×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

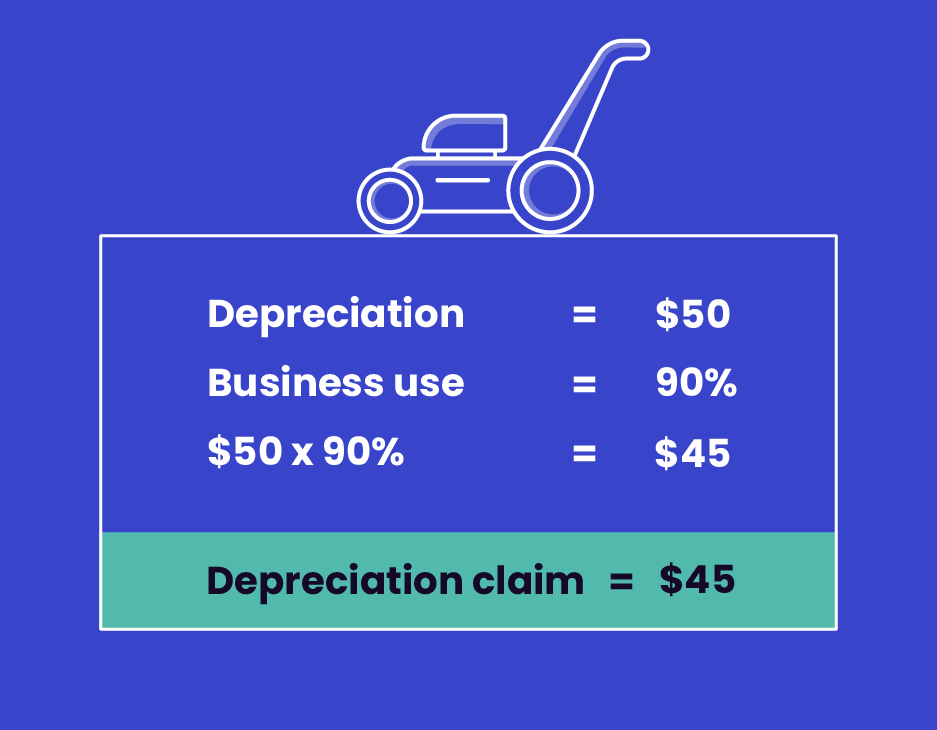

A deduction for the decline in value of a depreciating asset is reduced by how much it's used for a non-taxable purpose.

So, if you used an asset 10% of the time for a private purpose and 90% for business you can only claim 90% of its decline in value as a deduction.

Last modified: 22 Mar 2024