×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

Generally, employees are entitled to super guarantee contributions from an employer if they’re 18 years or over, or if they’re under 18 years old and work more than 30 hours per week.

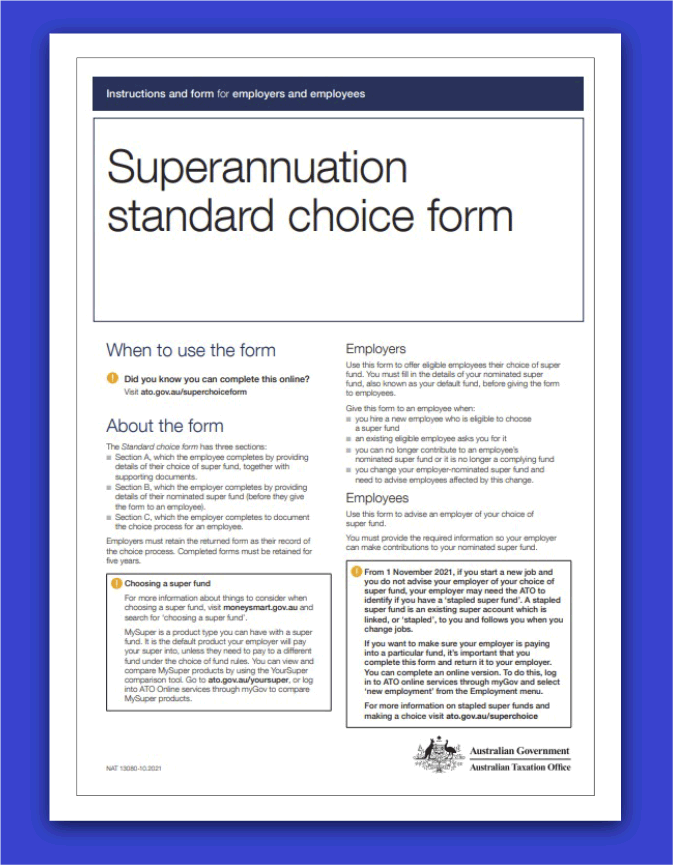

You must provide the superannuation standard choice form to eligible employees within 28 days of their employment start date.

In the superannuation standard choice form, employees can either choose a super fund that they want their contributions paid into. Or they can choose to use a super fund that you (as the employer) have chosen – this is known as an ‘employer nominated fund’ or ‘default super fund’.

Last modified: 15 Nov 2023

Hiring workers

| Steps | Progress | |||||

|---|---|---|---|---|---|---|

What to consider before hiring workers |

3 mins | |||||

Hiring a new worker |

2 mins | |||||

Determine workers’ classifications |

4 mins | |||||

Setting up for employer tax and superannuation obligations |

5 mins | |||||

Tax and superannuation commencement forms |

5 mins | |||||

Employee records |

7 mins | |||||

Related courses |

1 mins | |||||

Course feedback |

||||||