To meet the 80% rule, you need to work out the amount of PSI that comes from each client (including the client's associates) in an income year.

If you obtain work through an agency, the source of the PSI you receive is the agency, not the end clients.

If you obtain work through one agency only (even if you work for multiple clients of that agency), you will not meet the 80% rule. You cannot self-assess for any of the other tests. If you obtain work through more than one agency, you need to work out what percentage of PSI comes from each agency.

If you operate through a company, partnership or trust and you have more than one individual generating PSI, the 80% rule applies to each individual. You need to look at the amount of PSI that you receive for each individual and how much of that amount comes from one client (including associates of the client).

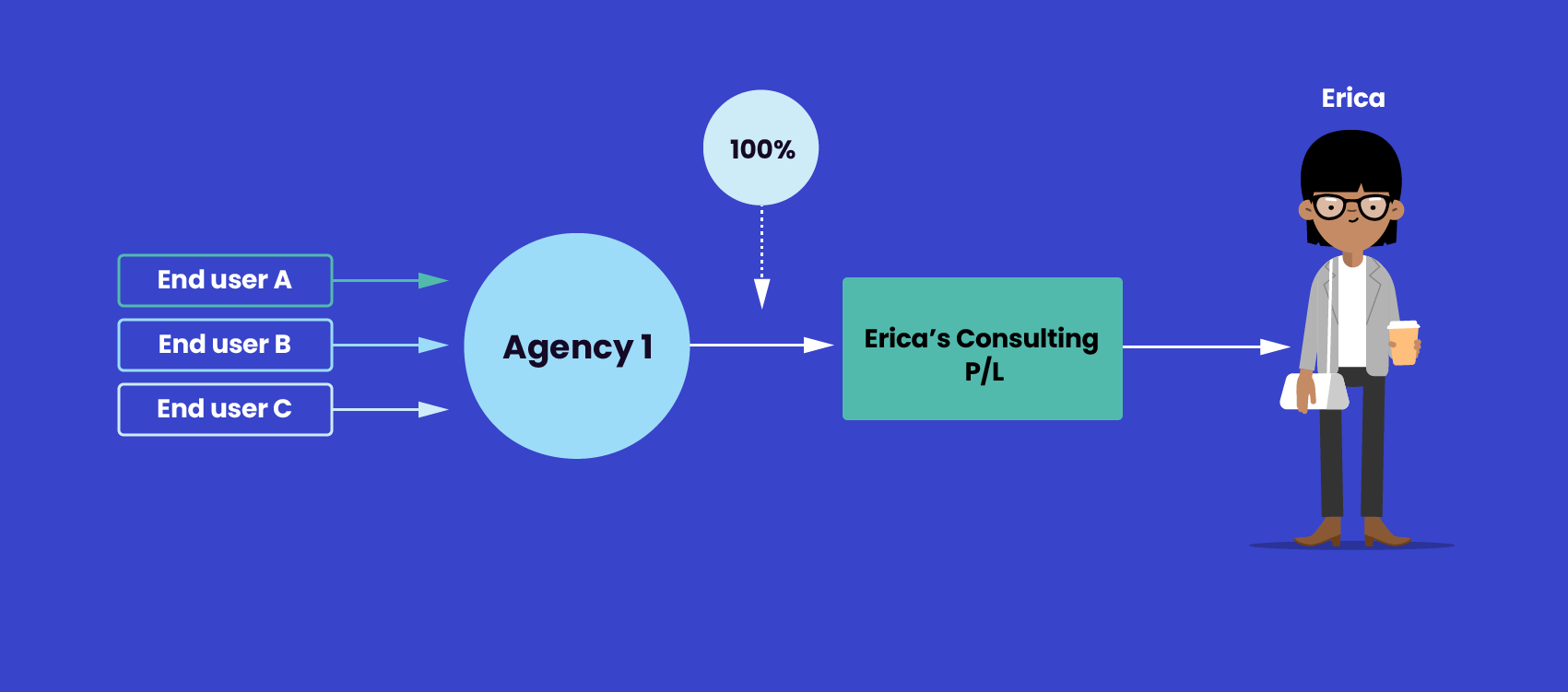

Example 1: Erica – one agency

Erica's Consulting Pty Ltd provides consultancy services performed by Erica. Erica's Consulting Pty Ltd receives 100% of its PSI from Agency 1.

Since the company receives more than 80% of its PSI from one client, the company cannot self-assess using the unrelated clients, employment, or business premises test. The PSI rules apply unless the company has a PSB determination for the relevant income year.

