×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

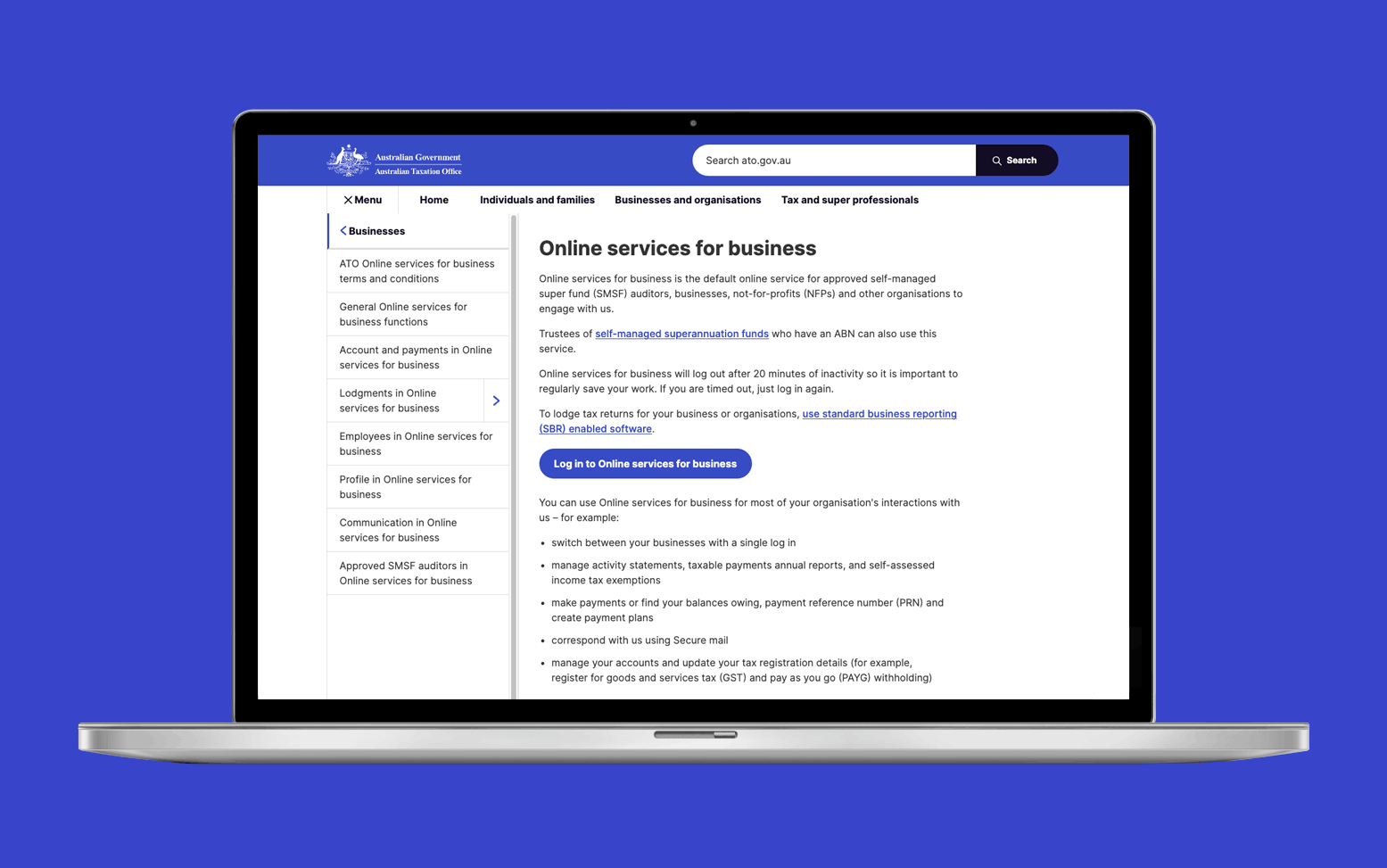

You can use ATO online services for business for most of your business interactions with the ATO – for example:

- view, prepare, lodge and revise activity statements

- view, prepare, lodge and revise your taxable payments annual report

- create payment plans

- switch between your businesses with a single log in

- view statements of account and find your payment reference number (PRN)

- manage your accounts and update your tax registration details (for example, add or cancel a role)

- view your Single Touch Payroll reports

- register for goods and services tax (GST) and pay as you go (PAYG) withholding

- access secure mail subjects

- access the Small Business Superannuation Clearing House

- view and print tax returns and income tax history (if you are a sole trader, continue to use ATO online)

- customise your home page.

You cannot lodge your tax return in ATO online services for business. To lodge your tax return, you’ll need to use your Standard Business Reporting (SBR) enabled software, or your registered tax agent or a paper form.

SBR is a standard approach to online or digital record keeping to simplify business reporting obligations. Digital service providers build SBR rules into business software to make the software ‘SBR-enabled’.

Last modified: 29 Oct 2025

Setting up your small business

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

The small business life cycle |

5 mins | |||||

Digital options |

15 mins | |||||

The big picture of tax |

5 mins | |||||

ATO online services |

6 mins | |||||

Setting up your business banking |

6 mins | |||||

Pay as you go instalments (PAYGI) |

5 mins | |||||

Record keeping overview |

10 mins | |||||

Small business support |

10 mins | |||||

Related courses |

1 mins | |||||

Course feedback |

||||||