×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

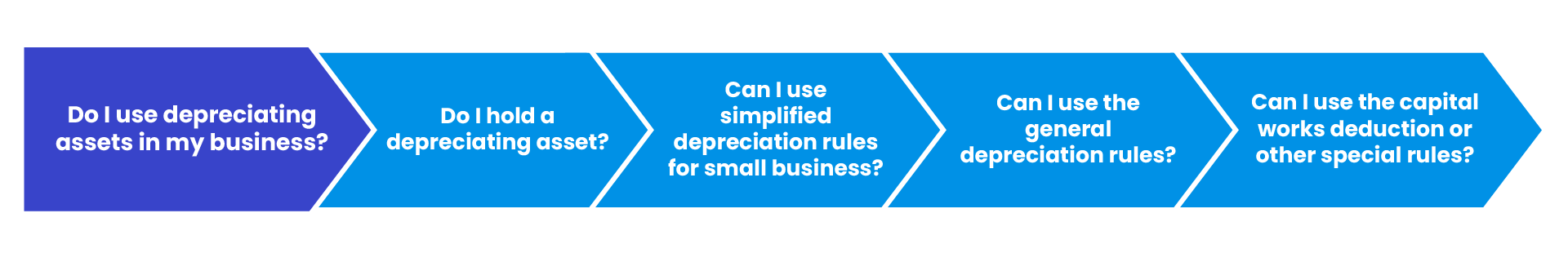

When considering depreciation, the first question to answer is - do I use depreciating assets in my business?

Depreciating assets are assets that have a limited effective life and can reasonably be expected to decline in value over the time they’re used.

Depreciating assets are items like:

- tools and equipment (for example, electric sanders and saws)

- computers, laptops and tablets

- office furniture (freestanding)

- office equipment (for example, coffee machines) motor vehicles (for example, cars, vans and tractors).

Not all assets are depreciating assets. For example, land and trading stock.

Last modified: 17 May 2024