When you make a purchase, ask for a tax invoice. You must have a valid tax invoice to claim GST credits for purchases over $82.50.

The GST amount doesn’t need to be listed separately on the invoice, it’s enough for a business to provide a total amount and state ‘GST included’.

How do you calculate the GST portion of an invoice if it hasn’t been listed separately?

Firstly, don’t make the mistake of dividing the total price by 10. This is a common error.

This calculation is different to the one you make when you add 10% to your total cost base to get your GST inclusive figure.

If you have an invoice and the GST hasn’t been listed separately, you will need to work out how much GST you’ve been charged for your purchase. You do this by dividing the total price of the purchase by 11.

Total price divided by 11 = GST amount

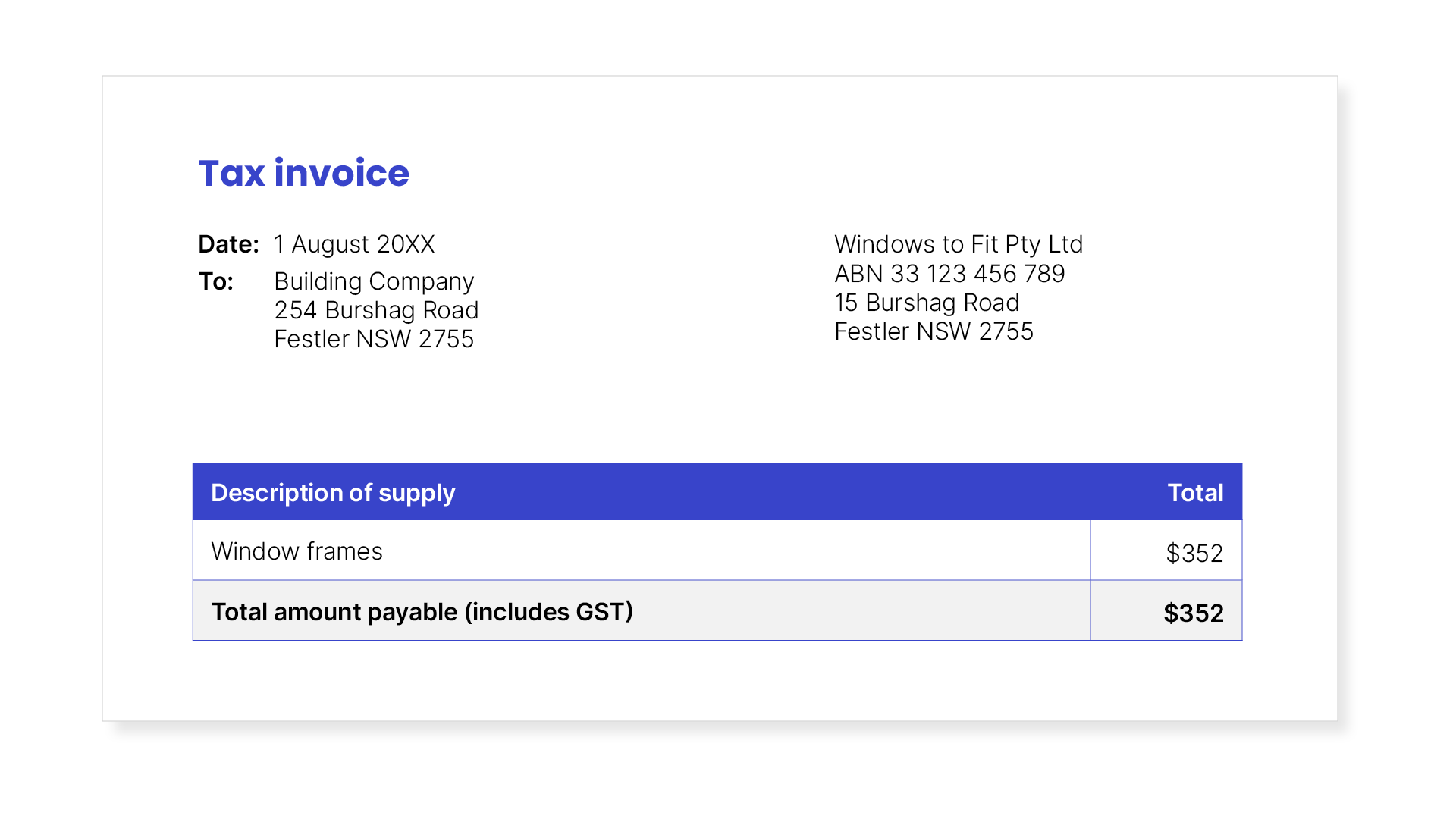

For example, let’s say you purchase an item for your business and pay $352 including GST. The GST isn’t listed separately on the tax invoice, so you must calculate it yourself.

If you divide the total price of $352 by 11, you get $32.

$352 divided by 11 = $32 GST

This $32 is the GST amount that you have paid when you purchased the item. It is also the amount you can claim as a GST credit.

Alternatively, you can use the Moneysmart.gov.au GST calculator to do the calculation for you. Using the GST calculator will save you time and helps to reduce calculation errors.

Goods and services tax (GST)

| Steps | Progress | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Introduction to the Goods and services tax (GST) |

4 mins | ||||||||||||||

Registering for GST |

4 mins | ||||||||||||||

Protecting yourself and your business |

7 mins | ||||||||||||||

Collecting GST on sales |

6 mins | ||||||||||||||

Claiming GST on purchases (GST credits) |

8 mins | ||||||||||||||

Claiming GST on imports and exports |

3 mins | ||||||||||||||

|

|||||||||||||||

Record keeping and GST |

5 mins | ||||||||||||||

Accounting for GST |

4 mins | ||||||||||||||

BAS lodgment and payment options |

6 mins | ||||||||||||||

Completing your BAS |

5 mins | ||||||||||||||

Managing errors and making adjustments |

5 mins | ||||||||||||||

Getting support when you need it |

2 mins | ||||||||||||||

Related courses |

1 mins | ||||||||||||||

Course feedback |

|||||||||||||||