×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

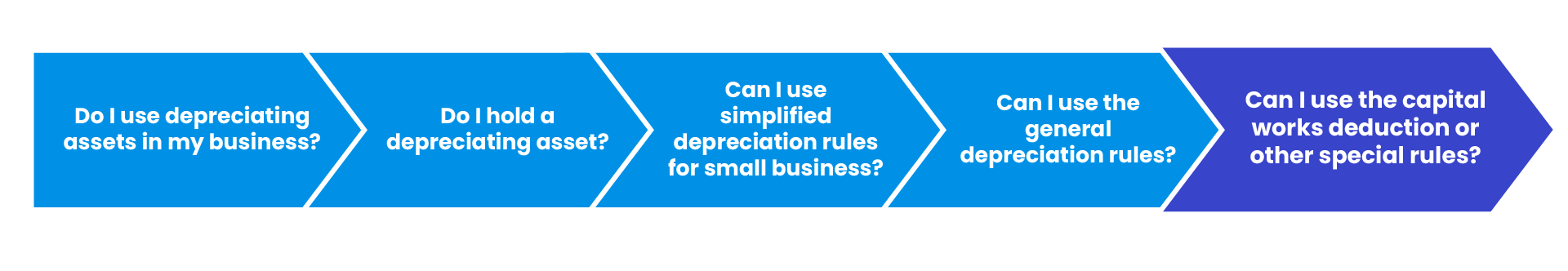

If you have capital works that you use to produce assessable income, ask yourself - can I use the capital works deduction or other special rules?

Capital works used to produce income, include buildings and improvements to buildings, are written off over a longer period than other depreciating assets.

The capital works deduction is available for:

- buildings or extensions, alterations or improvements to a building

- alterations and improvements to a leased building and leasehold improvements

- structural improvements such as sealed driveways, fences and retaining walls

- earthworks for environmental protection, such as embankments.

Deduction rates of 2.5% or 4.0% apply, depending on the date on which construction began, the type of capital work, and how it is used.

Note: the cost of land a capital work is on can't be written off and its cost isn't deductible.

Last modified: 22 Mar 2024