×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

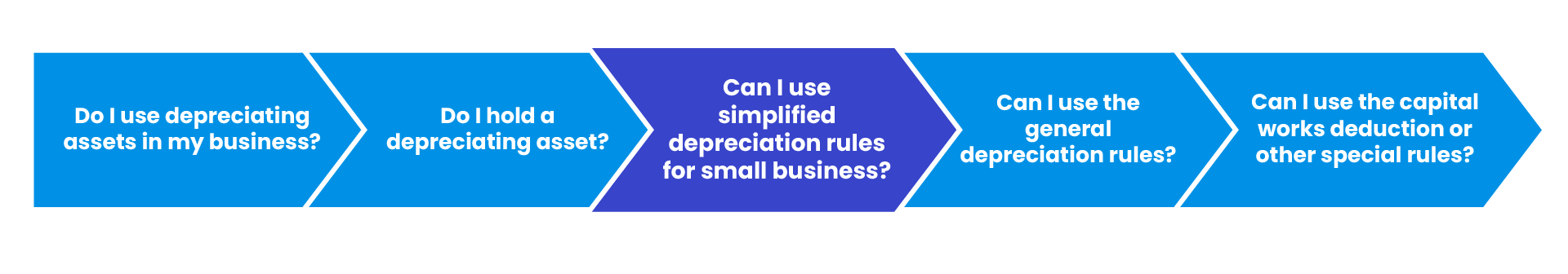

If you are the holder of a depreciating asset, you can look at ways to claim deductions for the decline in value of the asset by asking - can I use simplified depreciation rules for small business?

Simplified depreciation rules for small businesses include:

- an instant asset write-off for assets that cost less than the relevant limit

- a small business pool for assets that cost the same or more than the relevant threshold - this has simplified calculations to work out the depreciation deduction.

Last modified: 20 Jan 2026