×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

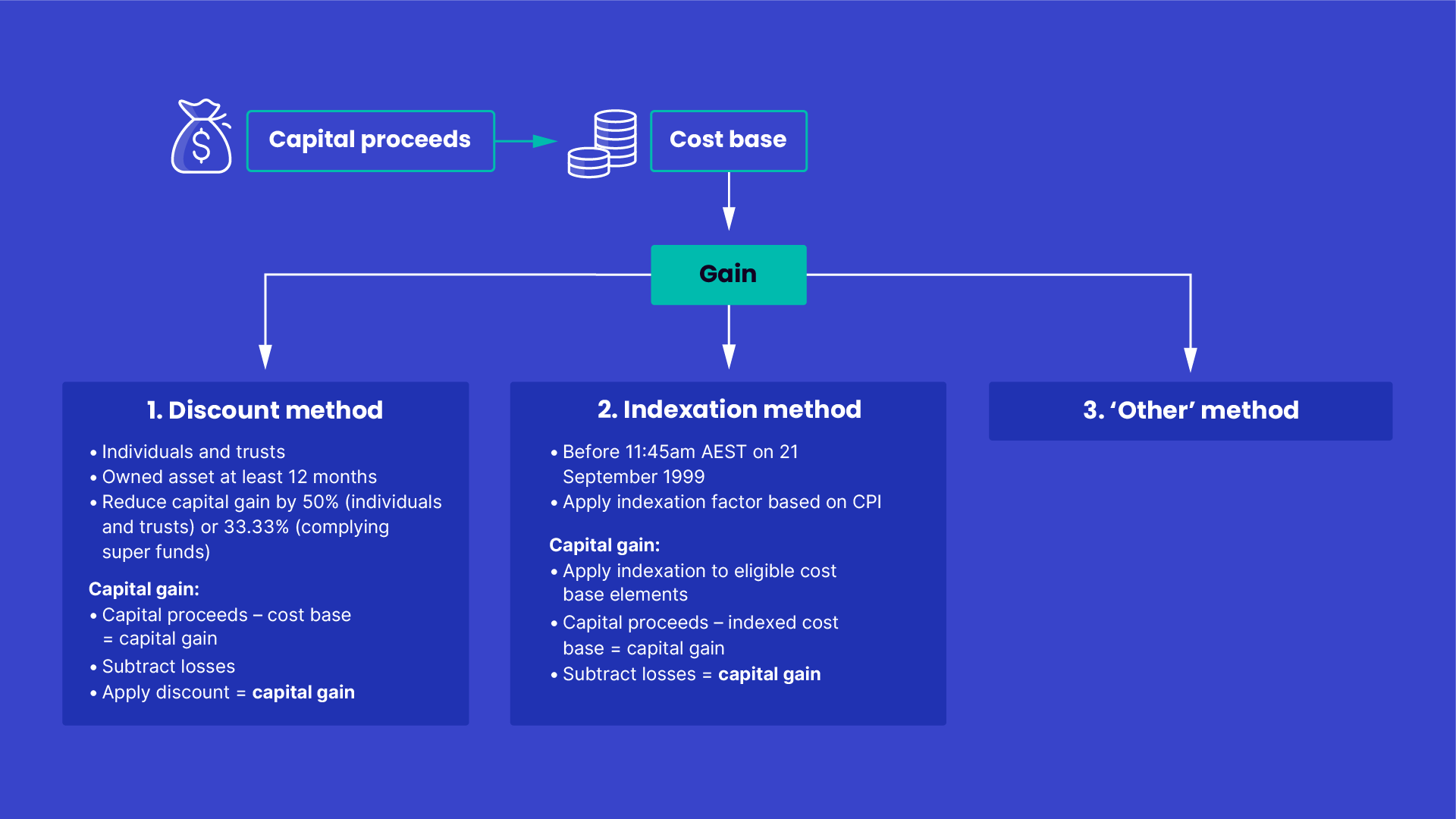

The indexation method allows you to increase the cost base by applying an indexation factor based on the consumer price index (CPI). You can only use it for assets acquired before 11:45 am AEST on 21 September 1999 that you’ve owned for at least 12 months.

To calculate this, apply the relevant indexation factor to each eligible element in the cost base, noting that some elements aren’t eligible to be indexed.

Add up both the indexed and non-indexed elements of the cost base together. Then subtract the indexed cost base from the capital proceeds. Subtract any current year capital losses or net capital losses from previous income years from the gain, to work out your net capital gain.

Last modified: 21 Jan 2026