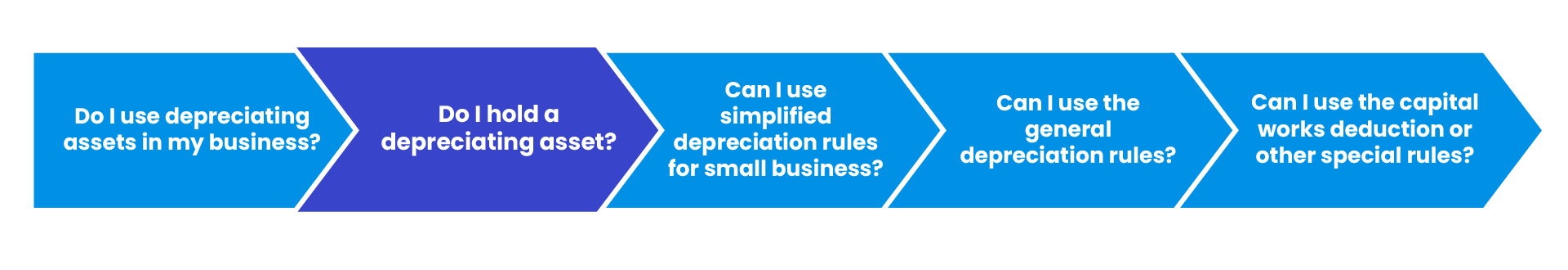

If you identify that you use depreciating assets in your business or for another taxable purpose, the next question to answer is - do I hold the depreciating asset?

Only the holder of a depreciating asset can claim a deduction for its decline in value.

In most cases, the legal owner of a depreciating asset will be its holder. There are special rules for partnerships.

There may be more than one holder of a depreciating asset. For example, joint legal owners of a depreciating asset are all holders of that asset. Each person’s interest in the asset is treated as a depreciating asset. Each person works out their deduction for decline in value based on their interest in the asset (for example, based on the cost of the interest to them, not the cost of the asset itself) and according to their use of the asset.

Example

Jenny and Rahul are both joint legal owners of a car. Jenny runs her own small farm and uses the car solely for taxable purposes, while Rahul uses the car solely for non-taxable purposes.

When they purchased the car Jenny paid 60% and Rahul paid 40% of the cost. They worked out that in this financial year the depreciation on the car is $19,900.

Because they are both legal holders of the car, Jenny works out her deduction for the decline in the value of the car based on:

- the cost of her interest in the car, not the cost of the car itself, and

- how much she uses it (100% for taxable purpose).

In certain circumstances, the holder is not the legal owner. For example:

- leased luxury cars

- certain depreciating assets subject to hire purchase agreements

- leased depreciating assets fixed to land if the lessor has a right to recover it

- depreciating assets which improve or are fixed to leased land.

Example

Jo owns a parcel of land. A finance company leases some machinery to Jo who pays the cost of fixing it to her land. Under the lease agreement, the finance company has a right to recover the machinery if Jo defaults on her lease payments.

The finance company holds the machinery because it has a right to remove the machinery from the land. The finance company is entitled to deductions for the decline in value of the machinery, based on the cost of the machinery to the finance company.

However, Jo also holds the machinery because it is attached to her land. She is entitled to a deduction for the decline in value of it, based on the cost to her of holding the machinery. This cost would not include her lease payments but would include the cost of installing the machinery.

Find out more about other ownership circumstances relating to depreciating assets.