×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

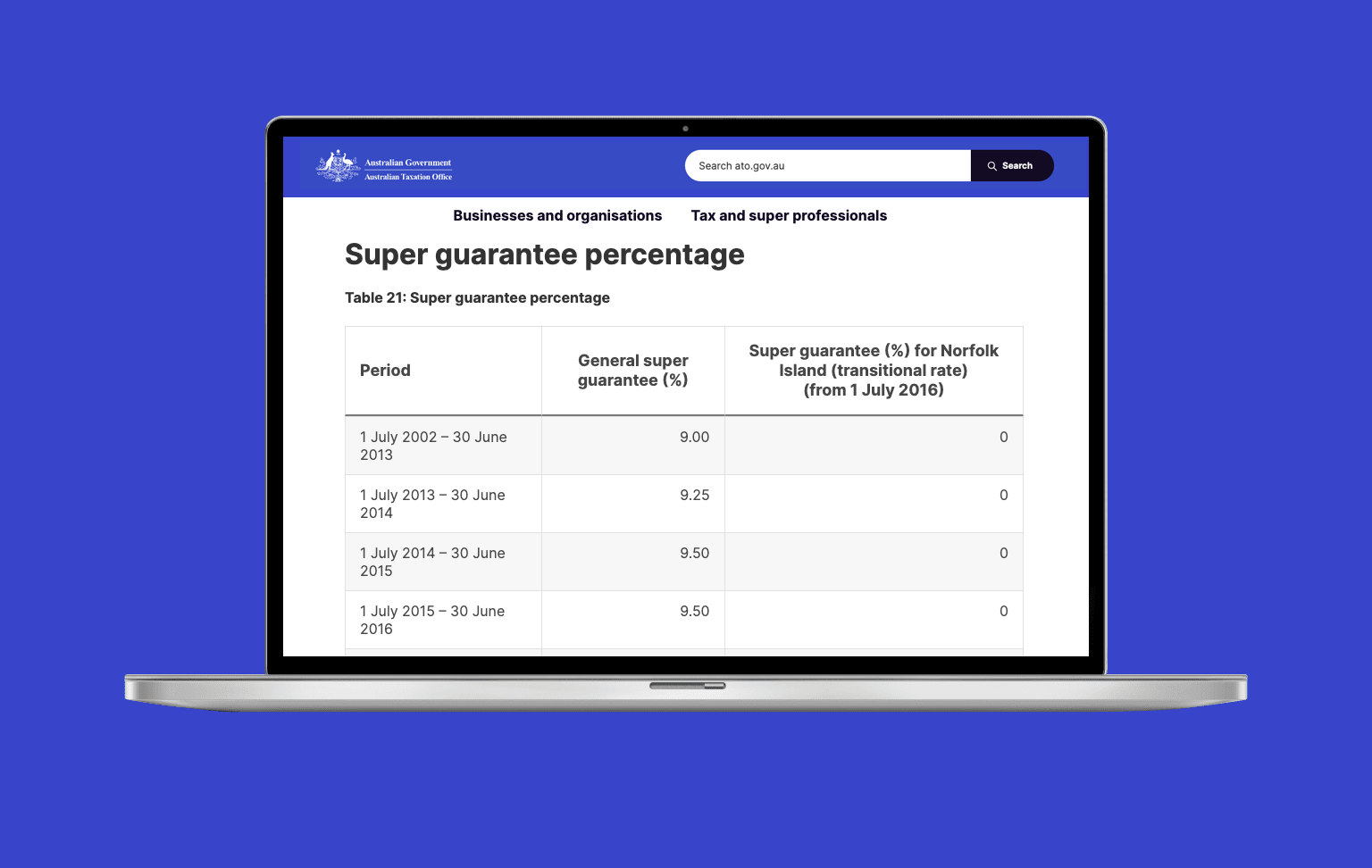

You can use the Super guarantee contributions calculator to work out how much super guarantee to pay into each employee's super fund.

Note: Super guarantee transitional rates apply to Norfolk Island, starting at 1% on 1 July 2016 and increasing 1% yearly to 12% on 1 July 2027. When using the calculator, Norfolk Island employers need to enter the relevant super guarantee rate. For the current super guarantee transitional rate for Norfolk Island employees, see Norfolk Island tax and super.

Last modified: 27 Aug 2024