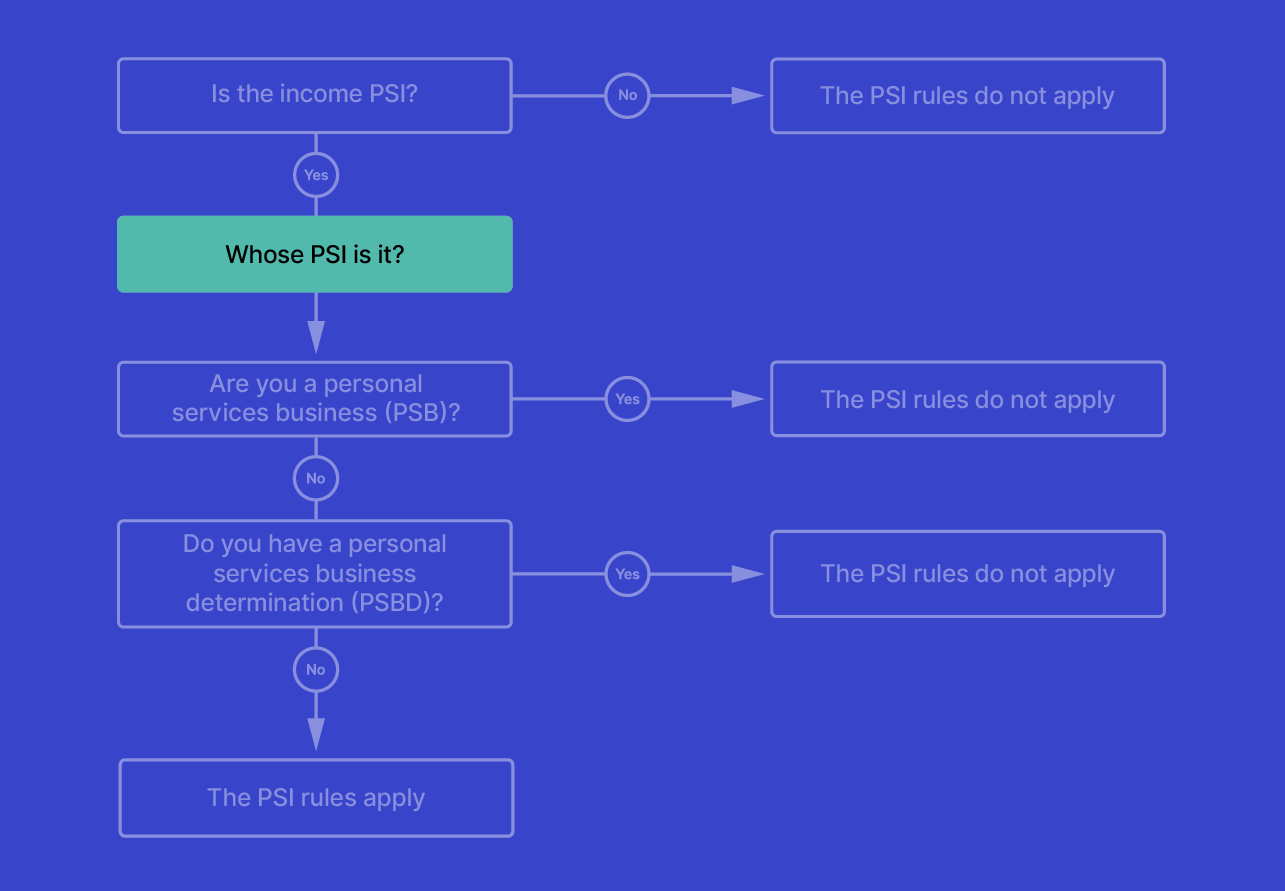

Once you have identified that PSI is being earned, you then need to work out whose PSI it is.

In working out who is earning the PSI, it is important to review the contract and consider all the facts and circumstances of the contractual arrangements between all parties involved. Part of this process involves working out who provides the principal work.

'Principal work' is work that is central to meeting your obligations under an agreement or contract. Principal work does not include associated clerical or administrative work (such as bookkeeping and answering phones) unless the principal work is administrative in nature.

Individuals can earn PSI either directly as a sole trader, or through another entity such as company, partnership or trust which is referred to as a ‘personal services entity’ (PSE).

If an individual is operating as a sole trader and has a contractual obligation to provide their services, then any PSI earned under that contract will belong to the sole trader even if another individual is engaged to assist them in completing principal work.

Where an individual is working through a PSE, the contract to provide services to another party is between the other party and the PSE. Unless the PSB requirements are met, the PSI will then belong to the individual who performs the principal work of the contract on behalf of the PSE even if the PSE engages another individual to assist them in completing this work. There are special rules to ensure the PSE then attributes the PSI to this individual. Where multiple individuals are working together through a PSE on the same contract, you will need to work out which individual mainly generated the PSI.

You can use contracts and invoices to help you work out whose PSI it is. For example:

- Contracts may indicate:

- the parties to the contract

- the obligations to be fulfilled (the principal work), and

- named individuals required to provide the services.

- Invoices may indicate:

- amounts of income received, and

- which individual actually provided the services.

Personal services income

| Steps | Progress | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

What is PSI? |

4 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Is the income PSI? |

5 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Income that is not PSI |

9 mins | ||||||||||||||||||||

Whose PSI is it? |

7 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Working out if the PSI rules apply: self-assess as a personal service business (PSB) |

2 mins | ||||||||||||||||||||

The 80% rule |

5 mins | ||||||||||||||||||||

Results test |

8 mins | ||||||||||||||||||||

Unrelated clients test |

5 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Employment test |

5 mins | ||||||||||||||||||||

Business premises test |

7 mins | ||||||||||||||||||||

Obtaining work through an agency |

5 mins | ||||||||||||||||||||

Apply for a personal services business determination (PSBD) |

3 mins | ||||||||||||||||||||

What to do when the PSI rules apply |

2 mins | ||||||||||||||||||||

What to do when the PSI rules apply: claiming deductions |

11 mins | ||||||||||||||||||||

|

|

|||||||||||||||||||||

What to do when the PSI rules apply: how to attribute PSI |

8 mins | ||||||||||||||||||||

What to do when the PSI rules apply: PAYG |

18 mins | ||||||||||||||||||||

|

|

|||||||||||||||||||||

What to do when the PSI rules apply: completing your tax return |

4 mins | ||||||||||||||||||||

What to do if the PSI rules don’t apply |

3 mins | ||||||||||||||||||||

Record keeping for PSI |

1 mins | ||||||||||||||||||||

Help for PSI |

1 mins | ||||||||||||||||||||

|

|||||||||||||||||||||

Case study: instructions |

1 mins | ||||||||||||||||||||

Case studies: sole trader |

11 mins | ||||||||||||||||||||

Case studies: partnership |

12 mins | ||||||||||||||||||||

Case studies: company |

12 mins | ||||||||||||||||||||

Case studies: trust |

12 mins | ||||||||||||||||||||

Related courses |

1 mins | ||||||||||||||||||||

Course feedback |

|||||||||||||||||||||