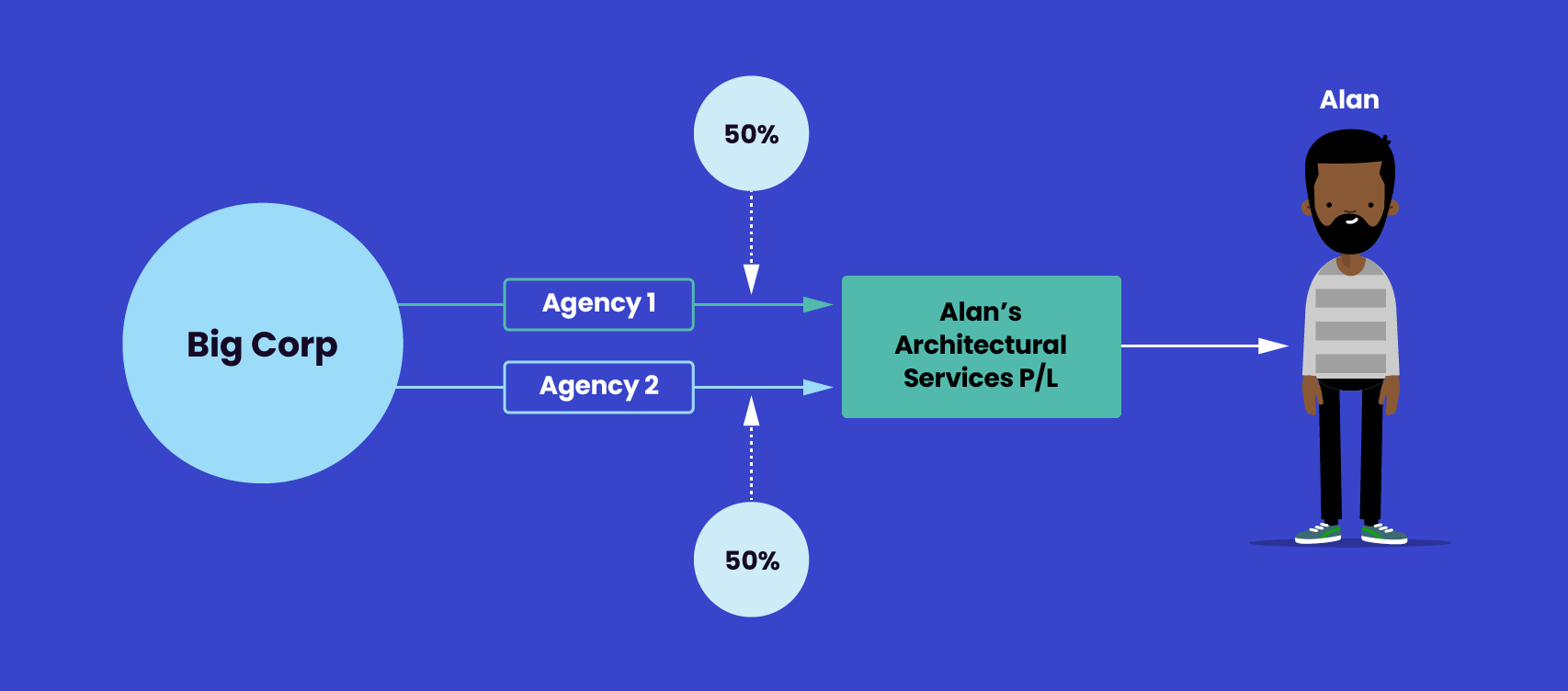

Example 2: Alan – more than one agency

Alan is an architect and provides his services through a company called Alan's Architectural Services Pty Ltd. The company receives 50% of its PSI from Agency 1 and 50% from Agency 2.

Since less than 80% of its PSI comes from one source, the company can self-assess using the unrelated clients, employment or business premises test.

Personal services income

| Steps | Progress | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

What is PSI? |

4 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Is the income PSI? |

5 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Income that is not PSI |

9 mins | ||||||||||||||||||||

Whose PSI is it? |

7 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Working out if the PSI rules apply: self-assess as a personal service business (PSB) |

2 mins | ||||||||||||||||||||

The 80% rule |

5 mins | ||||||||||||||||||||

Results test |

8 mins | ||||||||||||||||||||

Unrelated clients test |

5 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Employment test |

5 mins | ||||||||||||||||||||

Business premises test |

7 mins | ||||||||||||||||||||

Obtaining work through an agency |

5 mins | ||||||||||||||||||||

Apply for a personal services business determination (PSBD) |

3 mins | ||||||||||||||||||||

What to do when the PSI rules apply |

2 mins | ||||||||||||||||||||

What to do when the PSI rules apply: claiming deductions |

11 mins | ||||||||||||||||||||

|

|

|||||||||||||||||||||

What to do when the PSI rules apply: how to attribute PSI |

8 mins | ||||||||||||||||||||

What to do when the PSI rules apply: PAYG |

18 mins | ||||||||||||||||||||

|

|

|||||||||||||||||||||

What to do when the PSI rules apply: completing your tax return |

4 mins | ||||||||||||||||||||

What to do if the PSI rules don’t apply |

3 mins | ||||||||||||||||||||

Record keeping for PSI |

1 mins | ||||||||||||||||||||

Help for PSI |

1 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Case study: instructions |

1 mins | ||||||||||||||||||||

Case studies: sole trader |

11 mins | ||||||||||||||||||||

Case studies: partnership |

12 mins | ||||||||||||||||||||

Case studies: company |

12 mins | ||||||||||||||||||||

Case studies: trust |

12 mins | ||||||||||||||||||||

Related courses |

1 mins | ||||||||||||||||||||

Course feedback |

|||||||||||||||||||||