×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

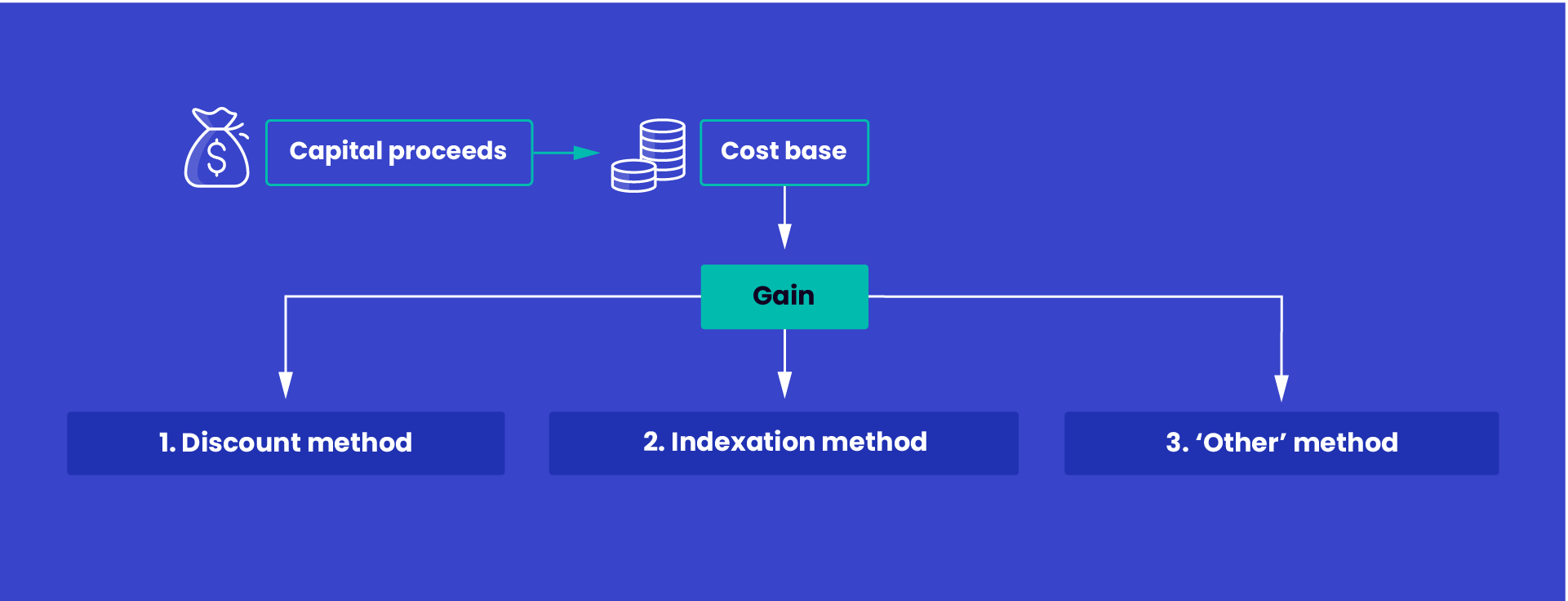

If you made a capital gain, you apply one of the 3 calculation methods to work out the gain from the CGT event:

- The discount method allows eligible Australian resident individuals and trusts who own an asset for more than 12 months to reduce their CGT by 50% or 33.33% (for complying super funds). This is not available to companies.

- The indexation method allows those who owned an asset for more than 12 months before 11:45 am AEST on 21 September 1999 to adjust the amount of an asset’s costs by applying an indexation factor based on the consumer price index.

- The ‘other’ method is used if you can’t use the discount or indexation methods, for example if you bought and sold an asset within 12 months.

You can only use one of these methods per CGT event. You don’t use them to calculate a capital loss.

Last modified: 21 Jan 2026