×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

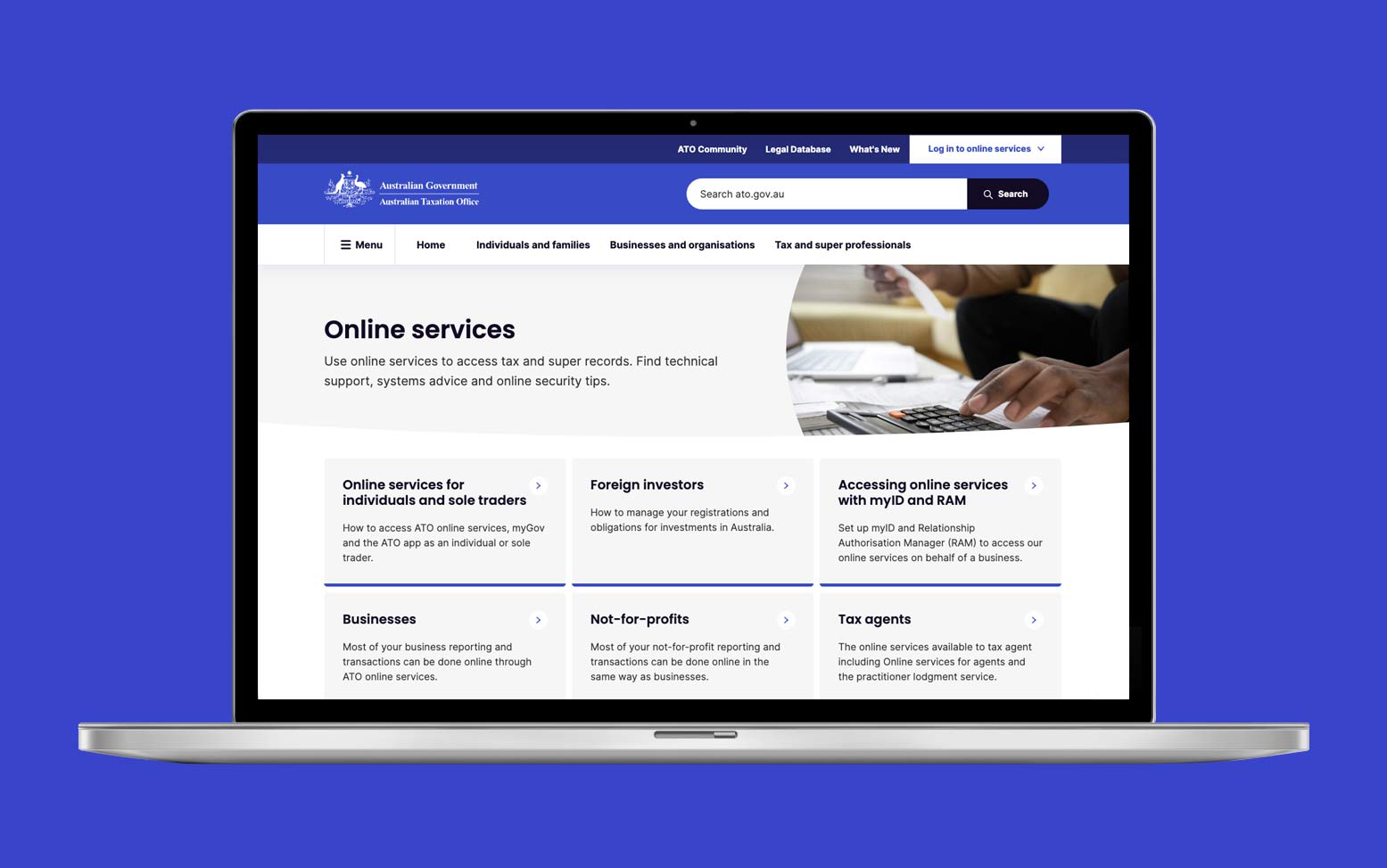

ATO online services makes it easier for you to manage your tax and super affairs online. It provides you a secure service that allows you to interact with the ATO when it’s convenient to you.

You can use ATO online services to lodge your activity statements, tax returns, employment documents, keep track of super and update your details.

ATO online services for business is recommended for small businesses.

If you're a sole trader, you can use ATO online services for individuals. ATO online services for individuals allows sole traders to access more services such as lodging their Individual tax return, which they can’t do in online services for business.

Last modified: 30 Oct 2025

Setting up your small business

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

The small business life cycle |

5 mins | |||||

Digital options |

15 mins | |||||

The big picture of tax |

5 mins | |||||

ATO online services |

6 mins | |||||

Setting up your business banking |

6 mins | |||||

Pay as you go instalments (PAYGI) |

5 mins | |||||

Record keeping overview |

10 mins | |||||

Small business support |

10 mins | |||||

Related courses |

1 mins | |||||

Course feedback |

||||||