If you use an asset for private use, you must account for this. You can only claim that part of the decline in value of an asset for your business or other taxable usage of it.

Example

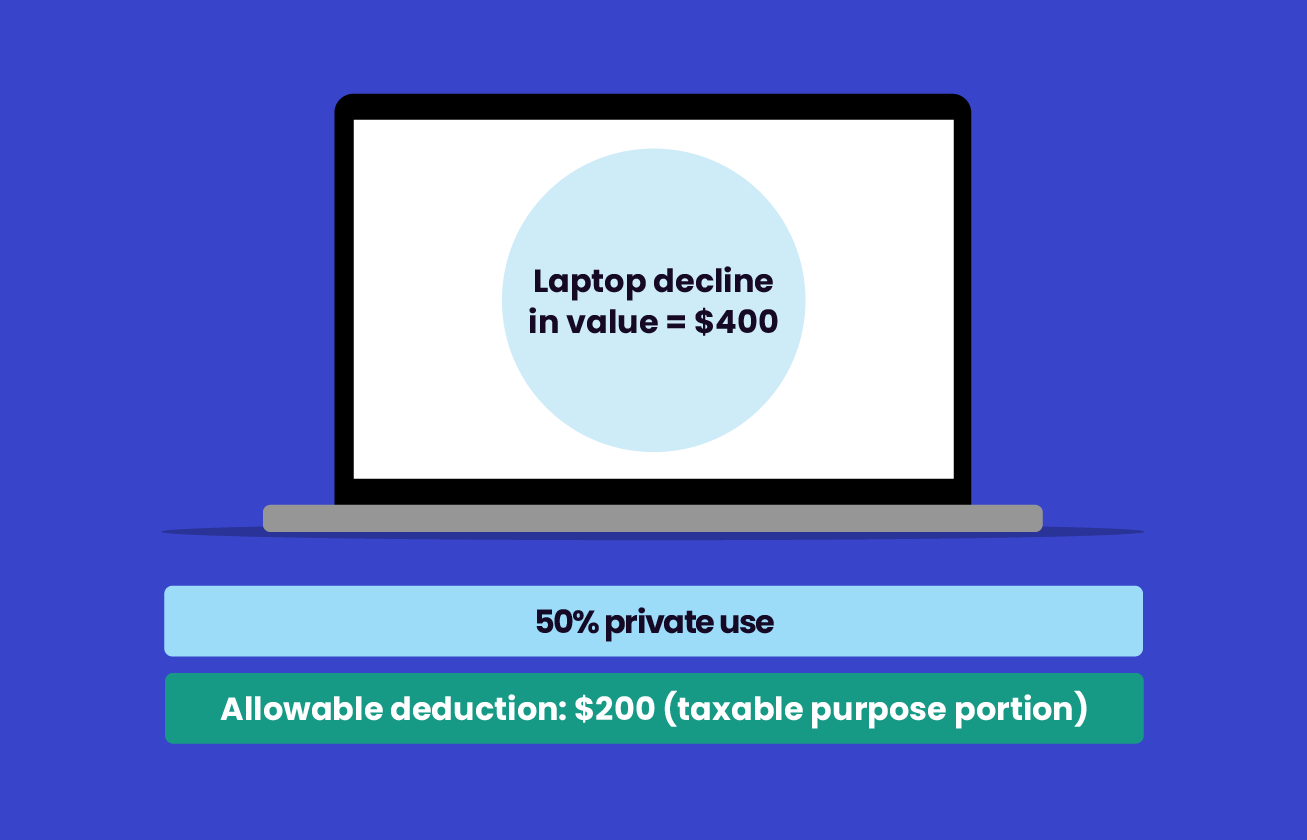

If you calculate an asset’s decline in value is $400 for an income year but you used it 50% of the time for private use, you can only claim 50%, being $200 for the taxable purpose portion.

Reviewing asset usage

You must review how much an asset is used for business and other taxable purposes (taxable purpose) in each of the first 3 income years that the asset was allocated to the small business pool.

If this proportion changes by more than 10% from your original estimated use (your estimate from when you first allocated the asset to your pool), you must make an adjustment to the opening balance of the small business pool for that year to reflect the change in use. You do this before you calculate your deduction.

For later income years if your estimated use changes again by more than 10% you must make a further adjustment to the opening balance of your pool. Learn more about how to make an adjustment.