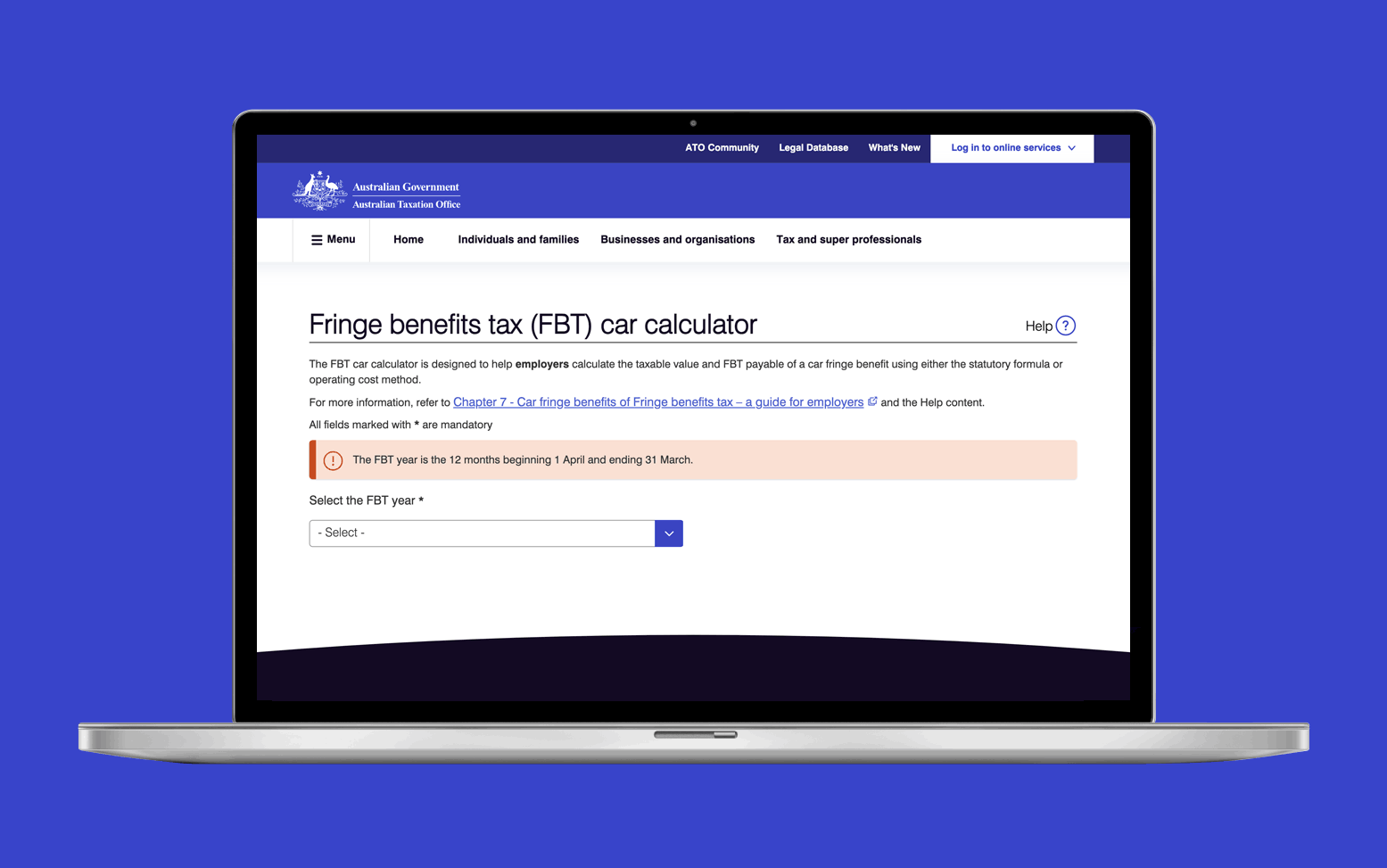

The ATO has made calculating your car FBT obligation quite straightforward by creating a tool called the Fringe benefits tax (FBT) car calculator. The data you enter is dependent on which method you choose. You’ll find the data you need in the records you keep.

Gather the data from your records then launch the tool on the ATO website. When all questions are answered and your data is entered, the tool will provide you information and calculations required to complete the Fringe benefits tax return. It will also give you information on how the estimate was calculated and, depending on method, information you may need to keep for the following year's calculation. You will also receive an estimate of your FBT payable.

It's important to add the tool results to your records. Use the Print friendly version option to save a PDF file to your record keeping system.

Car fringe benefits tax

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

Fringe benefits overview |

3 mins | |||||

Reducing your FBT liability |

3 mins | |||||

Providing a car fringe benefit |

7 mins | |||||

Operating cost method |

20 mins | |||||

Statutory formula method |

11 mins | |||||

Car fringe benefits records |

1 mins | |||||

Related courses |

1 mins | |||||

Course feedback |

||||||