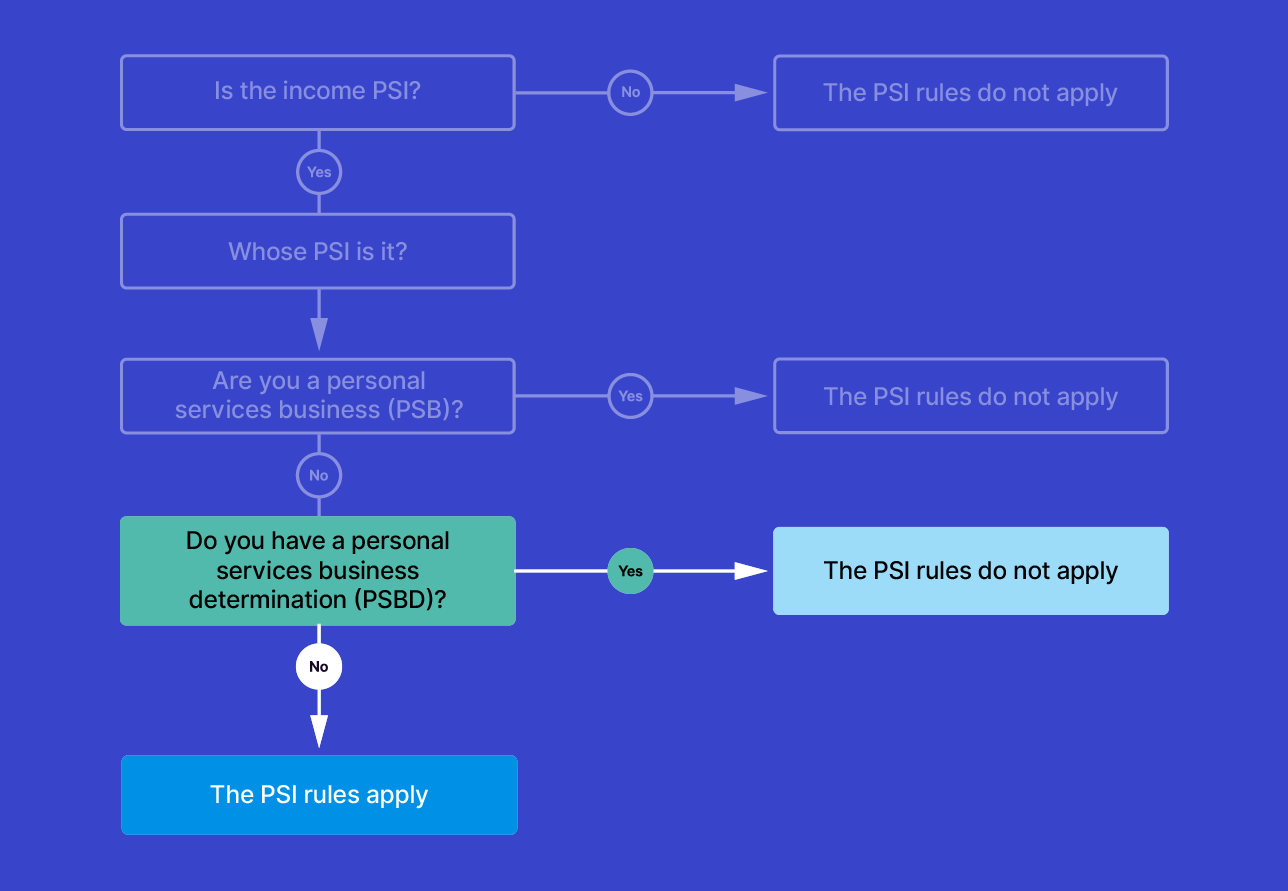

A personal services business determination (PSBD) is a notice from the Commissioner of Taxation which states that one of the PSB tests has been met for the relevant income year.

Where a PSBD is issued, the PSI rules will not apply to that income for the income year.

PSBDs are only issued in relation to one individual who is earning PSI. If multiple individuals are earning PSI through another entity such as a company, partnership or trust (which the ATO refer to as a personal services entity or PSE), the entity will need to apply for a PSBD for each individual.

You can apply to the ATO for a PSBD if:

- you’re unsure whether you have passed one of the PSB tests

- unusual circumstances prevented you from passing one of the PSB tests, or

- you met the unrelated clients test but unusual circumstances prevented you from meeting the 80% rule.

Personal services income

| Steps | Progress | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

What is PSI? |

4 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Is the income PSI? |

5 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Income that is not PSI |

9 mins | ||||||||||||||||||||

Whose PSI is it? |

7 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Working out if the PSI rules apply: self-assess as a personal service business (PSB) |

2 mins | ||||||||||||||||||||

The 80% rule |

5 mins | ||||||||||||||||||||

Results test |

8 mins | ||||||||||||||||||||

Unrelated clients test |

5 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Employment test |

5 mins | ||||||||||||||||||||

Business premises test |

7 mins | ||||||||||||||||||||

Obtaining work through an agency |

5 mins | ||||||||||||||||||||

Apply for a personal services business determination (PSBD) |

3 mins | ||||||||||||||||||||

What to do when the PSI rules apply |

2 mins | ||||||||||||||||||||

What to do when the PSI rules apply: claiming deductions |

11 mins | ||||||||||||||||||||

|

|

|||||||||||||||||||||

What to do when the PSI rules apply: how to attribute PSI |

8 mins | ||||||||||||||||||||

What to do when the PSI rules apply: PAYG |

18 mins | ||||||||||||||||||||

|

|

|||||||||||||||||||||

What to do when the PSI rules apply: completing your tax return |

4 mins | ||||||||||||||||||||

What to do if the PSI rules don’t apply |

3 mins | ||||||||||||||||||||

Record keeping for PSI |

1 mins | ||||||||||||||||||||

Help for PSI |

1 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Case study: instructions |

1 mins | ||||||||||||||||||||

Case studies: sole trader |

11 mins | ||||||||||||||||||||

Case studies: partnership |

12 mins | ||||||||||||||||||||

Case studies: company |

12 mins | ||||||||||||||||||||

Case studies: trust |

12 mins | ||||||||||||||||||||

Related courses |

1 mins | ||||||||||||||||||||

Course feedback |

|||||||||||||||||||||