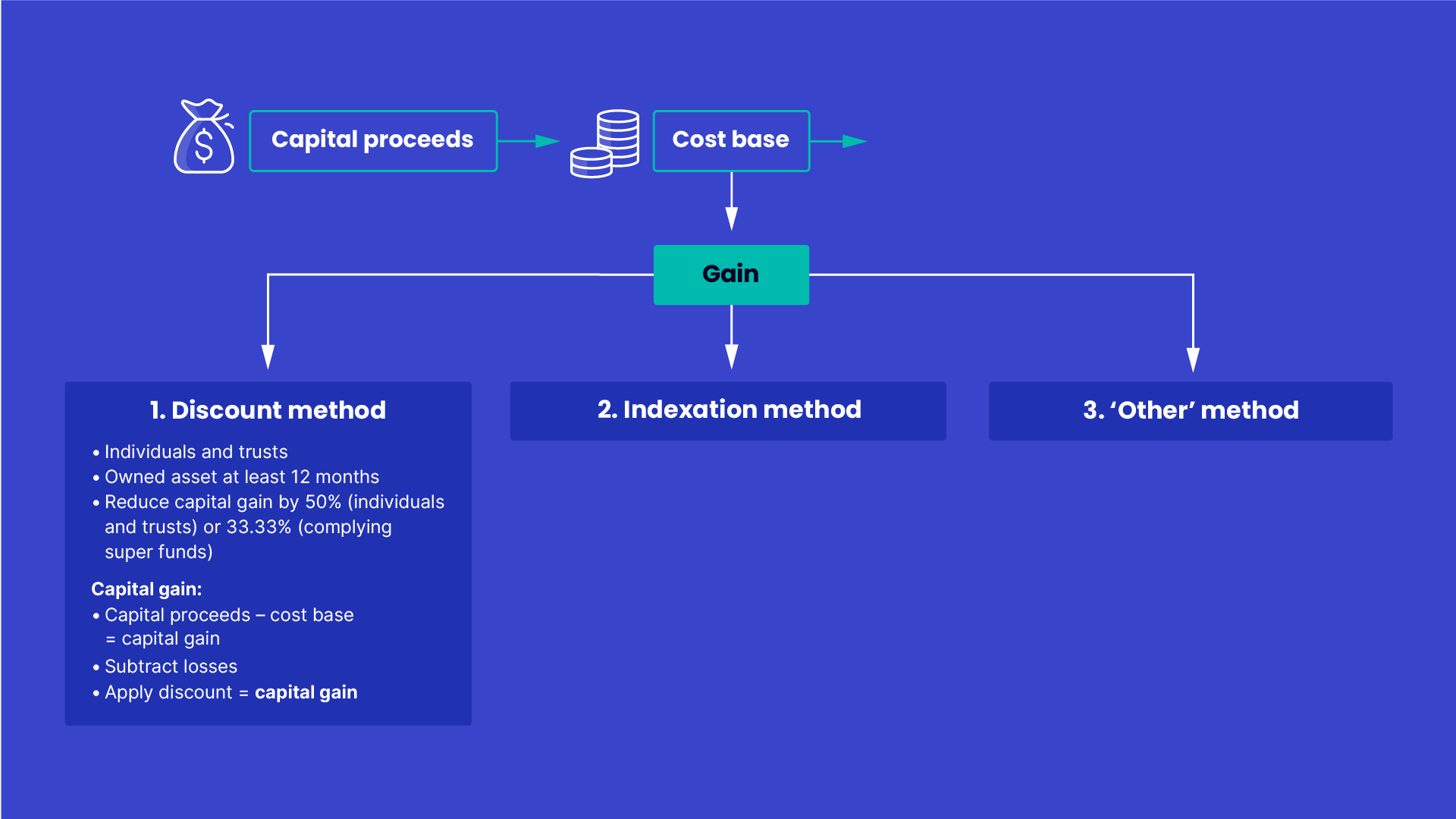

The discount method allows you to discount your capital gain for an asset owned for 12 months or more. It’s also known as the CGT discount.

When you sell or dispose of a CGT asset, you can reduce your capital gain by 50% if:

- you’re an individual or a trust

- you owned the asset for at least 12 months.

If you’re a foreign resident or were an Australian resident for only part of the time you held the asset, you may not be eligible for the full 50% discount.

Eligible complying super funds can discount a capital gain by 33.33%.

Companies (other than certain life insurance companies) are not eligible for the CGT discount and it doesn’t apply to capital gains from certain CGT events. For example, creating contractual rights or granting a lease or an option.

To calculate your CGT discount, first subtract the cost base from the capital proceeds. Then subtract any capital losses for the current income year and any unapplied net capital losses from earlier years. Next reduce the amount by the relevant discount percentage, to work out the capital gain.

You can choose which capital gains to subtract your losses from. If you have any capital gains that are not eligible for the CGT discount, subtract your losses from these gains first. This gives you the best result (the lowest CGT).

To determine whether you acquired a CGT asset at least 12 months before the CGT event, you exclude both the day of acquisition and the day of the CGT event.

For example, if you acquired an asset on 20 June 2024 and the CGT event was 20 June 2025, you count from 21 June 2024 to 19 June 2025. This is 364 days, which means you haven’t held the asset for at least 12 months and can’t use the discount method.

The ATO website provides a calculator tool which assists you to work out the number of days between two dates.