×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

×

To use this feature, you need to log in to your account.

Don't have an account yet?

Create an account.

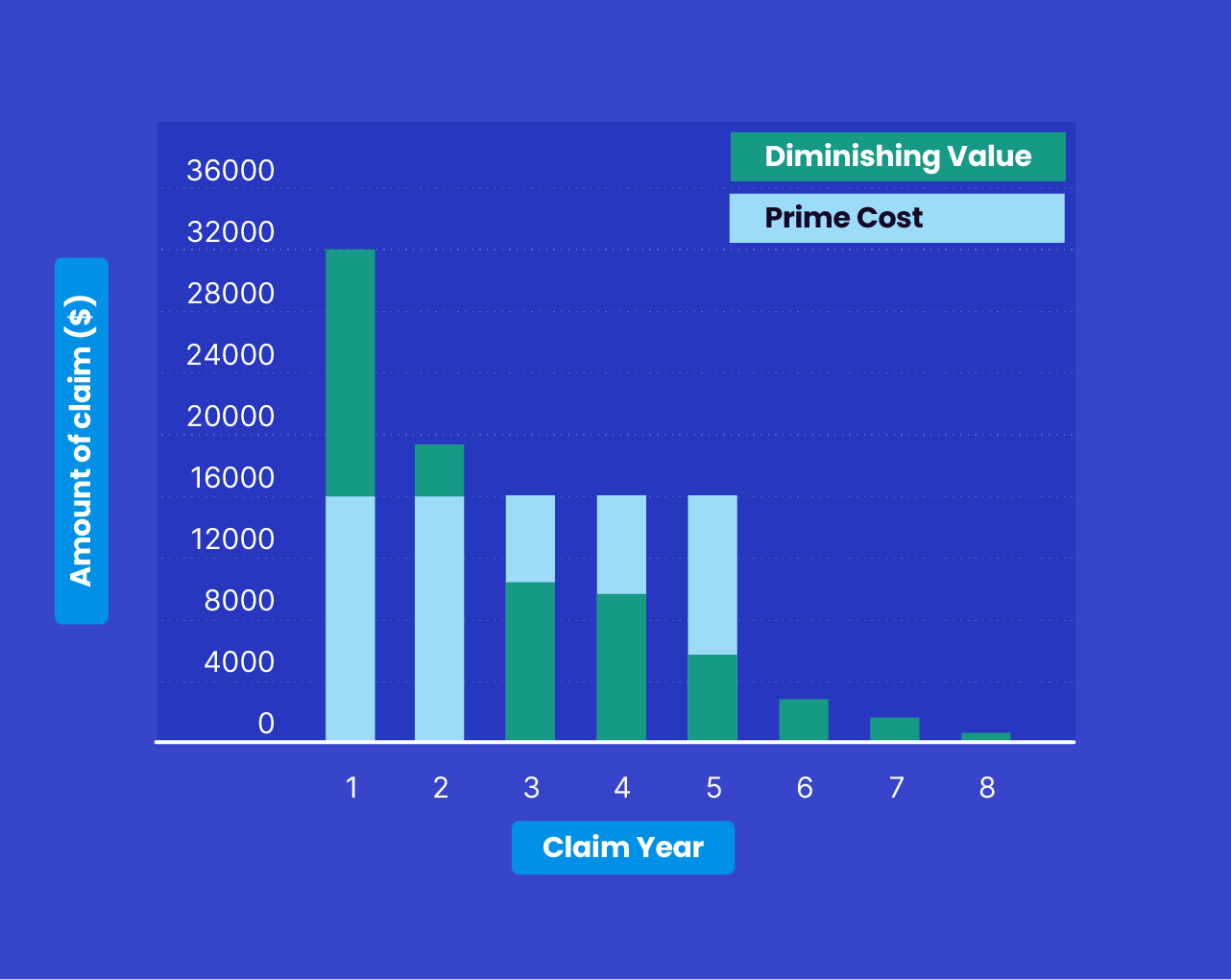

This graph compares the amount you would claim under each method for the depreciation of an asset used only for a taxable purpose.

The asset in this example costs $80,000, was acquired on the first day of the income year, and has an effective life of 5 years.

Speak with your registered tax professional to determine the best method to use for your circumstances.

Last modified: 17 Apr 2024