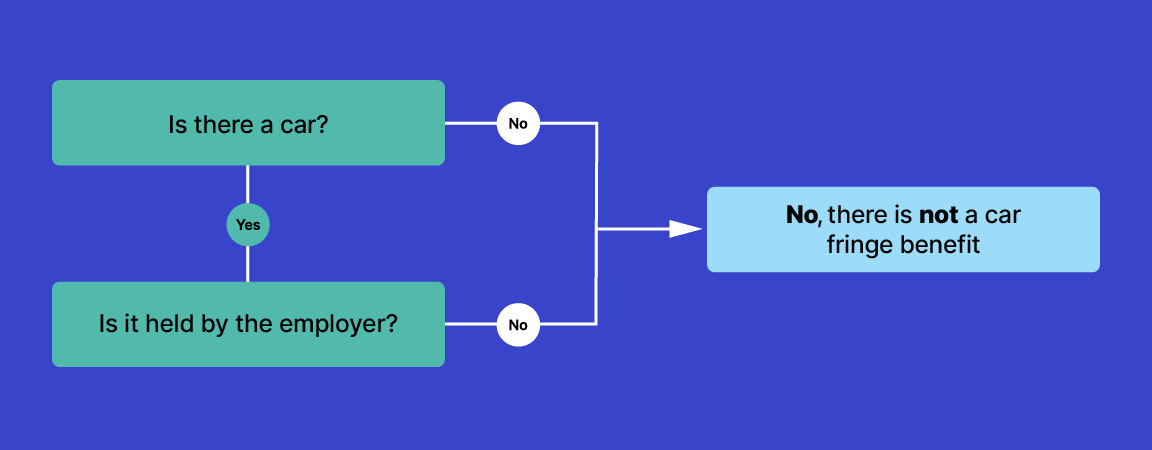

There are other exemptions – but these are the most common. If there is no car there is not a car fringe benefit.

Car fringe benefits tax

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

Fringe benefits overview |

3 mins | |||||

Reducing your FBT liability |

3 mins | |||||

Providing a car fringe benefit |

7 mins | |||||

Operating cost method |

20 mins | |||||

Statutory formula method |

11 mins | |||||

Car fringe benefits records |

1 mins | |||||

Related courses |

1 mins | |||||

Course feedback |

||||||