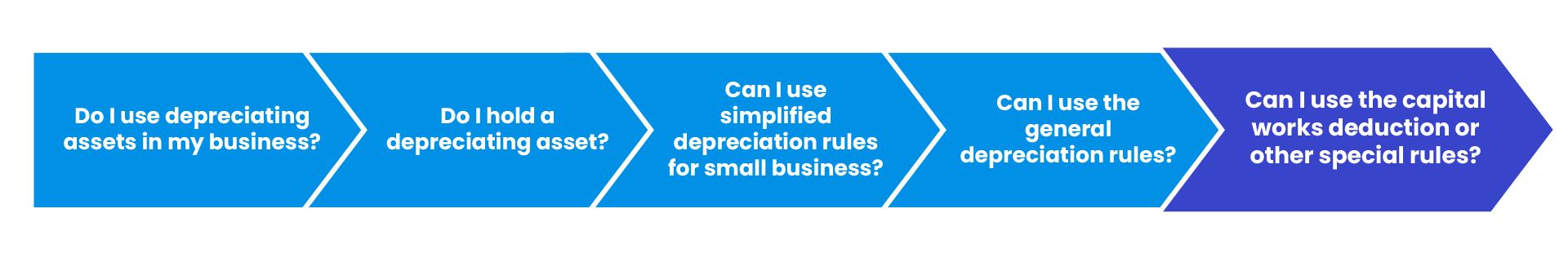

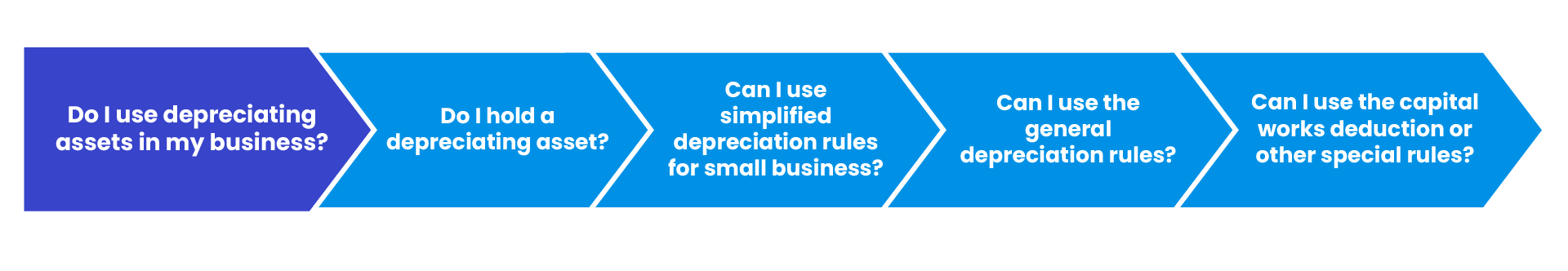

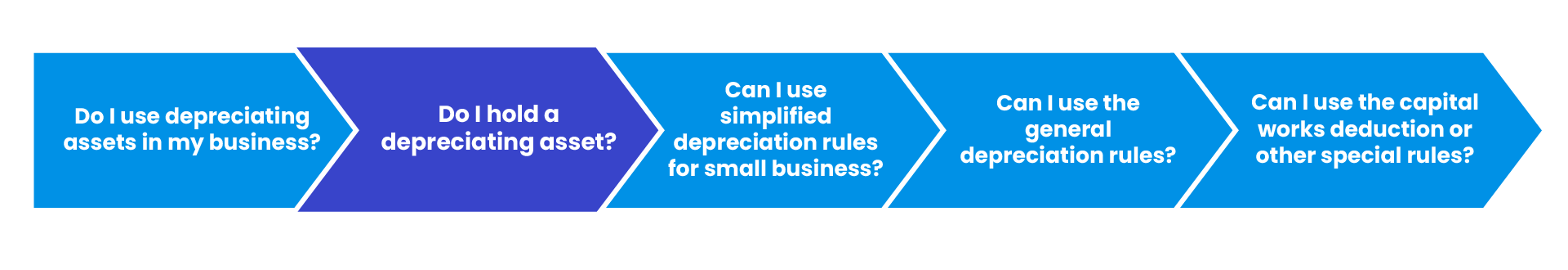

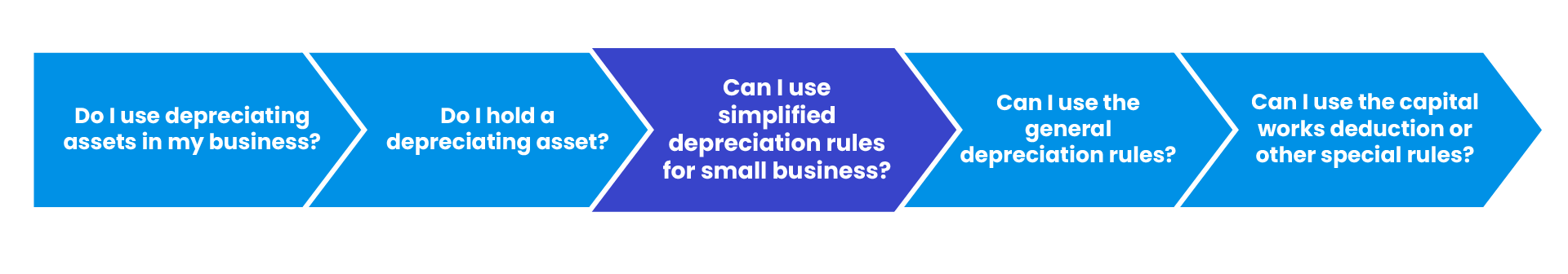

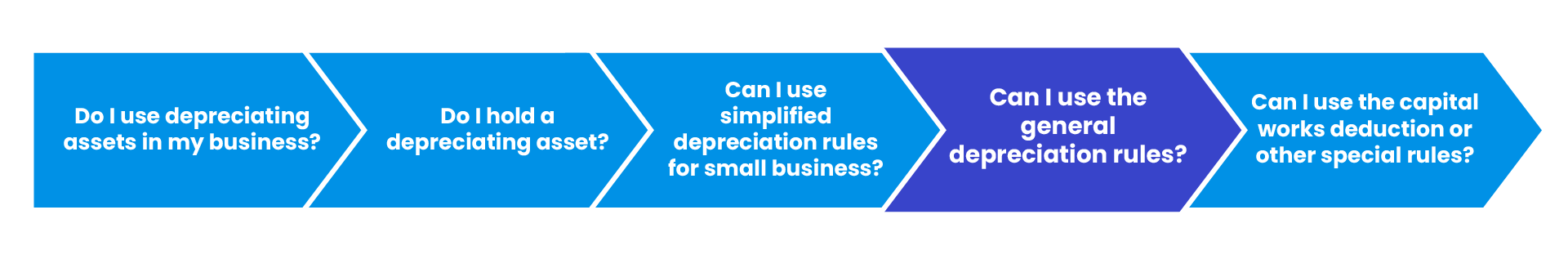

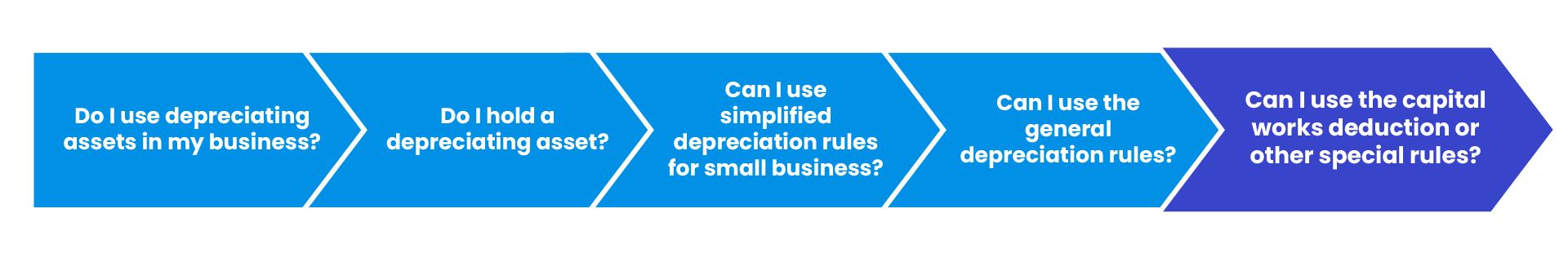

When working out if you can claim a deduction for the depreciation of your business assets you can ask the following questions.

Do I use depreciating assets in my business?

The depreciation rules apply to most depreciating assets and allow you to claim deductions for the decline in value of depreciating assets you use in your business or for another taxable purpose.

Do I hold a depreciating asset?

Only the holder of a depreciating asset can claim a deduction for its decline in value. Generally, if you are the legal owner of the asset, then you are its holder.

Can I use simplified depreciation rules for small business?

If you meet the eligibility requirements, you can use simplified depreciation rules for small business. Even if you’re eligible, you may also choose not to use the simplified depreciation rules and you would use the general depreciation rules instead.

Using the simplified depreciation rules (instead of general depreciation) generally makes working out your deductions easier and may provide you better tax results.

Can I use general depreciation rules?

You must use the general depreciation rules to calculate any deductions you are entitled to for your depreciating assets, unless:

- you are eligible to use the simplified depreciation rules and elect to use them, or

- another more specific rule applies for the asset.

The ATO has a Depreciation and capital allowances tool that can help you to calculate your deductions under the general depreciation rules. To use the tool, you will need to understand a few concepts, including:

- what the asset’s effective life is

- the date the asset was purchased and when it started to decline in value (generally, when it was first used or installed ready to use for any purpose)

- that the different methods for calculating the decline in value of an asset - the prime cost (straight line) method or the diminishing value method.

Can I use the capital works deduction or other special rules?

Other special rules apply to claiming deductions for certain capital expenses, some of which involve depreciating assets. Examples include capital works, in-house software or primary production.

Capital works used to produce income (for example by redesigning your shop to make it more contemporary) are written off over a longer period than other depreciating assets and are worked out using different rates and rules. Examples of capital works include buildings or extensions to a building, as well as structural improvements like sealing a driveway