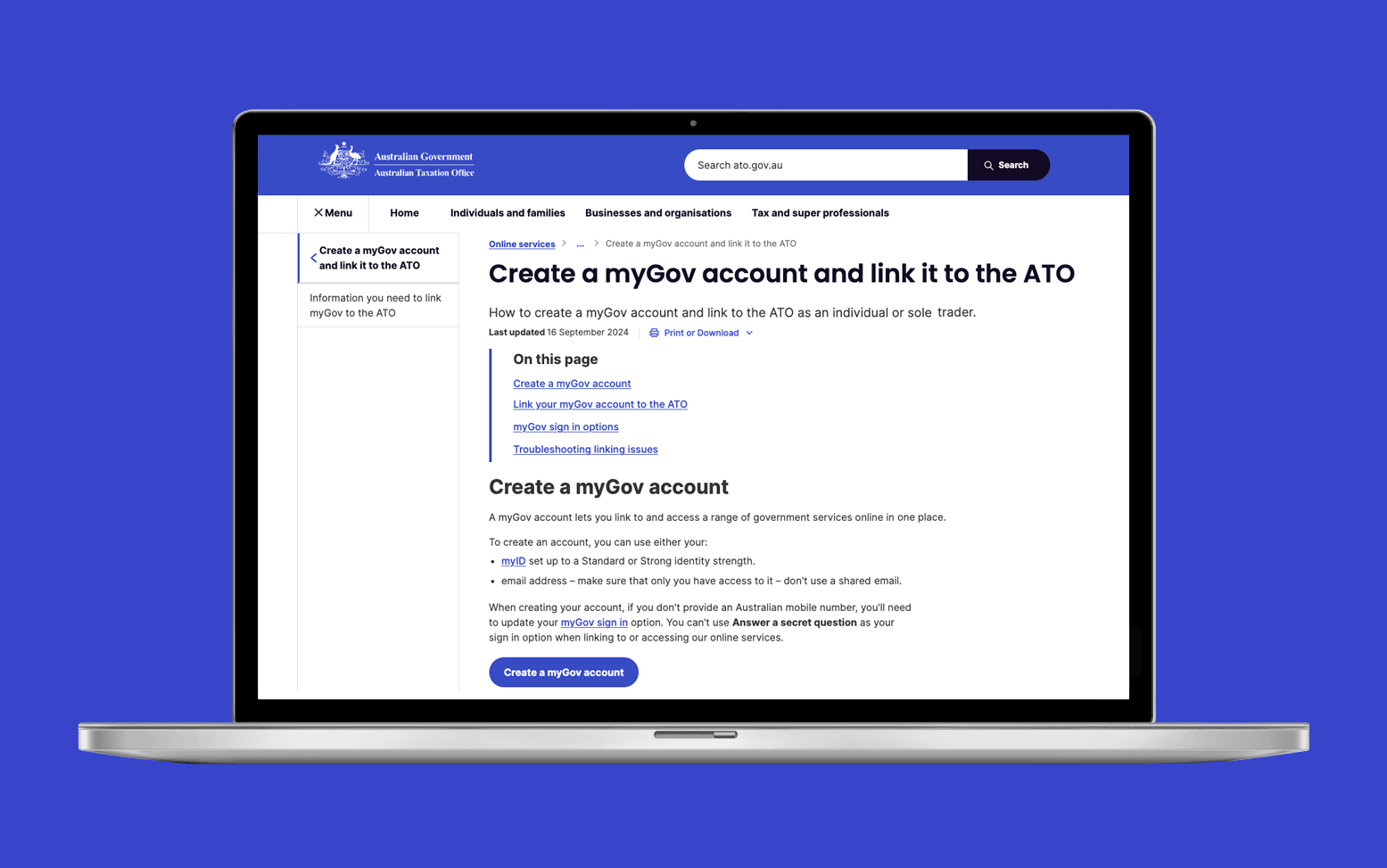

As a sole trader, to access ATO online services you need to create a myGov account and link it to the ATO.

When linking your myGov account to the ATO, you may be asked to provide:

- your tax file number (TFN), and

- information from your bank account details, super account statement, notice of assessment, Centrelink payment summary, dividends statement or PAYG payment summary.

To learn more, visit Create a myGov account and link it to the ATO.

You can also access ATO online services for individuals by using a Digital ID, such as the Australian Government's Digital ID app – myID. myID is an app you download to your smart device that will prove who you are when signing into myGov.

When you use myID, information is encrypted and verified against your records. Using myID provides better account security and helps protect your personal information.

To find out more about using myID with myGov and ATO online services, visit Increase your online security with myID.

Setting up your small business

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

The small business life cycle |

5 mins | |||||

Digital options |

15 mins | |||||

The big picture of tax |

5 mins | |||||

ATO online services |

6 mins | |||||

Setting up your business banking |

6 mins | |||||

Pay as you go instalments (PAYGI) |

5 mins | |||||

Record keeping overview |

10 mins | |||||

Small business support |

10 mins | |||||

Related courses |

1 mins | |||||

Course feedback |

||||||