×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

Before you lodge your final annual return and wind up your SMSF make sure you have finalised any other outstanding tax and compliance obligations.

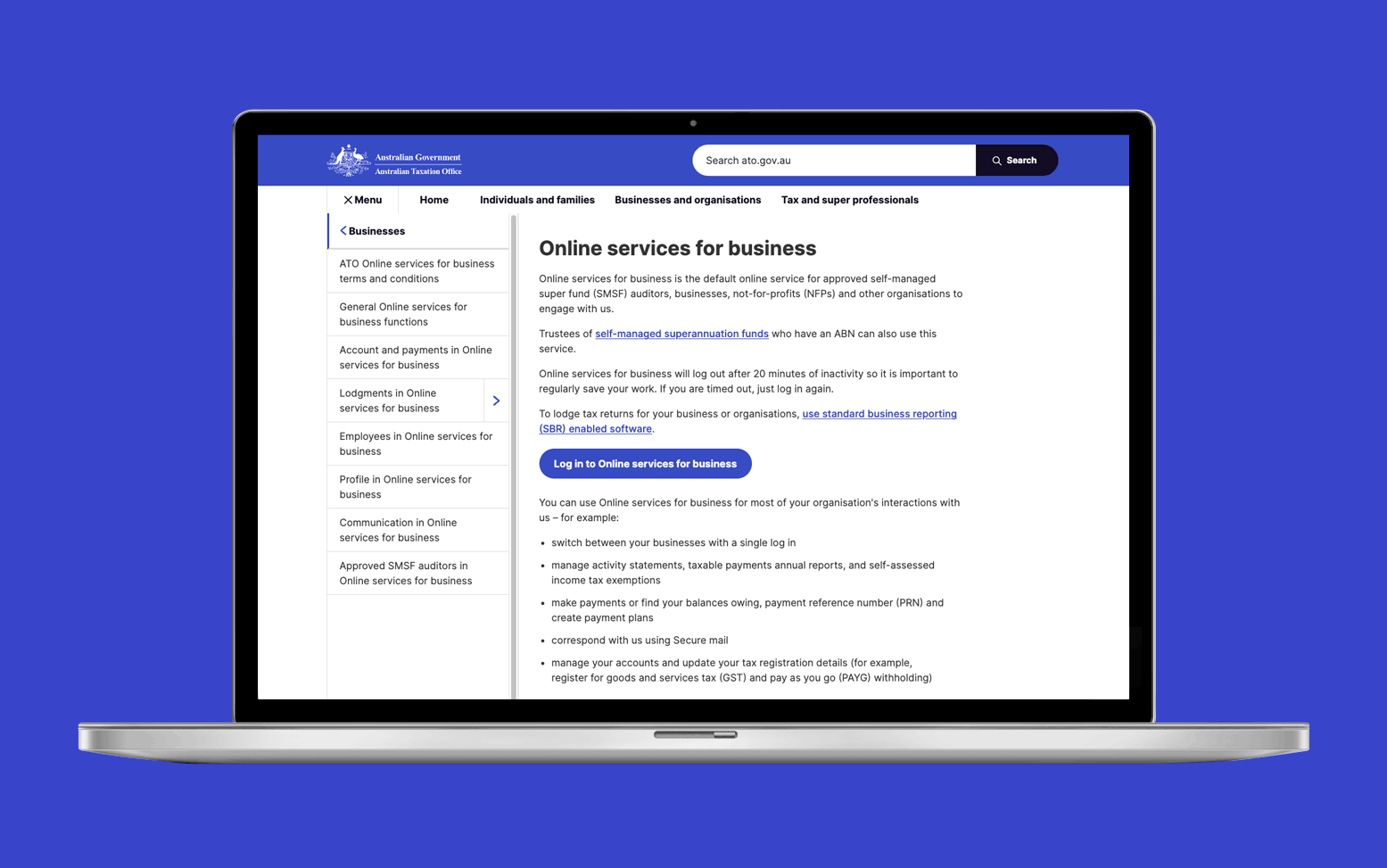

The easiest way to report to the ATO is through:

- Online services for business

- your registered SMSF professional, or

- standard business reporting (SBR) enabled software if you have it.

Otherwise, you can find paper forms on ato.gov.au

Last modified: 04 Apr 2025

Winding up a self-managed super fund (SMSF)

| Steps | Progress | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

When should I wind up my SMSF? |

3 mins | |||||||||||||||||||||||

Have a plan for when to wind up your SMSF |

2 mins | |||||||||||||||||||||||

Prepare an exit plan |

2 mins | |||||||||||||||||||||||

How to wind up an SMSF |

1 mins | |||||||||||||||||||||||

Check your trust deed |

1 mins | |||||||||||||||||||||||

Get written agreement |

1 mins | |||||||||||||||||||||||

Sell or dispose of your fund’s assets |

1 mins | |||||||||||||||||||||||

Finalise outstanding tax and compliance obligations |

3 mins | |||||||||||||||||||||||

Pay outstanding expenses and tax liabilities |

1 mins | |||||||||||||||||||||||

Calculate and distribute member benefits |

5 mins | |||||||||||||||||||||||

Complete a final audit |

1 mins | |||||||||||||||||||||||

Lodge your final SMSF annual return (SAR) |

1 mins | |||||||||||||||||||||||

Notify third parties |

1 mins | |||||||||||||||||||||||

Close your SMSF bank account |

1 mins | |||||||||||||||||||||||

Keeping SMSF records |

2 mins | |||||||||||||||||||||||

Consider professional advice |

2 mins | |||||||||||||||||||||||

Help and more information |

3 mins | |||||||||||||||||||||||

|

||||||||||||||||||||||||

Related courses |

1 mins | |||||||||||||||||||||||

Course feedback |

||||||||||||||||||||||||