×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

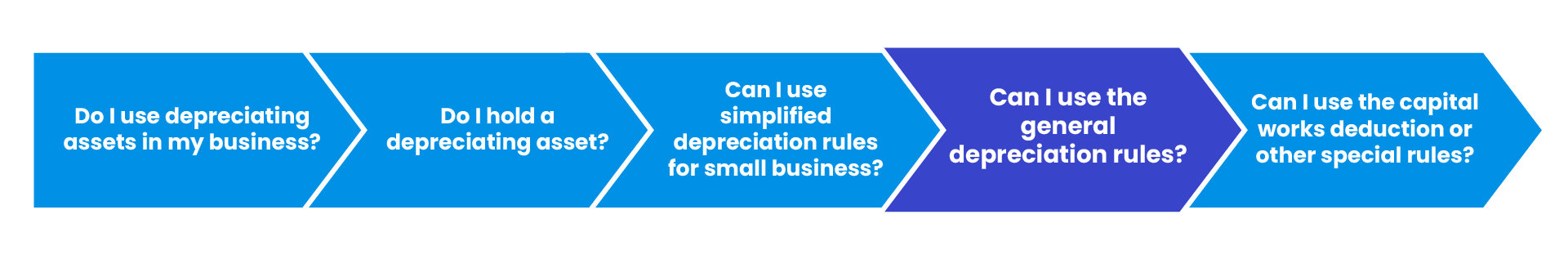

If you’re not eligible or you are eligible but choose not to use the simplified depreciation rules, ask yourself - can I use the general depreciation rules or does another rule apply?

The general depreciation rules set the depreciation deduction you can claim for most depreciating assets based on the asset's effective life. Like simplified depreciation, there are some assets that are included or excluded under special rules.

General depreciation rules include:

- calculation methods to work out your depreciation deduction based on the asset's effective life

- a low-value pool to which you allocate low-cost assets (that cost less than $1,000) and low-value assets (that have been depreciated to less than $1,000) and depreciate them at specified amounts.

The ATO Depreciation and capital allowances tool is an easy way of working out your depreciation claims under the general depreciation rules. Before using the tool, there are a few basic concepts you need to be aware of, which affect how you claim general depreciation

Last modified: 22 Mar 2024