×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

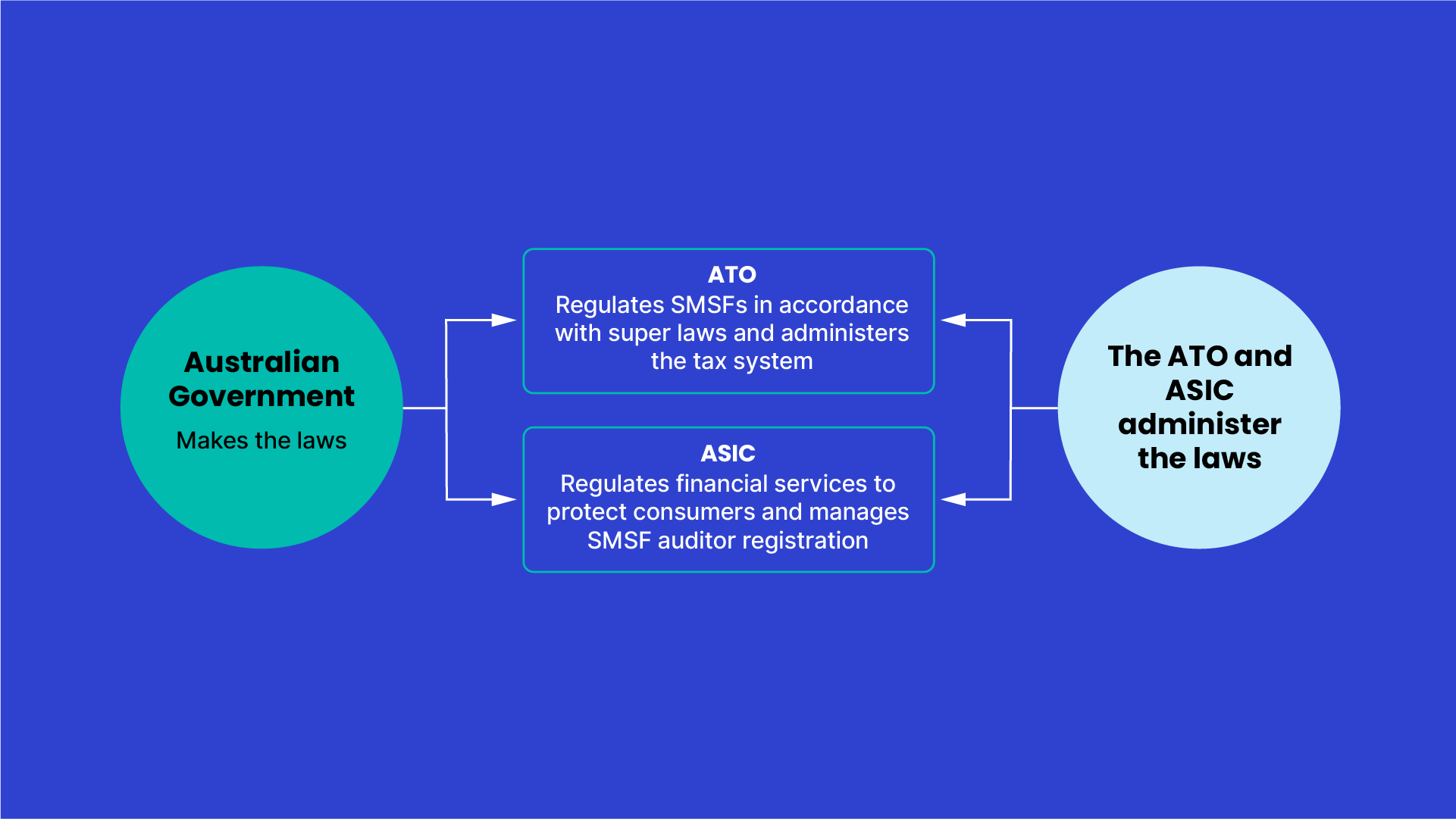

The ATO and the Australian Securities & Investments Commission (ASIC) are co-regulators of the SMSF sector.

The Australian Government makes the law.

The ATO regulates SMSFs in accordance with super laws and administers the tax system.

ASIC regulates financial services to protect consumers and manages SMSF auditor registration.

Together, the ATO and ASIC administer the laws.

Last modified: 11 Jul 2024

Winding up a self-managed super fund (SMSF)

| Steps | Progress | |||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

When should I wind up my SMSF? |

3 mins | |||||||||||||||||||||||

Have a plan for when to wind up your SMSF |

2 mins | |||||||||||||||||||||||

Prepare an exit plan |

2 mins | |||||||||||||||||||||||

How to wind up an SMSF |

1 mins | |||||||||||||||||||||||

Check your trust deed |

1 mins | |||||||||||||||||||||||

Get written agreement |

1 mins | |||||||||||||||||||||||

Sell or dispose of your fund’s assets |

1 mins | |||||||||||||||||||||||

Finalise outstanding tax and compliance obligations |

3 mins | |||||||||||||||||||||||

Pay outstanding expenses and tax liabilities |

1 mins | |||||||||||||||||||||||

Calculate and distribute member benefits |

5 mins | |||||||||||||||||||||||

Complete a final audit |

1 mins | |||||||||||||||||||||||

Lodge your final SMSF annual return (SAR) |

1 mins | |||||||||||||||||||||||

Notify third parties |

1 mins | |||||||||||||||||||||||

Close your SMSF bank account |

1 mins | |||||||||||||||||||||||

Keeping SMSF records |

2 mins | |||||||||||||||||||||||

Consider professional advice |

2 mins | |||||||||||||||||||||||

Help and more information |

3 mins | |||||||||||||||||||||||

|

||||||||||||||||||||||||

Related courses |

1 mins | |||||||||||||||||||||||

Course feedback |

||||||||||||||||||||||||